Macroeconomics and financial markets

In the US NY stock market on the day, the Dow Jones Industrial Average fell 38 dollars (0.1%) from the previous day, and the Nasdaq Index closed 102 points (0.8%) lower.

connection:US stocks rose slightly Debt ceiling talks scheduled to be held today | 16th Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

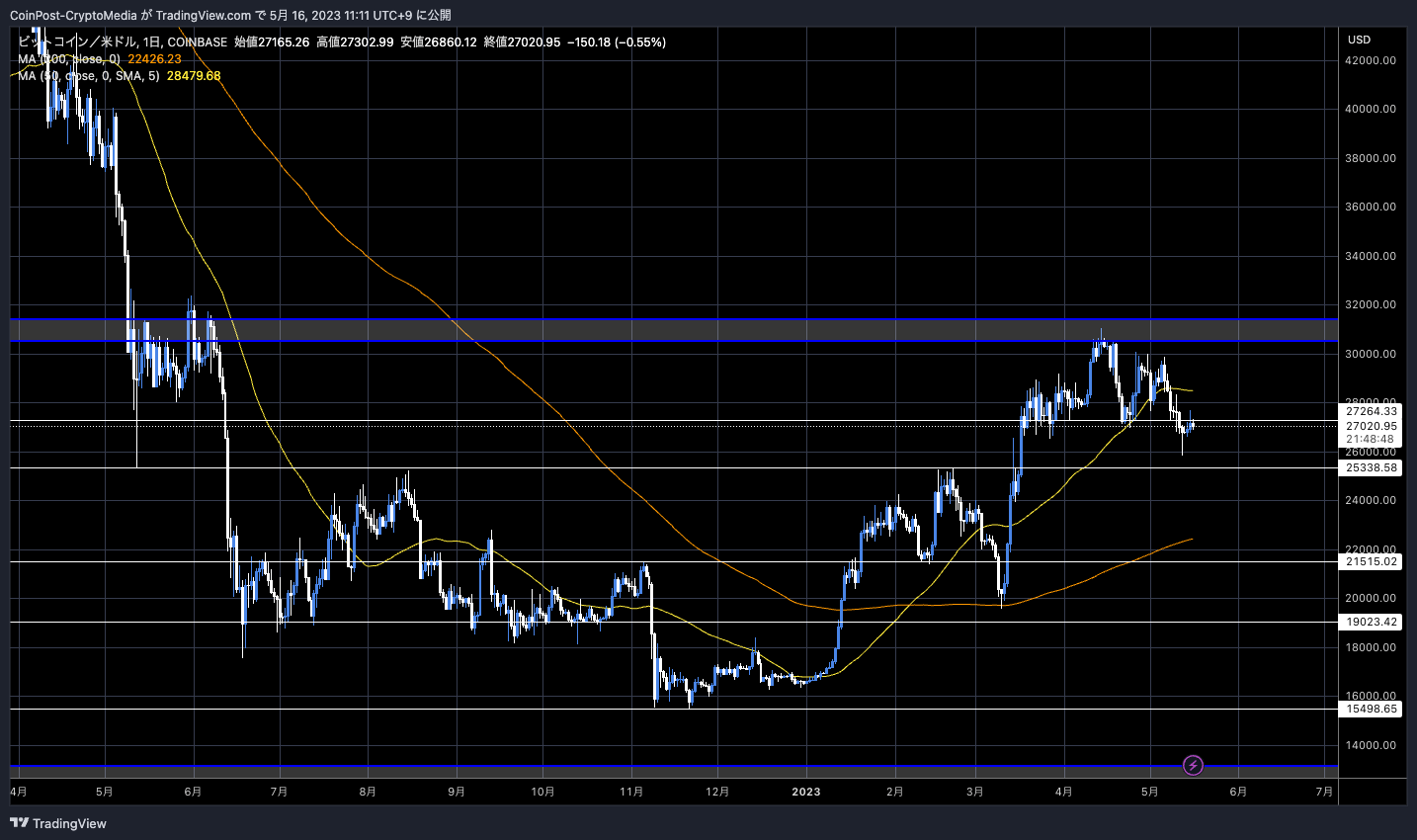

In the crypto asset (virtual currency) market, Bitcoin fell 0.54% from the previous day to $27,029.

BTC/USD daily

Although the price temporarily returned to 1 BTC = $ 27,500, buying did not continue. The upper price is hit and the unstable transition is followed.

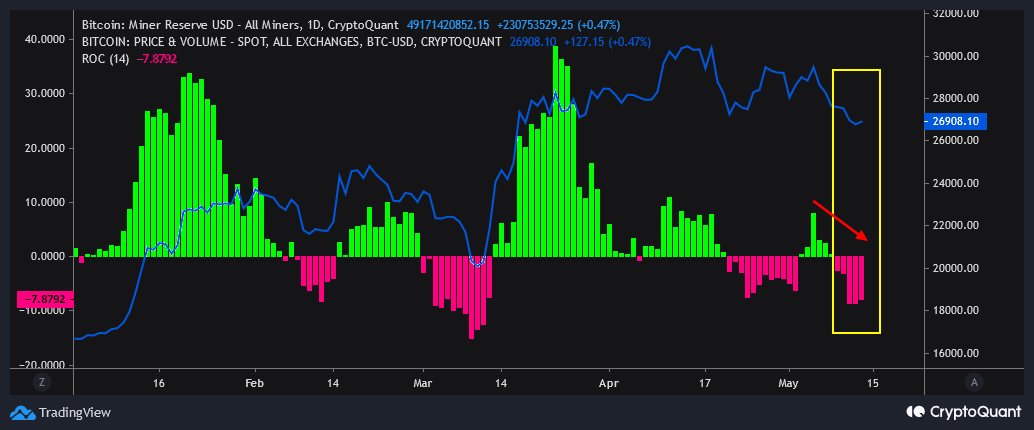

BaroVirtual, an analyst at data analytics firm CryptoQuant, said yesterday that the latest Bitcoin selling pressure may have been led by miners.

On-chain data from the Bitcoin Miner Reserve shows that miners began to significantly reduce their Bitcoin holdings from May 5, 2023, when the Bitcoin price was in the $29,500 range. The net position turned negative.

CryptoQuant

Net position refers to the total amount of Bitcoin held by miners minus the amount sold. The data shows that there was strong selling pressure from miners, and it is possible that they sold bitcoins to maintain equipment, raise working capital, and pay off debts.

“The current miner net position is in the zone where Bitcoin rebounded last time and the local upward trend continued,” BaroVirtual said. “If we reach the target 1BTC = $24,000 level, we may slow down or stop selling our holdings,” he said.

Major miners tend not to sell newly mined bitcoins immediately during a bullish trend and tend to hold them for a while in anticipation of price appreciation, but in a bearish trend they often prioritize selling to secure cash on hand. .

Recently, with the overheating of meme coins using “BRC-20”, an experimental framework token standard for Bitcoin, Bitcoin transaction fees have skyrocketed. It reached an average of $30 per trade on the 8th.

The total market capitalization of BRC-20 tokens has reached about 90 billion yen ($700 million) as of the 9th, and bitcoin miners have earned a large amount of temporary bonus income.

connection:Meme Coin Overheated, Bitcoin Token Standard “BRC-20” Market Expands Rapidly

Lido Finance, the largest protocol for liquid staking, which accounts for 29% of Ethereum depositors, has launched the mainnet of the large-scale upgrade “Lido V2” after on-chain voting. A locked-up Ethereum withdrawal (withdrawal) function has been implemented.

Following a successful on-chain vote, Lido V2 is officially here.https://t.co/36EmuagToD

—Lido (@LidoFinance) May 15, 2023

Lido is the leading “liquid staking” that manages alternative assets (stETH) while receiving Ethereum staking rewards.

Before the withdrawal function was implemented in Ethereum’s major upgrade “Shanghai (Shapella)”, it received a derivative token (stETH) issued at a ratio of 1:1 to the deposited capital (ETH), It has been especially useful for traders who dislike capital restrictions from the viewpoint of the liquidity of their assets.

With this upgrade, you will be able to unstake ETH directly from the Lido protocol, further improving reliability and liquidity. At the time of stETH redemption, staking rewards (ETH) can be obtained along with the original capital, so the re-stake rate will also be noted.

connection:Explaining “LSD (Liquid Staking Derivatives)” that enables operation while staking Ethereum

In the Ethereum market, in addition to selling pressure due to unstaking through Lido, asset sales due to debt consolidation of Celsius Network (Celsius), a cryptocurrency lending company that went bankrupt last year, are also expected. According to Wu Blockchain, Celsius holds 400,000stETH worth $720 million through Lido Finance.

Lido V2 Upgrade / Ethereum Withdrawals are Live. Lido V2 introduces two major components, with the most user-facing aspect being Ethereum withdrawals. This allows Ethereum stakeholders with Lido to directly unstake ETH through the protocol. Lido currently holds the largest percentage…

— Wu Blockchain (@WuBlockchain) May 15, 2023

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Selling pressure from bitcoin miners increases, Lido V2 launches to implement Ethereum withdrawal function appeared first on Our Bitcoin News.

2 years ago

138

2 years ago

138

English (US) ·

English (US) ·