Macroeconomics and financial markets

In the US NY stock market on the 6th, the Dow Jones Industrial Average was 10 dollars (0.03%) higher than the previous day, and the Nasdaq Index was 46.9 points (0.36%) higher.

The “Nasdaq Composite Index”, which has been sold until 2022 during the FRB (Federal Reserve System) monetary tightening (interest rate hike) phase, has renewed its high since the beginning of the year. Since the beginning of this year, the year-to-date rise and fall rate has reached +27.8%.

Google Finance

connection:NY Dow and cryptocurrency-related stocks all fall, Apple announces MR headset | 6th Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, bitcoin rebounded sharply to $26,983, up 4.7% from the previous day.

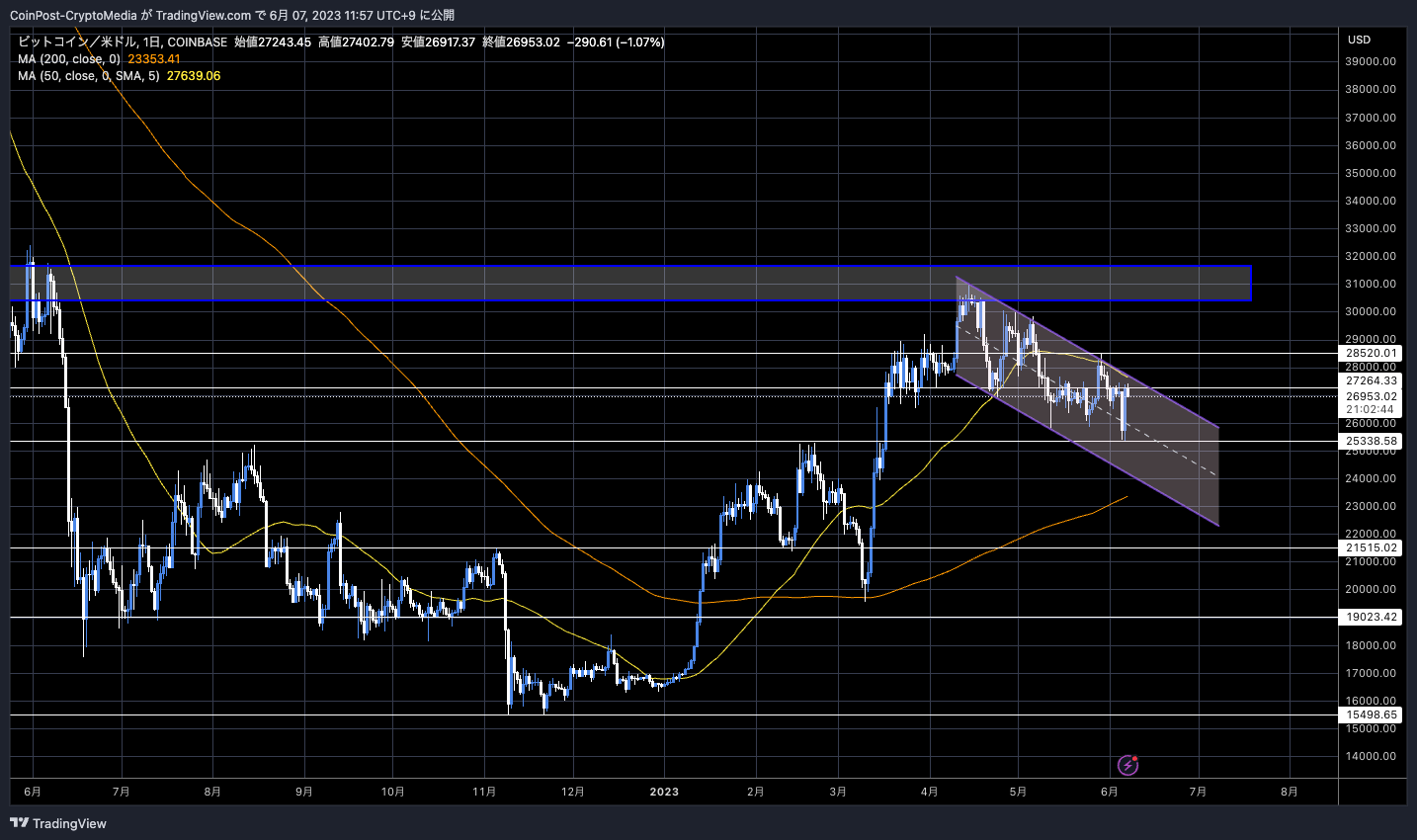

BTC/USD daily

The price fell at the support line (lower support line) of $25,300, and after double-bottoming on the hourly chart, it turned upward.

Following Binance the day before, Coinbase, the largest US crypto asset (virtual currency) exchange, was sued by the US SEC (Securities and Exchange Commission), but it was already factored in at the time of issuing the Wells notice. It led to a full return to pre-Binance shock price levels. *Figure below

BTC/USD 4-hour chart

connection:Coinbase sues SEC Chairman Gensler “We don’t need cryptocurrencies anymore”

In the stock market, the stock price of Coinbase also plummeted, but due to intermittent bargain buying due to the recent undervalued price, the closing price remained at 12% lower than the previous day.

Coinbase’s quick reaction to the lawsuit also eased investor anxiety. “When we go public on the Nasdaq in April 2021, it should be reviewed and cleared by the SEC,” said Coinbase CEO Arm Strong. He pointed out several inconsistencies in the statements of the SEC and the CFTC (U.S. Commodity Futures Trading Commission), and showed a willingness to fight all the way.

Regarding the SEC complaint against us today, we’re proud to represent the industry in court to finally get some clarity around crypto rules.

Remember:

1. The SEC reviewed our business and allowed us to become a public company in 2021.

2. There is no path to “come in and…

— Brian Armstrong  (@brian_armstrong) June 6, 2023

(@brian_armstrong) June 6, 2023

In yesterday’s Binance lawsuit, many of the altcoins with the highest market capitalization, including BNB, Solana (SOL), Ada (ADA), and Polygon (MATIC), were declared “unregistered securities” by the SEC, and appeared to be declining across the board. was presenting.

In the futures market, the biggest loss cut (forced liquidation) in the past three months occurred, and it seems that the subsequent short cover was caused by the feeling that the market was over. After yesterday’s plunge, during the Asian time, the BTC price was reluctant to drop, and the FundingRate (funding rate) was in a negative divergence.

That said, there is still a strong sense of uncertainty about the future. If major tokens are delisted from the U.S. market and lead to the withdrawal of market makers, liquidity will inevitably decline, and there is also the risk of affecting the standards of handling in other countries.

BTC has been trading within a range while lowering its topside recently, and the 50-day moving average (50SMA) and the upper end of the descending channel have yet to break, and the topside is undeniably heavy. The near-term focus may be on the return high of $28,500 and the neckline near $27,000.

According to Franklin of The Tie, a blockchain data analysis company, the aftermath of the bankruptcies of FTX and Alameda Research, the industry’s largest companies, is large, and hedge funds, venture capitals, pension funds, and others that have expanded their investment exposure in the web3 industry. Institutional investors such as mutual funds continue to be forced to hold back due to unclear regulations and credit risks.

altcoin market

In terms of individual stocks, Optimism (OP), which completed its first upgrade “Bedrock”, rose 6.6% from the previous day.

Optimism is an L2 (Layer 2) scaling solution that employs Optimistic Rollup developed to solve the scalability problem of Ethereum (ETH).

Along with this upgrade, we have improved the blockchain gas pricing model by incorporating “EIP-1559”, a major improvement proposal for Ethereum. It is expected that the transaction fee (gas fee) will be reduced and the transaction completion time will be significantly shortened, and it will be closer to achieving parity with the Ethereum mainnet.

connection:Optimism’s major upgrade “Bedrock”, implementation complete

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post SEC Coinbase Lawsuit also Rebounds Bitcoin Significantly, Full Recovery of Binance Shock Decrease appeared first on Our Bitcoin News.

2 years ago

135

2 years ago

135

English (US) ·

English (US) ·