The inflow of funds into Bitcoin ETFs (Exchange Traded Funds) is attracting attention, but it is likely that sales by Bitcoin miners are weighing on the recent Bitcoin (BTC) price. Analysts at Bitfinex (currency) exchange said in a report dated February 5th.

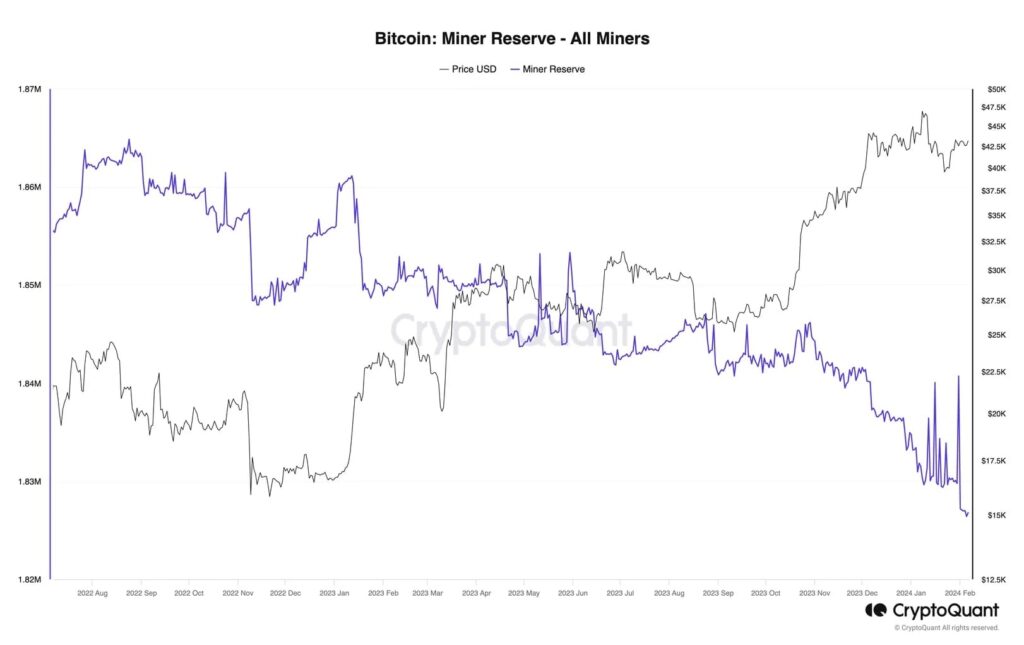

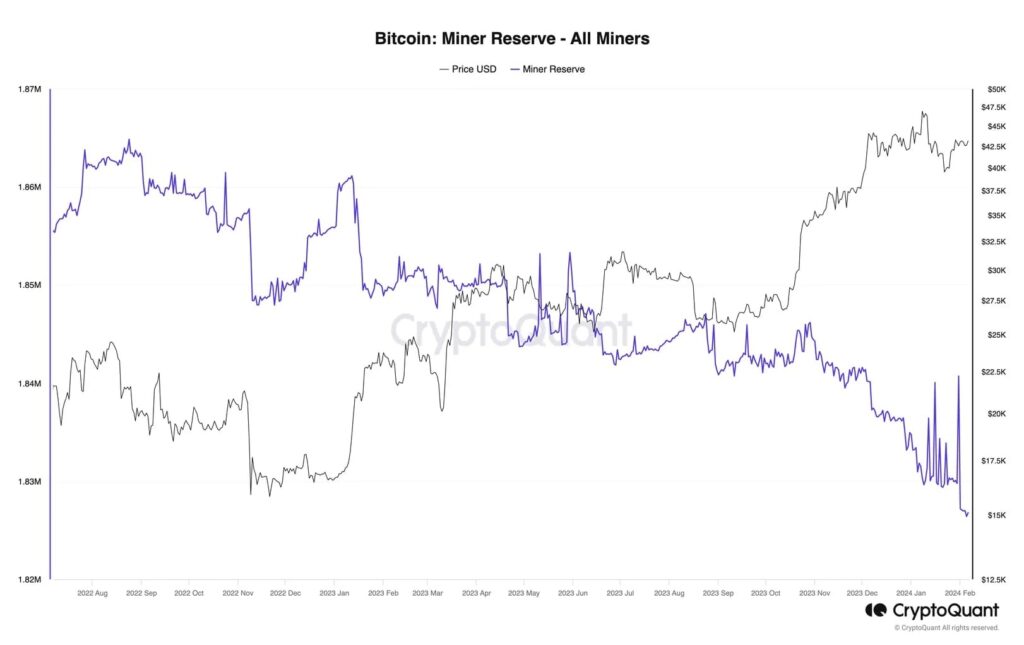

Miner reserves have declined to their lowest level since June 2021, with net outflows since the Bitcoin ETF made its market debut, according to CryptoQuant data.

The Bitfinex report highlighted data from Glassnode showing that miners transferred approximately $1 billion worth of BitCoinDesk JAPAN to crypto exchanges on January 12, the day after the Bitcoin ETF made its market debut. This was likely timed to coincide with the Bitcoin price rising to its highest level in two years.

“This decline in reserves indicates that miners are selling their Bitcoin holdings or leveraging them to raise capital.” “This appears to be an upgrade of the

(Miners’ reserves are at their lowest level since June 2021/Source: CryptoQuant)

(Miners’ reserves are at their lowest level since June 2021/Source: CryptoQuant)Selling is increasing because the once-every-four-year halving is scheduled for April. The report notes that the halving will have a significant impact on miner profitability, with smaller, less efficient miners potentially being forced out of business or forced to merge with larger companies to survive. ing.

“The current sell-off[in Bitcoin]provides miners with funds to upgrade their infrastructure and is a reminder of their significant influence over market liquidity and price discovery.”

Continued selling pressure from miners is likely contributing to Bitcoin's decline in recent weeks. Bitcoin has fallen as much as 20% after hitting a year-to-date high of $49,000 on the day of the ETF's market debut. Since then, the price has recovered and remains flat at around $40,000, but attempts to raise it above $44,000 have failed numerous times.

While capital outflows from miners are increasing, Matthew Sigel, head of digital asset research at U.S. asset management giant VanEck, said the extent of selling by individual miners depends on operating costs. He said he is doing so.

“Low-cost miners like CleanSpark, Riot, and Cipher Mining are selling fewer Bitcoins,” he wrote on X (formerly Twitter) on the 6th. .

“In contrast, high-cost miners like Argo Blockchain and TeraWulf sell up to 100% of their revenue.”

|Translation and editing: CoinDesk JAPAN

|Image: Shutterstock

|Original text: Bitcoin Miner Selling Ahead of Halving Is Capping Prices: Bitfinex

The post Selling pressure from Bitcoin miners in preparation for halving weighs on Bitfinex | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

70

1 year ago

70

English (US) ·

English (US) ·