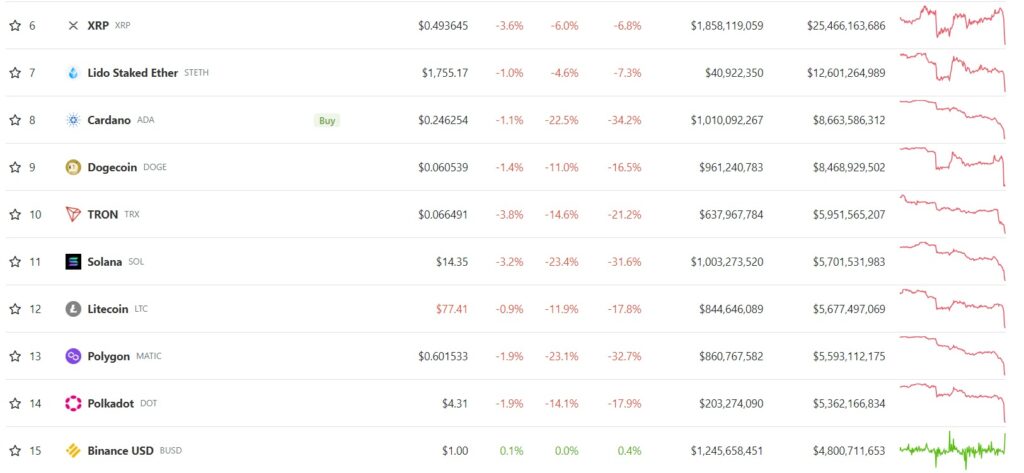

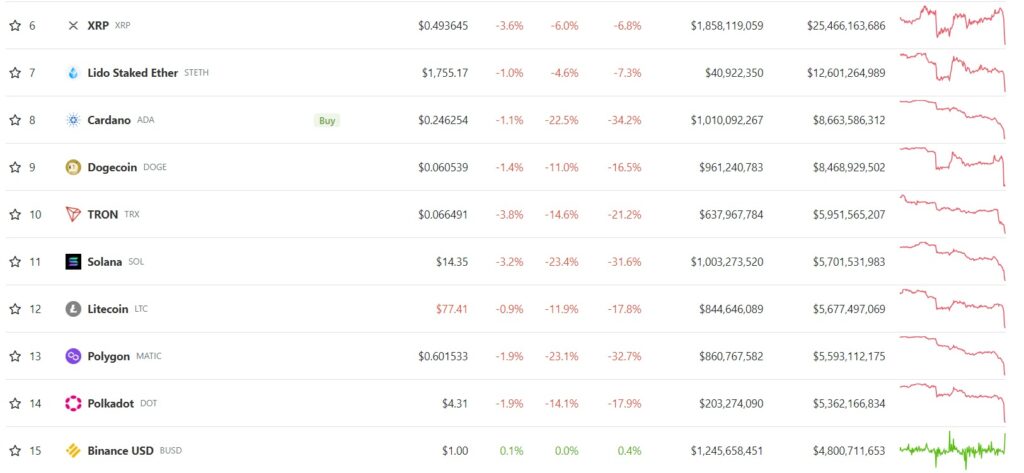

In the US Securities and Exchange Commission (SEC) lawsuit against cryptocurrency exchanges Binance and Coinbase, 13 crypto assets were deemed securities days after they were deemed securities, some more than 20% in 24 hours. fell.

The data shows that the decline occurred in the early hours of the 10th ET. Solana (SOL), Polygon (MATIC) and Cardano (ADA) are down 25% in a few hours. On Twitter, there were also voices that a major crypto asset fund sold its holdings in a market environment with low liquidity.

The weekly rate of decline has reached 34%.

Coin Gecko

Coin GeckoBinance Token (BNB), Dogecoin (DOGE) and XRP (XRP) also dropped more than 11%. Bitcoin (BTC) is down 3.6% while Ethereum (ETH) is down 4.5%.

Nearly $300 million in crypto-related futures liquidations occurred earlier this week, according to data from Coinglass, surpassing the first nine-month liquidation earlier this week.

Earlier this week, the SEC deemed several altcoins to be securities in a lawsuit filed by two exchanges. In response, popular payment app Robinhood seems to have ended support for Cardano, Solana, and Polygon.

|Translation: coindesk JAPAN

|Editing: Takayuki Masuda

|Image: Solana price change for one week (CoinDesk)

|Original: SOL, ADA, MATIC Tokens Slide 20% in Sudden Move Days After SEC Lawsuit Allegations

The post Solana, Cardano, and Polygon temporarily drop by more than 20% | CoinDesk JAPAN | CoinDesk Japan appeared first on Our Bitcoin News.

2 years ago

109

2 years ago

109

English (US) ·

English (US) ·