The post SEC News : Green United Faces Trial For $18 Million Mining Scam appeared first on Coinpedia Fintech News

The U.S Securities and Exchange Commission has filed a case against a Utah based crypto mining company. The court has permitted the lawsuit to move for trial. The SEC accused the firm of orchestrating a fraudulent scheme. Green United is accused of raising $18 million from investors through the sale of fake crypto mining equipment. It is one of a kind of case, so let’s see what actually happened and why SEC filed the lawsuit.

What Happened? A Fake Mining Scheme Uncovered

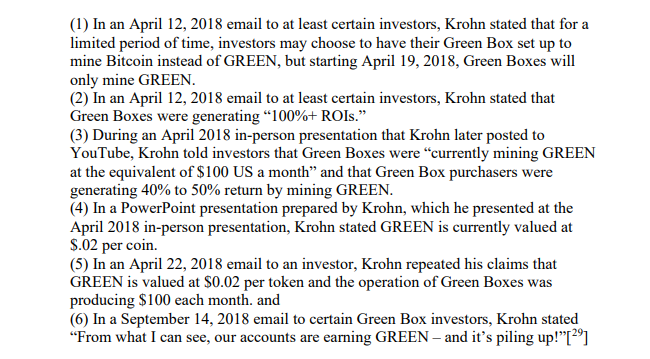

Green United, led by Wright Thurston and Kristoffer Krohn, allegedly sold “Green Boxes” and “Green nodes” as specialized crypto mining equipment. Investors were told these devices would mine GREEN tokens on a “Green Blockchain,” which would support a public decentralized power grid and offer massive returns—up to 50% monthly. However, according to the SEC, the so-called blockchain never existed.

Instead, Thurston allegedly took the money from investors and bought commercial Bitcoin mining machines (S9 Antminers) for his own gain. The investors were assured they will earn GREEN tokens with great value. What they actually received were worthless tokens created by Thurston himself on Ethereum. He did not share any mined Bitcoin with the investors.

The Court’s Ruling: The Case Goes to Trial

Despite Green United’s attempts to dismiss the case, Judge Ann Marie McIff Allen ruled that the SEC presented sufficient evidence.The court highlighted that the sales of these mining devices fell under the category of “investment contracts.” And because of that, these are subject to U.S securities laws. The judge also stressed on the deceptive nature of the operation. Investors were misled into believing that they were earning legitimate returns, even though the tokens were fake.

The ruling shook parts of the online crypto community, sparking rumors about the SEC categorizing crypto mining devices as securities. However Neeraj Agrawal from Coin Center has assured the crypto community that this lawsuit is a case specific to Green United’s fraud. This has nothing to do with legitimate mining operations.

What’s Next?

The lawsuit is now moving to the discovery phase, and a trial seems likely. If found guilty, Thurston and Krohn could face serious legal penalties. Their initial argument that the SEC lacks authority over digital assets was also dismissed by the court, with Judge Allen noting that the SEC has been enforcing these types of regulations for nearly a century.

Why Does It Matters?

This case highlights the risks involved in unregulated crypto investments and the SEC’s ongoing effort to crack down on fraudulent schemes. The $18 million raised by Green United through false promises serves as a reminder to investors to be cautious of too-good-to-be-true opportunities in the crypto space.

11 months ago

65

11 months ago

65

English (US) ·

English (US) ·