Two domestic financial companies, SBI Holdings and Monex Group, have released financial reports that show that their business profits from crypto assets (virtual currencies) are expected to improve.

The first exchange-traded fund (ETF) that tracks physical Bitcoin to be listed in the United States is likely to change the flow of funds in the Bitcoin market and impact the business environment for crypto assets.

SBI announced its financial results for the third quarter (April to December 2023) on the 7th. Among them, the revenue (sales) of the crypto asset business increased by 26.9% from the same period last year to 30.89 billion yen. SBI had recorded a loss (before tax) of 17.32 billion yen in this business in the same period last year, but secured a profit of 2.04 billion yen.

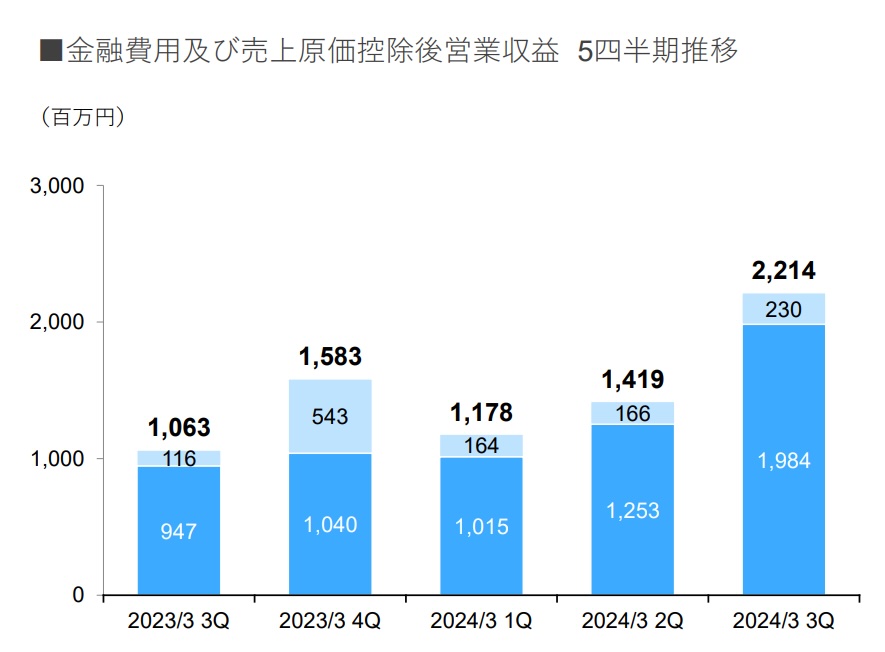

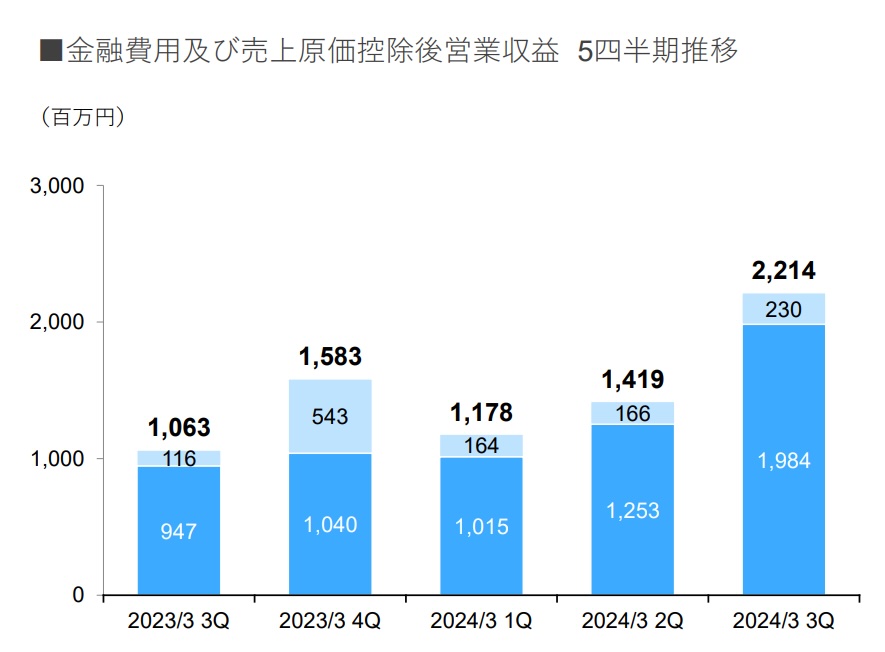

Monex announced its financial results on January 31st, and the operating revenue (deducting financial expenses and cost of goods sold) of its crypto asset business, which includes the trading service “Coincheck,” as of the third quarter (9 months) was 48.1%. billion yen, down 17% from the same period last year. However, if we look at the operating revenue of this business quarterly, it was 2.21 billion yen in the October-December period (3Q), approximately double the 1.18 billion yen in the April-June period (1Q). The crypto asset market recovered every quarter, and the increase in trading volume contributed to the increase in revenue in the October-December period.

(Changes in quarterly operating revenue in Monex’s crypto asset business/Blue is trading profit and loss, light blue is other operating revenue: From Monex’s financial report)

(Changes in quarterly operating revenue in Monex’s crypto asset business/Blue is trading profit and loss, light blue is other operating revenue: From Monex’s financial report)Increased buying interest in Bitcoin ETFs

The price of Bitcoin (BTC) briefly rose in June last year, immediately after BlackRock, the largest asset management company, applied to list a Bitcoin spot ETF. Four months later, in October, the market saw a surge in buy orders on speculation that the U.S. Securities and Exchange Commission (SEC) would approve the company’s listing application.

Prices had been hovering below $30,000 in October, but quickly rose to over $40,000 toward the beginning of the year, and at one point exceeded $45,000. The U.S. SEC approved the listing application for a Bitcoin ETF on January 10 (local time), making it the first Bitcoin ETF managed by major U.S. asset management companies such as BlackRock, Fidelity, and Franklin Templeton to be listed on a U.S. stock exchange. Listed.

(Bitcoin price trends over the past 12 months/from CoinMarketCap)

(Bitcoin price trends over the past 12 months/from CoinMarketCap)Although the listing of the Bitcoin spot ETF is in the US market, and individual Japanese investors will not be able to purchase this new ETF, the impact has also been felt in Japan’s domestic crypto asset market. Looking at data from the Japan Crypto Asset Exchange Association (JVCEA), the volume of spot trading of crypto assets has increased significantly over the past year. Physical trading volumes hit their highest level in August since September 2018, and rose even further in December.margin tradingAs of December, the number of long positions (unsettled long positions) was approximately 8.5 billion contracts, the highest ever, and significantly exceeded the short position of 2.89 million contracts.

margin tradingWhat it means: Buying and selling transactions using margin money deposited in an account as collateral for an amount larger than that amount. Also called leverage trading.

With the creation of Bitcoin ETFs, general investors in the United States can now purchase investment trusts linked to Bitcoin without having to purchase physical Bitcoin directly.

BlackRock and Franklin Templeton have entrusted the storage and management of physical Bitcoin, which is the backing asset of the Bitcoin ETFs (funds) they manage, to Coinbase, a major U.S. cryptocurrency trading service. There is. The business of managing and storing financial assets is called custody.

Coinbase has sought to diversify its business by providing custody services and other services for companies and institutional investors, with its core business providing crypto asset trading services to individuals. The company is also currently developing and operating the blockchain “Base” to extend the Ethereum blockchain.

It is not possible to simply compare Coinbase and Japanese crypto asset exchange companies, but when analyzing businesses centered on crypto asset trading services over the medium to long term, the business model and profit structure of Coinbase, which leads the U.S. market, is important. will be helpful to some extent.

Short-term “buy” factors and long-term “sell” factors for U.S. Coinbase

(Trends in segment revenue of Coinbase in the US, unit is $Million/Coinbase financial report)

(Trends in segment revenue of Coinbase in the US, unit is $Million/Coinbase financial report)First, we need to understand the company’s earnings structure based on Coinbase’s financial report. Coinbase’s biggest earner remains fee income from its trading services for individual customers.

The company’s revenue (sales) for the July-September (3Q) period was $674.1 million, or approximately 100 billion yen when converted to Japanese yen. Transaction fee income from personal services was $274.5 million, accounting for 41% of the total.

The second largest source of revenue was $172.4 million (approximately 26% of the total) from a contract with US Circle, which issues the stablecoin USDC, which is linked to the US dollar. Fee income from trading services for corporate and institutional investors was just $14.1 million (2.1%), and revenue from custody services was $15.8 million (2.3%).

Coinbase stock tripled in six months

(Coinbase stock price trend over the past 12 months/from Yahoo Finance)

(Coinbase stock price trend over the past 12 months/from Yahoo Finance)What is the stock market’s reaction to Coinbase shares listed on the US NASDAQ?

Similar to the curve the Bitcoin price followed last year, Coinbase’s stock price made a peak on the chart in June when BlackRock filed for an ETF, and after filing by the US SEC. It spiked in October as hopes for approval rose.

Coinbase stock, which had been hovering around $60 a share before June, exceeded $100 in July and topped $180 in December. It has tripled in just six months.

In the short term, Coinbase may earn significant fees through custody services agreements it has with U.S. asset managers that operate Bitcoin ETFs. On the other hand, many individual investors have a long-term view that they will invest indirectly in Bitcoin by purchasing ETFs rather than using crypto asset trading services such as Coinbase or Binance. You hear it from lists, strategists, etc.

Analysts at AllianceBernstein, a major U.S. asset management firm, predicted in December that “within the next five years, 10% of the total Bitcoin supply will be managed by ETFs.” Bitcoin ETFs are said to be the thickest conduit between traditional financial markets and crypto asset markets.

Partnership between SBI’s digital asset business and Circle Inc.

(SBI Holdings Chairman Yoshitaka Kitao/Photo: Airi Okonogi)

(SBI Holdings Chairman Yoshitaka Kitao/Photo: Airi Okonogi)So far, SBI has acquired domestic crypto asset exchanges such as TaoTao and BitPoint to expand its individual customer base, while also developing blockchain as a core technology through partnerships with companies in Germany, Switzerland, Singapore, and the United States. We have developed a broadly defined digital asset business both domestically and internationally.

One thing to keep an eye on in SBI’s crypto assets and blockchain-related business in the short to medium term is the stablecoin business partnership it signed with US Circle in November last year. In January, SBI Chairman Yoshitaka Kitao named stablecoins linked to the US dollar as one of the most interesting themes in 2024.

Related article:SBI Chairman Kitao talks about “two and a half months” in Saudi negotiations: Riyadh aims to create a next-generation digital kingdom

It goes without saying that stablecoins, which are pegged to the US dollar and circulated on blockchain, have been used in crypto asset transactions around the world. At the same time, in African and Latin American countries, the number of individuals using stablecoins linked to the US dollar is rapidly increasing due to unstable national currencies and dysfunctional financial systems.

SBI entered into a “basic agreement for a comprehensive business alliance” with Circle Inc. in November last year. Under the plan, the two companies will promote the spread of USDC, a stable coin issued by Circle, in Japan. In this regard, SBI VC Trade, which operates crypto asset trading services under the SBI umbrella, will be able to handle USDC by registering as an electronic payment means trading business.

The stablecoin agreement with Circle has become a major pillar of Coinbase’s revenue base. On the other hand, in Japan, where stablecoin regulations are already in place, how much will SBI be able to distribute USDC and develop it into one of its core businesses?

| Text and editing: Shigeru Sato, Takayuki Masuda

|Image:

The post SBI, Monex: Signs of improvement in business profits of crypto assets ─ Fund flow changes dramatically with first Bitcoin ETF listing | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

101

1 year ago

101

English (US) ·

English (US) ·