With the crypto industry rightfully dubbed the “Wild West,” crypto founders are looking for predictability and clarity when looking for a place to incorporate. They tend to favor regulation.

That is why Singapore, a regulated and efficiently governed city-state, has the headquarters and satellite offices of some of the biggest names in the cryptocurrency industry, such as Binance, Coinbase and Crypto.com. office is located.

But with the spectacular bankruptcies of homegrown darlings Terraform Labs and Three Arrows Capital, the ecosystem entered a “crypto winter.” Singapore’s crypto community is now starting to heal its wounds and look to the future.

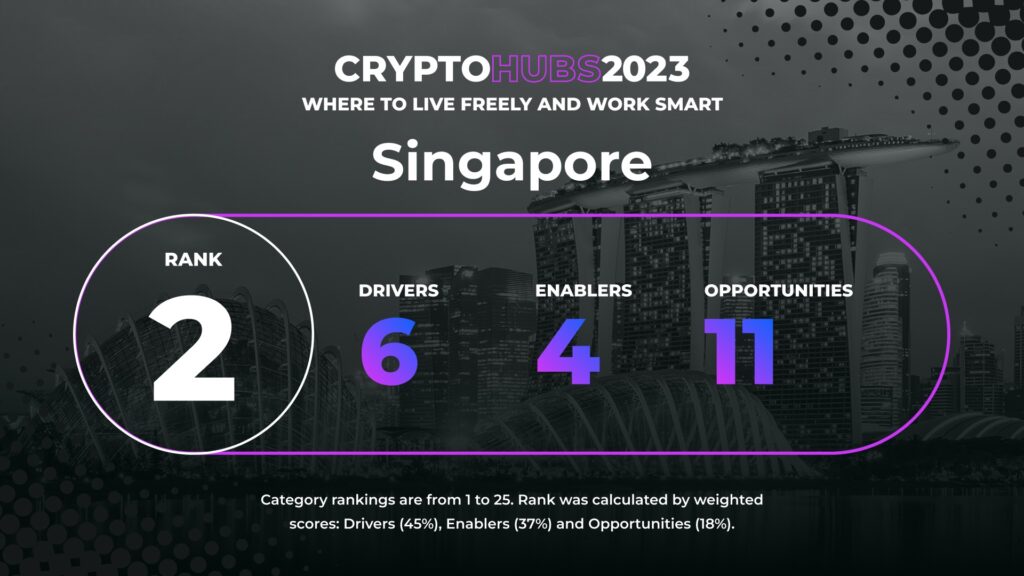

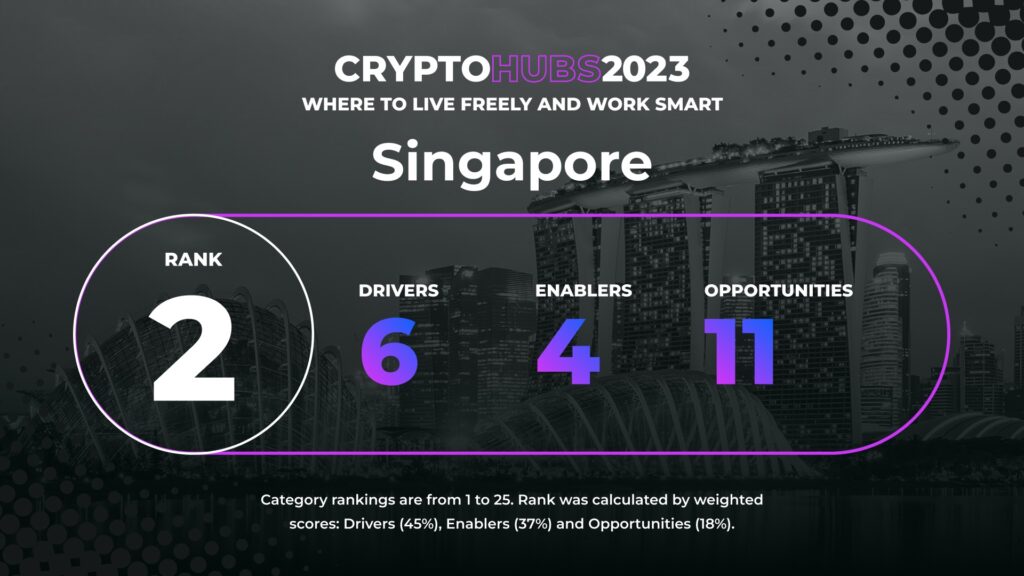

Powerful Crypto Hub

Singapore’s reputation is still alive and well. In a CoinDesk survey of about 30 globe-trotting crypto professionals this spring, it received the most votes as the best crypto hub. Nicknamed the Red Dot, Singapore ranks highest in the world for digital infrastructure (Digital Evolution Index by Tufts University’s Fletcher School), second in the World Bank’s Ease of Doing Business Index, and has a strong cryptocurrency. It has everything you need for a hub.

According to the 2023 Global Financial Centers Index, Singapore is the most competitive fintech hub in the Asia-Pacific region, ahead of Hong Kong, as well as a regulatory pioneer in the crypto industry. The Monetary Authority of Singapore (MAS) has passed the Payment Services Licensing Act in 2020.

“Singapore was the first country in the region to have a robust framework for digital asset licensing in place, resulting in a rush of companies to apply for licenses,” said Institutional Digital Assets. said Pamela Lee, head of APAC sales at trading technology developer Talos.

Prakash Somosundram, founder of Enjinstarter, a blockchain-based crowdfunding platform for early-stage crypto projects, said he has been “front row at the Singapore crypto scene” since 2015. “I’ve seen it,” he says.

“From a regulatory perspective, the early days of crypto were very pro-crypto, which is why many crypto influencers moved their capital here,” Somosandram said. He also pointed out that the absence of capital gains tax “is an ideal place for the crypto wealthy to come.”

“Crypto Island”

Highly educated talent and organized fintech know-how make for a strong combination for Singapore. Early ICOs (initial coin offerings) include Singapore startups such as cryptocurrency payment platform TenX, which raised $43 million in just seven minutes in 2017. was included.

In the same year, Singapore raised $1.5 billion in ICO funding, surpassing the US with $1.2 billion. For a country about the size of New York City with only two-thirds of the population, the numbers are staggering.

Until the current “cryptocurrency winter” arrived, Singapore had attracted a lineage that could be described as a stereotype of the culture and lifestyle of cryptocurrency celebrities. That world was centered around the affluent Sentosa Island, which Somosundrum called “Crypto Island.”

Sentosa is the only place in Singapore where foreigners can own real estate and is flooded with wealthy expats. Sentosa residents include Binance founder and CEO Chengpeng Zhao and cryptocurrency thought leader and American investor Balaji Srinivasan. Crypto-related meetups, conferences and events were held at villas and yachts, Somosandram recalled.

Diverse island

But Zhao and Balaji left Singapore relatively early. Zhuling Chen, founder and CEO of staking access startup RockX, his second crypto startup in Singapore, shares his views on the local crypto community. said it was clearly not a luxury island for high-profile billionaires.

Chen said the community is racially and gender-diverse, and the crypto ecosystem is diversifying. In addition to ICOs, “Singapore is also one of the earliest countries where the Ethereum community was formed,” according to Chen. “When you go to NEAR or Solana meetups, you see different types of people. Strong fan bases” exist in various token projects, Chen said.

Singapore’s residents come from all over the world, with around 30% of the population being non-citizens, or foreigners. “Singapore has been a fintech hub for many years, attracting talent from across the Asia-Pacific region,” Cheng said, adding, “It’s a pretty attractive place to find top talent.” In fact, Cheng’s company has 40 staff from eight different nationalities.

“We don’t want to be seen as crypto bros (self-righteous and arrogant crypto men),” said Lee, who is a member of the Singapore Blockchain Association’s Women in Blockchain Committee. says Mr.

“I think that’s not what Singapore really wants to build. What we want is a fintech hub with a highly innovative environment for people to work together and grow together.”

A cautious stance and fear of leaving Singapore

As Singapore returns to its roots, both MAS and crypto investors are a little more cautious than before. Temasek Holdings, a government-backed conglomerate and venture capital firm, has reportedly written off $200 million in losses due to the FTX bankruptcy.

While Singapore has maintained its commitment in terms of promoting blockchain, Cheng said banks have taken stricter measures, including paying more attention to know-your-customer (KYC) and anti-money laundering (AML) measures. I accept that it is evolving.

Such a cautious stance may move crypto-wealthy to Dubai and Hong Kong, where crypto-friendly regulations are attracting corporate and VC capital, Somosandram said.

Somosandram himself said he has moved Engine Starter’s tokens from an offshore entity to Dubai and is applying for a license for the first phase of the startup.

“We are being overtaken by Hong Kong and Dubai,” Somosandram said. Cheng and Lee say Singapore is not being overwhelmed by hotspots like Dubai and Hong Kong.

“Singapore is a comfortable place, so it is not so easy to move the entire business that we have set up here to Hong Kong,” Lee said. “I would rather stay in Singapore and set up a small office elsewhere,” he continued.

In any case, Singapore is in a much better position than New York City, the world’s top financial hub, when it comes to crypto regulation. The Winklevoss brothers, co-founders of cryptocurrency exchange Gemini, announced in June that they would expand their Singapore footprint to more than 100 people. By the way, the company currently has 500 employees worldwide.

“Our Singapore office will act as a hub for our wider APAC business. We believe APAC will be a major driver of crypto and Gemini’s next growth,” Gemini said in a blog post. .

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

|Image: Wirestock Creators / Shutterstock.com

|Original: Singapore: The Center of Asian Crypto Wealth Is Ready for a Reset

The post Singapore: A big base in Asia ready to restart[Crypto Hub 2023]2nd place | CoinDesk JAPAN | CoinDesk Japan appeared first on Our Bitcoin News.

2 years ago

196

2 years ago

196

English (US) ·

English (US) ·