Performance of foreign ETFs

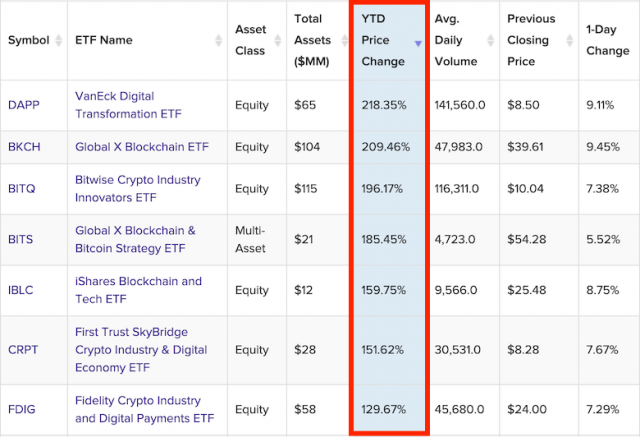

Seven blockchain-related ETFs (exchange traded funds) traded in the U.S. have seen year-to-date performance of more than 100%.

According to VettaFi data, the best-performing ETF is the VanEck Digital Transformation ETF (DAPP), which is up more than 218% year-to-date as of this writing. With the new NISA system starting in 2024, interest in foreign ETFs is increasing in Japan as well.

What is an ETF?

Abbreviation for “Exchange Traded Fund.” Refers to investment trusts listed on financial instruments exchanges, where a wide range of financial products, not just virtual currencies, are traded.

Virtual currency glossary

Virtual currency glossary

The image below is a blockchain-related ETF with year-to-date performance of over 100%.

Source: VettaFi

connection:Top 3 rankings of domestic and overseas ETFs (exchange traded funds) that can be purchased with NISA

DAPP is an ETF that tracks the stock index called “MVIS Global Digital Assets Equity.” This financial product provides investors with exposure to companies driving DX (digital transformation) with digital assets.

Specifically, blockchain-related companies include the U.S. crypto asset (virtual currency) exchange Coinbase, MicroStrategy, which owns a large amount of Bitcoin (BTC), and allocation to the stock price of U.S. fintech company Block Inc., led by Jack Dorsey. is increasing.

connection: MicroStrategy purchases approximately $600 million worth of virtual currency Bitcoin

Among individual stocks, Coinbase’s stock price also rose due to the upward trend in virtual currency prices. According to TradingView, the year-to-date increase is over 320% as of this writing.

Other ETFs

Among the ETFs pictured above, only the Global X Blockchain & Bitcoin Strategy ETF (BITS) offers exposure to multiple assets, rather than just investing in stocks.

BITS is an ETF that specializes in blockchain and digital assets and aims for long-term profits. He explained that he does not invest directly in Bitcoin, but instead invests directly or indirectly in U.S. Bitcoin futures and in companies that are likely to benefit from the spread of blockchain.

Although the year-to-date increase rate of BITS is over 185%, which is a high performance, there are some products, including DAPP, whose prices have fallen significantly compared to November 2021, when Bitcoin hit a new all-time high. . DAPP, for example, is down over 75% compared to this period.

VanEck, Global

connection: “Involved in recent court ruling” SEC Chairman Gensler comments on Bitcoin ETF listing application

Bitcoin ETF review list

Source: Bloomberg Intelligence

Bitcoin ETF special feature

The post Seven US blockchain ETFs have achieved year-to-date performance of over 100% appeared first on Our Bitcoin News.

1 year ago

64

1 year ago

64

English (US) ·

English (US) ·