Showing interest in handling Bitcoin spot ETFs

Robinhood Markets in the US is planning to handle Bitcoin spot ETFs (exchange traded funds), according to CEO Vlad Tenev’s comments on X (formerly Twitter). “As a leader in crypto access, we intend to quickly bring these ETFs to the Robinhood app,” Tenev said.

Exciting update from Washington today! As a pioneer in offering spot crypto trading, Robinhood is thrilled about the @SECGov‘s decision to approve spot Bitcoin ETFs. We’ve been ahead of the curve in crypto access, and we plan to list these ETFs on @Robinhoodapp as soon as…

— Vlad Tenev (@vladtenev) January 10, 2024

The approved Bitcoin spot ETFs are a total of 11 stocks issued by well-known funds such as BlackRock, Bitwise, Grayscale, and Hashdex. As a result of market competition, the initial period fee has been reduced to 0.0%. The ETFs are scheduled to begin trading on the 12th and will be accessible through brokerage services such as Morgan Stanley’s E-Trade and Fidelity Investments.

Source: Bloomberg

With these treatments, Robinhood could attract an additional customer base, potentially creating a new wave of investment fever similar to the one seen with the GameStop stock trading boom and other meme stocks in early 2021. do not have.

Tenev added: “The introduction of Bitcoin ETFs will further the integration of cryptocurrencies and traditional finance, providing customers with sophisticated risk management tools in managing their digital assets.”

Robinhood began trading cryptocurrencies in 2018, focusing on Bitcoin and Ethereum. Later, during the bull market, the addition of Dogecoin and other coins caused further excitement.

connection:“DOGE, ETC, BCH” virtual currencies handled by major US investment app Robinhood soar across the board

Tenev said Robinhood continues to provide its customers with educational materials about Bitcoin, ETFs, and risk management strategies to help them improve their investment knowledge.

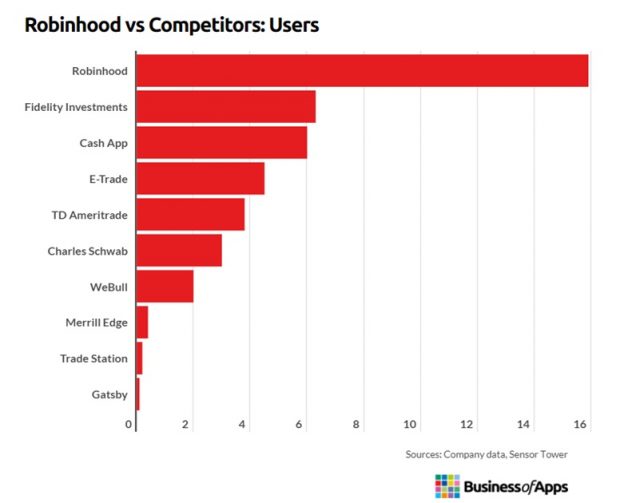

According to Robinhood’s Q2 2023 earnings report, the number of monthly active users on its app decreased from 14 million in the same period last year to 10.8 million. However, apart from the amount of assets under management, it still outperforms its competitors in terms of number of users.

Source: Business of Apps

connection:All 11 Bitcoin ETFs listed, SEC approved for first spot ETF in US history

What is the US GameStop stock turmoil?

An incident in which members of Reddit’s r/wallstreetbets forum and small investors, including Robinhooders (users of the Robinhood app), engaged in a buying and selling war with a major hedge fund. Many hedge funds had been shorting GameStop’s stock on a large scale, but the stock price skyrocketed due to intensive buying activity by Reddit users and Robinhooders. As a result, these hedge funds faced a “short squeeze” in which they bought back stocks at higher prices.

Amid the turmoil, Robinhood made the decision to temporarily restrict trading in certain stocks, including GameStop. The move received strong criticism from Robinhood users and the media, sparking a broader debate about the role and responsibilities of online trading platforms.

connection:

Learn about Bitcoin ETFs from the beginning: Explaining the advantages and disadvantages of investing and how to buy US stocks

Half-life special feature

We have introduced the “Heat Map” function to the CoinPost app for investors!

In addition to important news about virtual currencies, you can also see at a glance exchange information such as the dollar yen and price movements of crypto asset-related stocks in the stock market such as Coinbase.

■Click here to download the iOS and Android versions

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU

— CoinPost (virtual currency media) (@coin_post) December 21, 2023

The post Robinhood CEO is keen on handling Bitcoin ETFs appeared first on Our Bitcoin News.

1 year ago

124

1 year ago

124

English (US) ·

English (US) ·