The post Shiba Inu Flashes Sell-Off Signal, Price Poised for 15% Drop appeared first on Coinpedia Fintech News

Amid the confusing market sentiment, Shiba Inu (SHIB), the popular meme coin is poised for a notable price decline as it has formed a bearish price action pattern on its daily chart. This negative sentiment extends across the cryptocurrency landscape including Bitcoin (BTC), Ethereum (ETH), and Solana (SOL).

Shiba Inu Technical Analysis and Upcoming Levels

According to CoinPedia’s technical analysis, SHIB appears bearish as it has broken down from a symmetrical triangle price action pattern on the daily time frame. This breakdown has shifted market sentiment toward a downtrend.

Source: Trading View

Source: Trading ViewDespite the breakdown, SHIB is currently finding support at the 200 Exponential Moving Average (EMA) on a daily time frame, indicating a potential uptrend. However, if the meme coin breaches and closes a daily candle below the 200 EMA, there is a strong possibility of a 15% decline, targeting the $0.000015 level in the coming days.

SHIB’s bearish thesis will hold only if it closes a daily candle below the 200 EMA or the $0.000017 level, otherwise, it may fail.

Bearish On-Chain Metrics

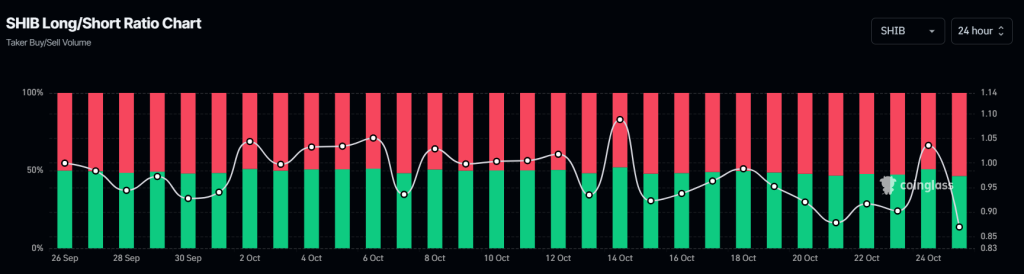

This negative outlook is further supported by on-chain metrics. According to the on-chain analytics firm Coinglass, SHIB’s Long/Short ratio currently stands at 0.869, the lowest since late September 2024. This ratio at press time indicates a strong bearish sentiment among traders.

Source: Coinglass

Source: CoinglassAdditionally, SHIB’s open interest has dropped by 7.67% over the past 24 hours, indicating increasing liquidation of long positions as the price continues to decline. Currently, 53.5% of top traders hold short positions, while 47.5% hold long positions.

Current Price Momentum

At press time, SHIB is trading near $0.0000173 and has experienced a price decline of over 3.8% in the past 24 hours. During the same period, its trading volume increased by 5%, indicating rising participation from traders and investors compared to the previous day.

4 weeks ago

22

4 weeks ago

22

English (US) ·

English (US) ·