The short-term outlook for the cryptocurrency looks positive as blockchain data shows short-term holders of Bitcoin (BTC) are profiting.

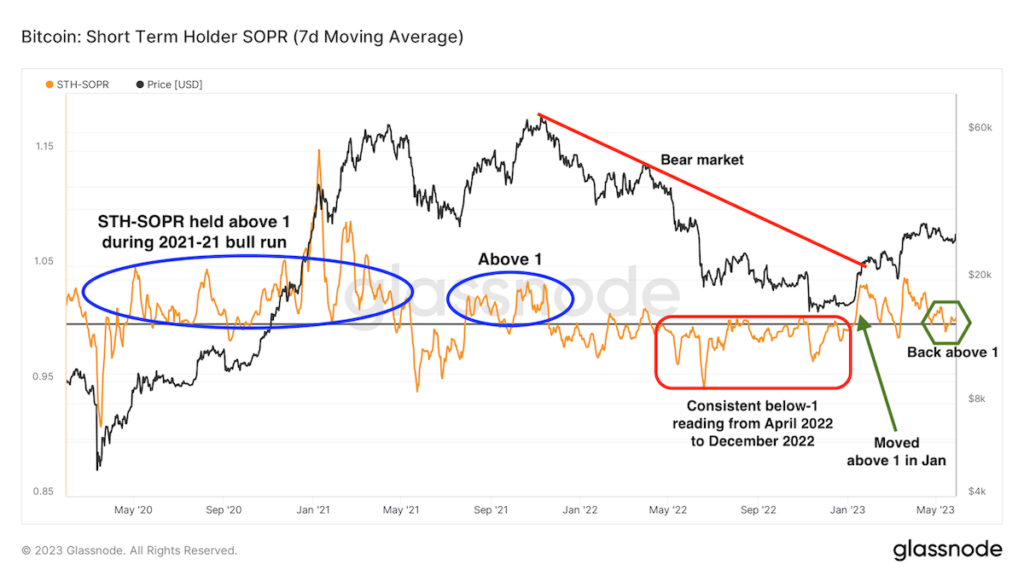

According to blockchain analytics firm Glassnode, the 7-day moving average of short-term holders’ SOPR (Spent Output Profit Ratio), a measure of Bitcoin’s (STH) profit margin, recently moved above 1 again.

“STH-SOPR is back above 1 after the coin has been trading in losses,” Blockware Solutions analysts said in their weekly newsletter. “We are bullish on short-term price action as this represents a return to short-term holders.”

A short-term holder’s SOPR above 1 means that the average short-term holder in the market is selling the coin at a profit. Anything below 1 is considered a sign of surrender, while 1 indicates that the average short-term holder is just breaking even.

SOPR is calculated by dividing the realized dollar value of a UTXO (unspent transaction output) by the value at the time the output was created, reflecting the degree of realized profit for all coins moved on-chain. SOPR for short-term holders focuses on all wallets holding coins for less than 155 days.

STH-SOPR has historically stayed above 1 in bull markets. This makes sense, as uptrends allow short-term holders (mostly new entrants, active traders, etc.) to liquidate their coin holdings at a price higher than the acquisition cost.

Also, around 1 tends to act as a support during bullish trends. Holders who expect the price to continue rising see the cost base as a profitable buying opportunity. Conversely, during a bearish trend, the area around 1 acts as resistance.

SOPR is over 1 (CoinDesk/Glassnode)

SOPR is over 1 (CoinDesk/Glassnode)STH-SOPR crossed 1 in January this year, indicating a bullish trend reversal, and has since tested resistance twice. Bitcoin is up more than 68% this year, according to CoinDesk data. At the time of writing, it was trading around $27,900 and was once as high as $28,441, according to CoinDesk data.

Bitcoin long-term holders also turned profitable a month ago, suggesting a big bull run ahead.

|Translation: coindesk JAPAN

|Editing: Toshihiko Inoue

| Image: CoinDesk/Glassnode

|Original: Bitcoin’s Short-Term Holders Are Again Selling at Profit

The post Short-term Bitcoin holders sell profits – positive for near-term price movements | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

157

2 years ago

157

English (US) ·

English (US) ·