Virtual currency market from 6/24 (Sat) to 6/30 (Fri) this week

Mr. Hasegawa, an analyst at the major domestic exchange bitbank, illustrates this week’s bitcoin chart and analyzes the future outlook.

table of contents

- Bitcoin on-chain data

- Contributed by bitbank

Bitcoin on-chain data

Number of BTC transactions

Number of BTC transactions (monthly)

Number of active addresses

Number of active addresses (monthly)

BTC mining pool remittance destination

Exchange/Other Services

bitbank analyst analysis (contribution: Yuya Hasegawa)

Weekly report from 6/24 (Sat) to 6/30 (Fri):

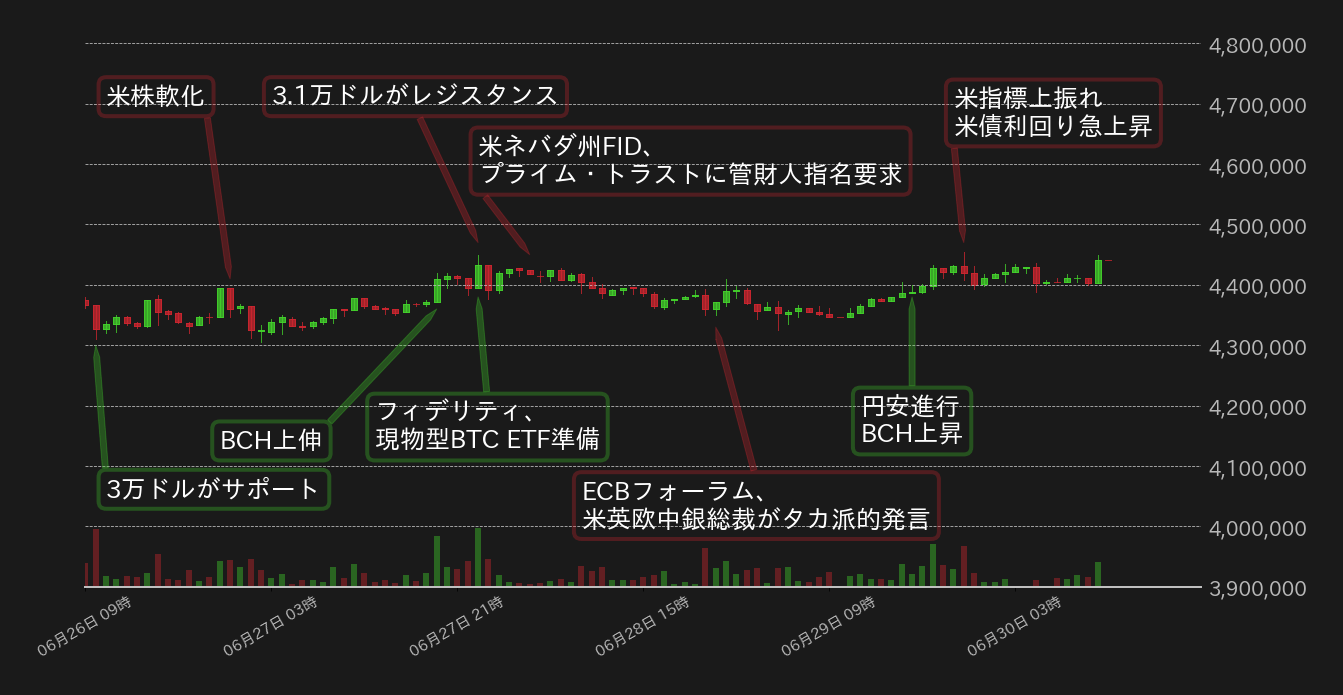

This week’s bitcoin (BTC) vs. yen exchange rate has remained flat around 4.4 million yen as of noon on the 30th.

The rise in the market due to the entry of traditional financial institutions (TradFi), starting with BlackRock, has slowed down, and this week BTC will start to struggle with support at the $ 30,000 level (about 4.32 million yen). hit the $31,000 level (approximately 10,000 yen) was tried.

On the other hand, when the market failed to break out of the same level and stalled, the scandal of the crypto asset (virtual currency) management company Prime Trust took a turn for the worse. The remarks weighed on the market, and continued to loosen slightly toward the middle of the week.

However, when BTC was again supported by buying at the $30,000 level where open interest was concentrated in the options market, the yen-denominated BTC price rose as the dollar strengthened and the yen weakened in the foreign exchange market. Combined with the rise in the BCH market price, it recovered to 4.4 million yen.

However, Thursday’s U.S. initial unemployment claims, quarterly gross domestic product (GDP) growth and final figures for personal consumption expenditures (PCE) are largely in line with further monetary tightening by the U.S. Federal Reserve. When it becomes content to justify , the yield of US Treasury bonds surged and put pressure on the top of the BTC market.

Fortunately, the market had factored in over 80% of the possibility of a resumption of interest rate hikes in July, so the extent of the decline was limited, but BTC continues to trade firmly with a heavy topside.

[Fig. 1: BTC vs Yen chart (1 hour)]Source: Created from bitbank.cc

Next week’s BTC will continue to have a heavy topside. Kathy Wood’s Ark Investments also made changes to its filing this week to favor its own ETF review, and on Thursday Fidelity actually submitted its Bitcoin ETF listing application to the U.S. Securities and Exchange Commission (SEC). ), but the impression is that the market response is waning.

On the other hand, this week, in addition to the above-mentioned US economic indicators, orders for durable goods in May and the housing price index in April also exceeded, making it difficult to expect a sustained inflow of funds from a macro perspective.

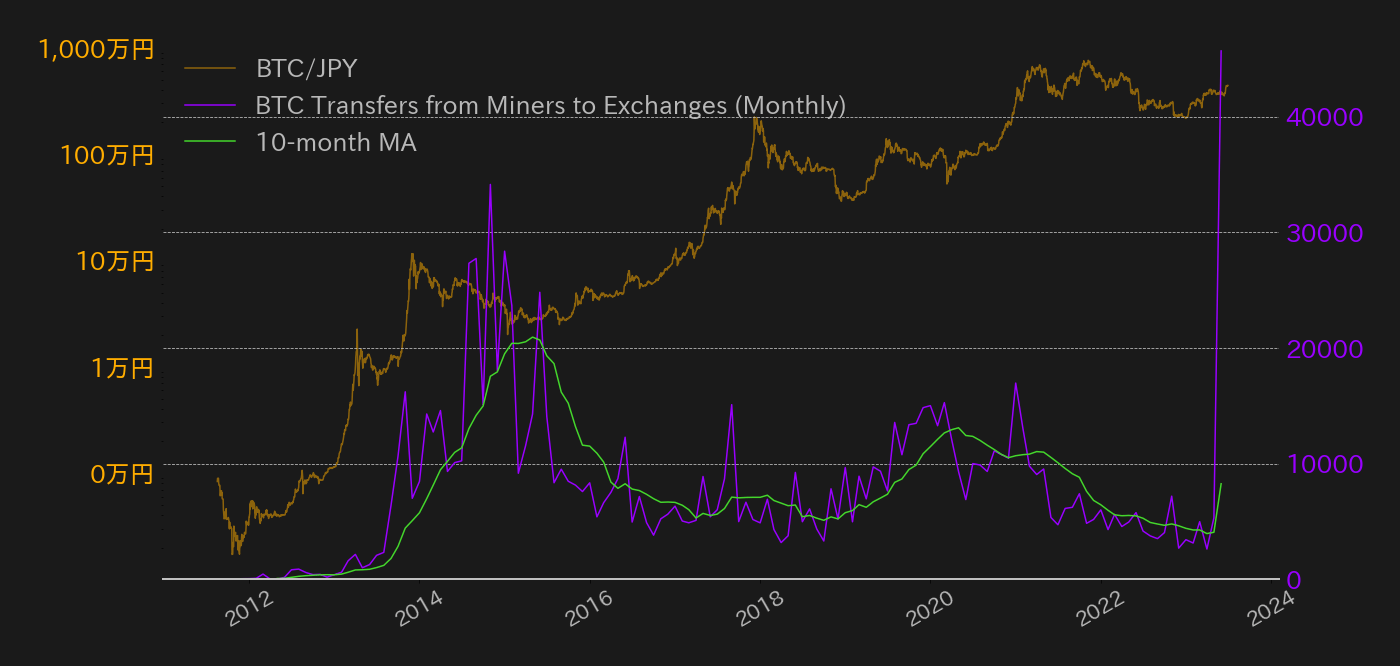

Under these circumstances, the BTC market is supported by ETF-related news flow, but the resistance of $31,000 is relatively strong, and it is not showing a sense of direction. In addition, the amount of BTC remittances from miners to exchanges has reached a record level of over 45,000 BTC per month, raising concerns about profit taking by actual demand sources (Fig. 2).

[BTC vs. Yen and monthly BTC remittances from miners to exchanges]Source: bitbank.cc, Glassnode

With the US Personal Consumption Expenditures (PCE) price index for May due to be released today (30th), the market is expecting a slight slowdown in growth from the previous month.

If the result is as expected, it will not be enough to justify the postponement of the interest rate hike, but it will not be a bad news. On the other hand, it has been pointed out that open interest is concentrated on the $30,000 strike in June contract in Deribit’s BTC options market. In light of this, it has been pointed out that the support at the same level may not be effective after option cuts, so we should pay attention to the upside of the PCE price index.

connection:bitbank_markets official website

Last report:Bitcoin hits new year-to-date high, technically suggests bull market

The post Rise in US bond yields puts pressure on BTC’s top price, and there is a sense of caution about profit taking by real demand sources | Contribution by bitbank analyst appeared first on Our Bitcoin News.

1 year ago

199

1 year ago

199

English (US) ·

English (US) ·