Ripple (XRP), one of the most prominent cryptocurrencies, has garnered attention due to a series of significant market and on-chain events that have left the XRP community uneasy.

With developments around large token transfers and increasing exchange reserves, questions have arisen about the future direction of XRP’s price.

In this article, we explore these key events, market sentiment, and what it could mean for XRP.

Ripple co-founder’s 30 million XRP transfer

One of the most unsettling developments within the XRP community has been the sudden activity from Chris Larsen, Ripple’s co-founder, whose wallet had been dormant for 11 years since 2013.

In a surprising move, Larsen’s wallet transferred 50 million XRP to a new anonymous wallet.

This transfer initially speculated to be for Ripple’s On-Demand Liquidity (ODL) service, has turned out to have a different purpose.

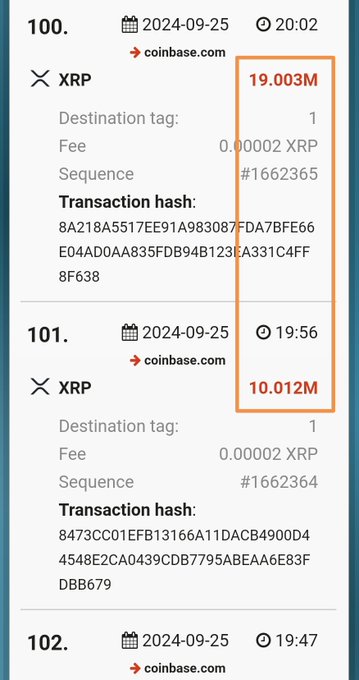

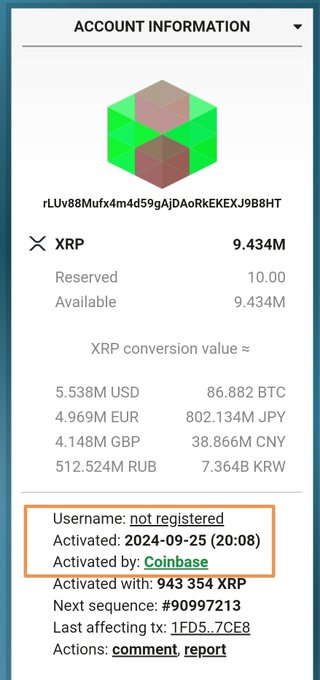

A closer look into the movement of these funds revealed that significant amounts were sent to major exchanges like Binance, Bittrex, and Coinbase, with 30 million XRP transferred on one occasion.

Larsen’s remaining 30M from the initial 50M has been sent to Coinbase (CB) in increments of 5M. From there it was sent to another CB wallet in two transactions of 10 and 19M. From here it begins to get a little busy. I was able to trace an amount sent to another CB wallet ⬇️tbc

The XRP community, composed largely of retail investors, has grown increasingly uneasy, especially with the lack of clarity from Larsen regarding these transactions.

Concerns range from potential large sell-offs, which could drive the price of XRP lower, to more extreme worries about whether Larsen’s account has been compromised, as was briefly suspected earlier in the year.

While some speculate that these transfers may still be related to ODL settlement services, the silence from Larsen on the matter has left many wondering if the tokens are being prepared for a broader sell-off, increasing the anxiety within the community.

Increasing XRP exchange reserves a bearish signal

Adding to the uncertainty is the rising level of XRP on exchanges, a situation that typically suggests higher selling pressure.

According to on-chain analytics firm CryptoQuant, XRP’s exchange reserves have slightly increased since mid-September when the price of XRP has been in consolidation trading between $0.558 and $0.598.

Source: CryptoQuant

Source: CryptoQuantAn increase in exchange reserves generally suggests that whales and institutions are moving their holdings to exchanges, potentially signalling an intent to sell.

As a result, traders and investors are on high alert, concerned that this could lead to an XRP price crash if sell-offs begin to gain momentum.

However, looking at the XRP technical analysis, XRP price remains above its 200 Exponential Moving Average (EMA), a key technical indicator suggesting the asset is still in an uptrend.

Key XRP price levels to watch

Amid these developments, XRP’s price action is currently focused on two key levels of support and resistance: $0.545 and $0.60.

A close above the $0.60 mark could signal a breakout, with the price potentially soaring to $0.72.

Conversely, if XRP breaks below the $0.545 level, a significant decline could follow, pushing the price as low as $0.464.

Moreover, XRP’s Long/Short Ratio, standing at 0.955, reflects a bearish outlook among traders.

A Long/Short ratio below 1 indicates that more market participants are taking short positions, expecting the price to drop further.

Alongside the rise in exchange reserves, this bearish sentiment underscores the uncertainty surrounding XRP’s future price trajectory.

The post Ripple at crossroads as co-founder moves 30 million tokens amid reserve surge appeared first on Invezz

English (US) ·

English (US) ·