Silvergate Bank lost more than $8 billion in deposits in the last few months of 2022 alone. This comes at a time when the bank’s core business is in a slump due to the turmoil in the cryptocurrency industry. Bank regulators, including the Federal Reserve, have warned of such liquidity risks.

The sudden loss of its deposit base was just one of several concerns for Silvergate. The bank is facing pressure from banking regulators who say banks should not focus solely on crypto assets. Most recently, investigations by regulators and the U.S. Department of Justice emerged, and ongoing audits may require revisions to the financial report.

Will the peak be in 2021?

What’s more, CoinDesk’s analysis of financial reports from the past few years shows that its former strengths have begun to wane.

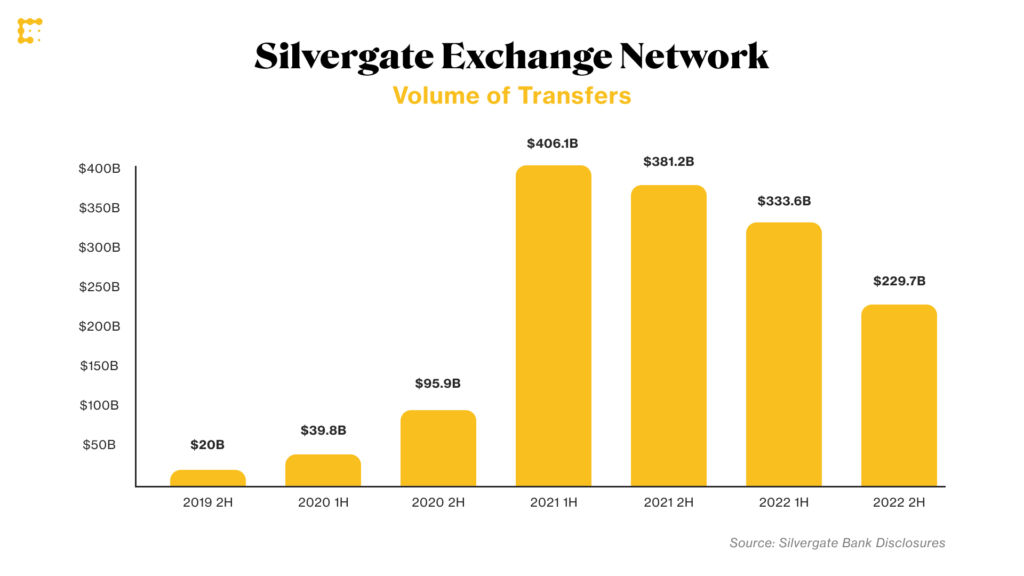

Trading Volume of the Silvergate Exchange Network

Trading Volume of the Silvergate Exchange NetworkSource: Kevin Ross/CoinDesk

Many of Silvergate’s historical financial numbers suggest the bank may have peaked in 2021, before a series of turmoil in 2022 rocked the crypto industry.

For example, the bank’s cryptocurrency settlement network “Silvergate Exchange Network (SEN)” will hit a record high of $406 billion (approximately ¥55 trillion) in the first half of 2021, and will reach a record high of $2,300 in the second half of 2022. billion dollars (about 31 trillion yen).

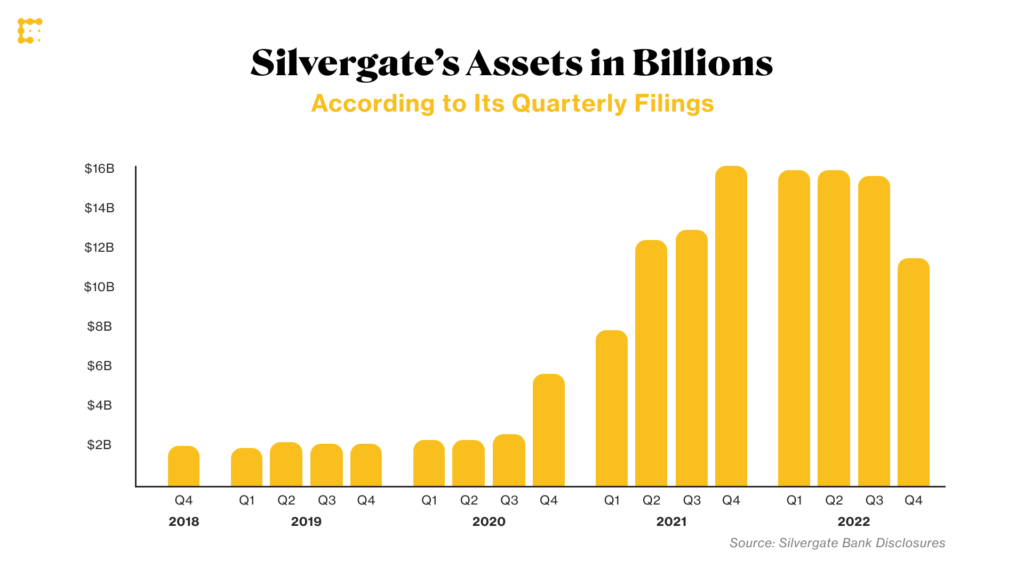

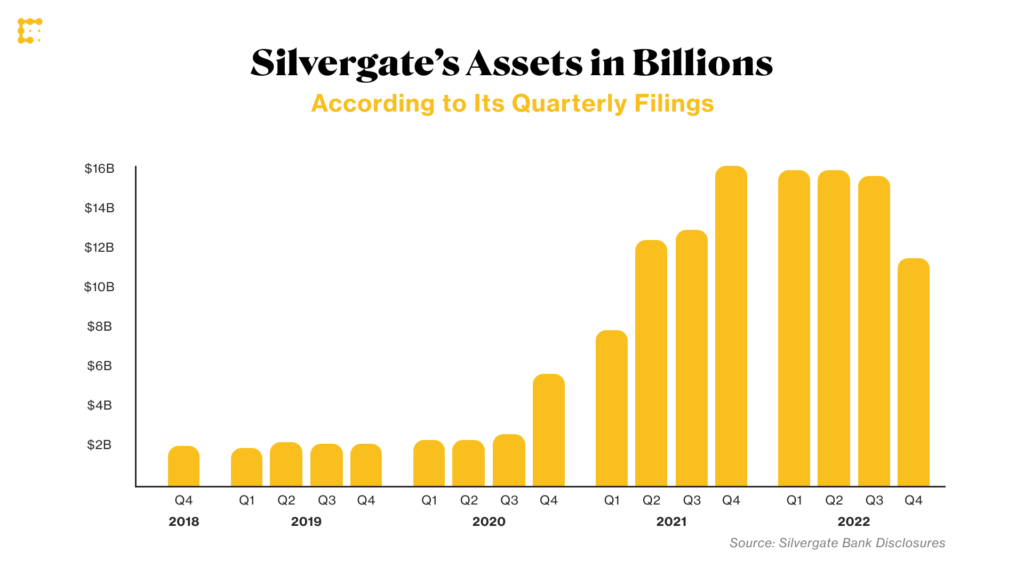

Overall Silvergate asset size also peaked at $16 billion in Q4 2021 and is at $11.4 billion in Q4 2022.

Silvergate property

Silvergate propertySource: Kevin Ross/CoinDesk

Lower leverage ratio

Even when its asset size was at its peak, the bank was very small for a bank and had a strong reputation for playing a core role in the industry as a crypto-friendly bank, but it was a medium-sized bank. Same level as regional banks.

In California, the Farmers and Merchants Bank of Long Beach, a community bank based in Southern California, is slightly larger, but about the same.

But the key difference between Silvergate and more traditional California community banks is a key measure of capital. Silvergate saw its so-called leverage ratio – the ratio of debt to equity – plummet to just 5.4% in Q4 2022. Meanwhile, Farmers and Merchants Bank of Long Beach has a leverage ratio of 10.9%.

5% is marginal, according to U.S. banks’ capital rules, below which it falls out of the “well-capitalized” category and into territory subject to urgent regulatory intervention.

A spokesperson for Silvergate said, “We cannot comment on anything other than what has already been made public.”

I can’t stop leaving the silver gate

Another data published by Silvergate showing the most dramatic decline is in deposits.

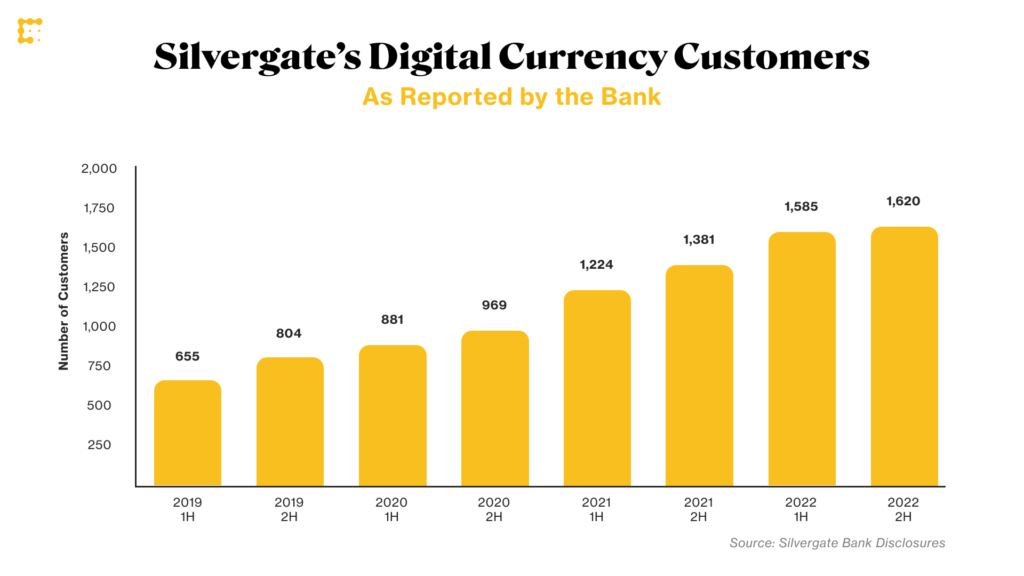

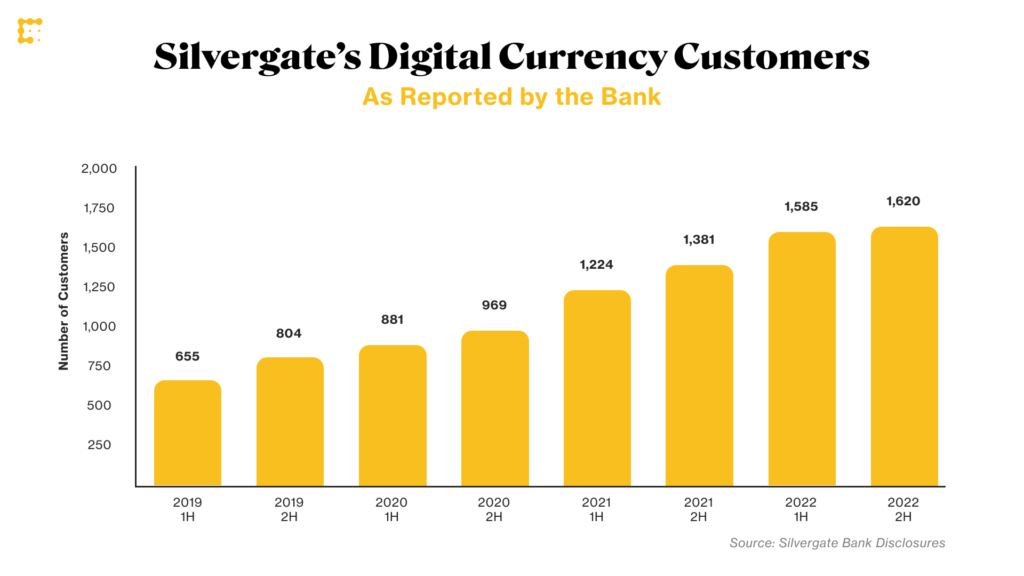

Silvergate publishes the number of cryptocurrency-related customers every quarter, which has consistently increased to 1,620 in the previous quarter. Many are described as institutional investors, but more than 100 “crypto asset exchanges” are also included.

And deposits of these crypto customers fell from around $12 billion in Q3 2022 to just under $4 billion at the end of last year.

Number of Silvergate customers related to digital assets

Number of Silvergate customers related to digital assetsSource: Kevin Ross/CoinDesk

Large customers have stopped trading, and there should be even fewer by now. Coinbase, Paxos, Circle, Galaxy Digital and others have publicly announced their suspensions.

few choices in the industry

Traditional regulated banks cannot survive without deposits. Silvergate’s assets under custody fell sharply last year as its major cryptocurrency clients faced bankruptcies, financial troubles and lawsuits and needed liquidity quickly.

With the Fed and other banking regulators warning financial institutions under their jurisdiction not to get too involved in the crypto sector, U.S. banks are left with fewer options for crypto companies. .

Few banks are as openly and positively crypto-focused as Silvergate, and Silvergate’s struggles spell gloom for those that follow.

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

| Image: Charlotte Harrison/Unsplash (edited by CoinDesk)

|Original: The Rise and Fall of Silvergate’s Crypto Business

The post Silver Gate, the rise and fall of the crypto asset business | coindesk JAPAN | coin desk Japan appeared first on Our Bitcoin News.

2 years ago

105

2 years ago

105

English (US) ·

English (US) ·