Altcoin Render (RENDER) outperformed over the past seven days amid Fed-triggered broad market revivals and bullish developments in the artificial intelligence space.

The crypto gained 31% on its weekly chart, leading to a break above a downward trendline. While that indicates robust bullishness and upside continuation, there’s a catch.

RENDER market activity balances after recent gains

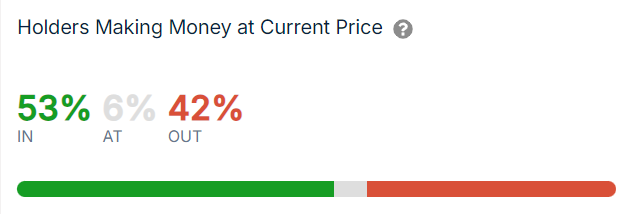

IntoTheBlock stats confirm that the market equilibrium for Render has 53% of holders profitable.

Any figure – or + 5% from the 50% zone indicates balanced market activity.

The balance between sellers and buyers shows RENDER could witness consolidation trends before the next move.

Source: IntoTheBlock

Source: IntoTheBlockThe altcoin might plunge to the recently breached descending trendline to catch a breath before continuing the upside.

Meanwhile, indicators such as social volume and skyrocketed large transactions suggest a short-lived dip for the altcoin.

RENDER’S on-chain indicators display optimism

The AI crypto has seen a notable jump in social volume over the past day.

That comes as retail players join the scene, and this could attract heightened interest from the overall crypto community.

Optimistic sentiment and enhanced engagements will keep Render afloat and push the current rally further.

Also, IntoTheBlock shows Render’s large transactions displayed a visible increase in the past two days.

That underscores renewed optimism by institutional players following the recent stall.

Such trends could extend RENDER’S recovery.

Declining BTC dominance signals “altcoins season”

Broad market sentiments support Render’s upside stance as Bitcoin dominance dips.

An uptick in this metric means the bellwether crypto outshines the market, while plunges indicate altcoins’ supremacy.

Crypto analyst Lark Davis revealed that Bitcoin dominance has plummeted over the previous week, indicating capital flow into the altcoin market.

Bitcoin dominance is decreasing. Is the alt season near?

Such developments could welcome an altcoin season, a phase where alt enthusiasts reap massive profits. Moreover, the Altcoin Season Index has climbed to 33, according to blockchaincenter.

That highlights a strengthening momentum for alternative tokens.

Meanwhile, it should soar to 75 for an alt season.

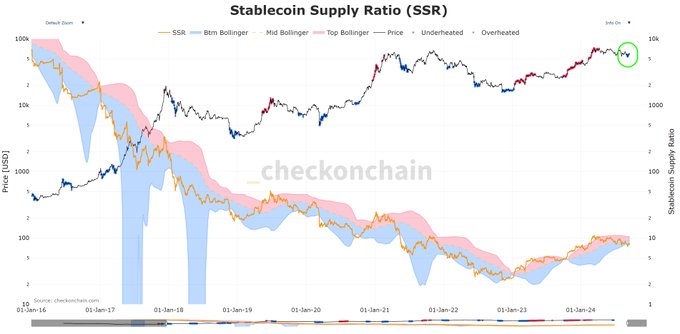

Also, the stablecoin chart supports imminent explosive upticks for altcoins. T

he stablecoin supply ratio’s (ssr) decline shows the market value of all stablecoins soared relative to BTC price.

That reflects an uptick in buying power, signaling potential price surges in the altcoin space.

#Bitcoin Stablecoin Supply Ratio (SSR) is signaling underheated again which historically in a bull cycle has been a great place to buy. This coupled with the fact that LTH & Whales are buying at these prices is a great sign for higher prices. x.com/LeonidShalimov…

RENDER’s current price action

The altcoin hovers at $6.15 after gaining 0.20% over the past day.

RENDER fluctuates as bears fight for control following last week’s robust gains.

Source: Coinmarketcap

Source: CoinmarketcapMeanwhile, the equilibrium between sellers and buyers indicates potential consolidation for the crypto.

Thus, Render could move sideways and record a slight dip before stable rallies.

However, surges in large transactions, soaring social volume, and the upcoming altcoin season suggest short-term setbacks for the AI cryptocurrency.

The post Render’s market activity balances out after 30% weekly gain: what's next for RENDER price? appeared first on Invezz

English (US) ·

English (US) ·