Macroeconomics and financial markets

In the US NY stock market on the 24th, the Dow closed at $28 (0.1%) lower than the previous day. The market is supported by receding fears of monetary tightening by the Federal Reserve (Fed) against the background of slowing inflation.

On the other hand, due to the drop in the crypto asset (virtual currency) market, the shares of Coinbase, the largest US exchange, fell 4.2% from the previous day, and the shares of Riot Platforms (formerly Riot Blockchain) fell 5.2%.

Relation:NY Stock Exchange System Failure Microsoft Financial Results, etc. | 25th Financial Tankan

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin fell 1.58% from the previous day to $22,574.

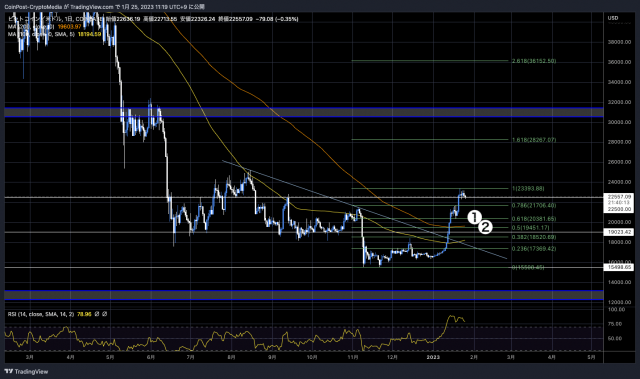

BTC/USD daily

Some altcoins, which had soared, dropped significantly due to profit-taking sales, and BTC fell 1.58% from the previous day, while Ethereum (ETH) dropped 4.5% from the previous day.

However, Bitcoin does not fall into the category of “adjustment” with this degree of decline, so it is necessary to pay attention to downside risks.

BTC has soared to the bottom of the latest low of $15,500, and when weighed by Fibonacci retracement, it pushes 61.8% to the support line of $20,400 (①), and the half-price return is 19,500 at 200MA (200-day moving average). Overlaps near the dollar. (②)

BTC/USD daily

Nonetheless, compared to last year’s bullish trend, individual investors remain cautious due to uncertainty about the future of the market. Since overheating in the derivatives (financial derivatives) market, such as the leverage ratio and open interest (OI), is limited, is there a low possibility of sudden fluctuations in volatility (price volatility) accompanied by large-scale loss cuts?

Arcane Research market analysis

In its latest report, Arcane Research pointed out that the strong performance of the crypto asset (virtual currency) market since the beginning of the year was fueled by the liquidation of excess leverage (going short). “Bitcoin’s daily RSI is at an abnormally high level of over 80,” he said. suggested the need for coordination.

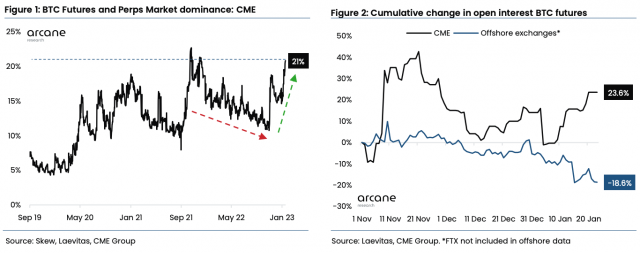

The analysis also attributed the increased entry of institutional investors into the futures market. Derivatives data from the Chicago Mercantile Exchange (CME) showed an upward trend in institutional investors entering the market.

CME’s share of total BTC futures open interest has risen to a record high of “around 21%” while total offshore open interest has fallen by 18.6% following the FTX bankruptcy last November.

Arcane Research

This is a level comparable to the end of 2021 when CME futures volume reached a record high of 1 BTC = $ 69,000 with the approval of Bitcoin ETF (exchange traded fund), and the presence of CME BTC futures market again. means that is increasing.

In addition, crypto asset exchange Gemini, a partner of Genesis Global Capital, which filed for Chapter 11 (Section 11 of the Federal Bankruptcy Law) last week, sold 30.9 million GBTC shares in a private liquidation. It became clear. GBTC is an investment trust issued and managed by Grayscale, an asset management company under the Digital Currency Group (DCG), the parent company of Genesis.

According to Arcane Research, when the GBTC discount (negative divergence) swelled to a record high of -50% toward the end of last year, some investors hedged with cheaper GBTC, which also contributed to the surge in CME activity. pointed out that it may have affected

On the other hand, during the BTC rebound phase since January this year, CME futures prices returned to “contango” against spot prices. In the bitcoin futures market, near-term futures are more expensive than near-term futures, and the long-term holding cost has been neglected.

In the future, we will also refrain from important macroeconomic indicators.

Although we assume that the influence of “Asian time” will be small because the Chinese region is in the Lunar New Year period, the US stock market is expected to remain stable for the next few weeks ahead of the US Federal Open Market Committee (FOMC) meeting scheduled for February 2nd. The correlation with the increased again.

This comes as macroeconomic sentiment gradually shifts from concerns about inflation to concerns about a potential recession.

Relation:Bitcoin Will Rise During Chinese New Year, Matrixport Says

minor trends

Selling pressure from miners has dropped to a three-year low, according to on-chain flows tracked by analysts at cryptocurrency exchange Bitfinex.

Minor selling to cover operating costs has run its course, and as the market environment improves, there are occasional “holdbacks” in anticipation of long-term holdings. When the market environment worsened toward the end of last year, major miners such as Core Scientific and Compute North reported bankruptcy and financial deterioration, and they were forced to consolidate their liabilities and liquidate their assets.

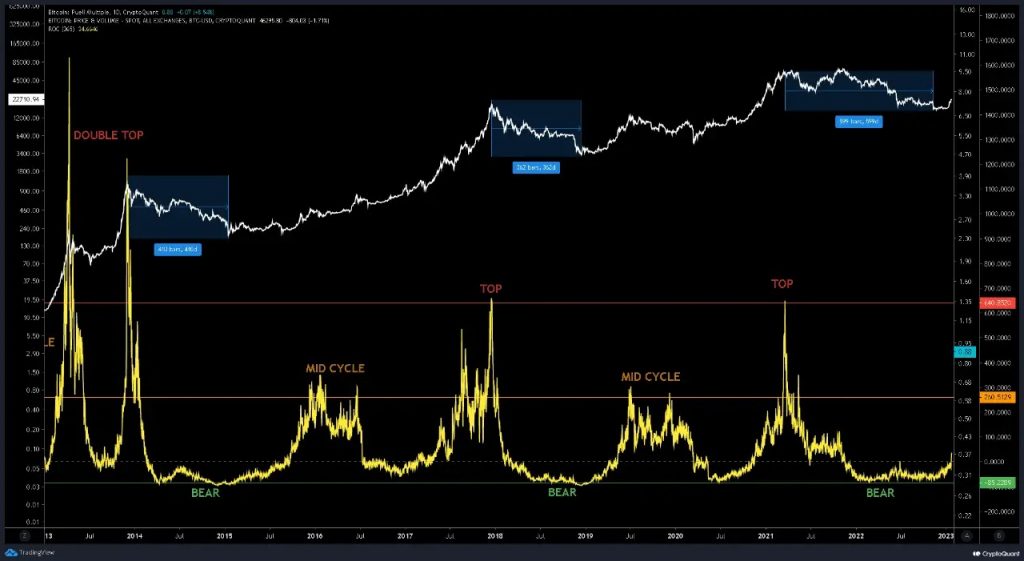

In the minor-related indicators, the Hash Ribbons of buy signals have lit up, and the Bitcoin Puell Multiple has exited the bearish zone. starting.

CryptoQuant

Relation:Bitcoin Maintains $23,000 Level, Minor Indicator “Puer Multiples” Exits Bearish Zone

Click here for a list of market reports published in the past

The post Soaring alt market rebounds, US CME bitcoin futures share hits record high appeared first on Our Bitcoin News.

2 years ago

106

2 years ago

106

English (US) ·

English (US) ·