Solana’s breakthrough

In the latest episode of “The Block Research Podcast,” Anatoly Yakovenko, CEO and co-founder of Solana Labs, an important figure in the blockchain industry, and Mert, CEO and founder of Helus Labs, which builds infrastructure such as Solana’s RPC nodes, will be featured. Mr. Mumtaz performed.

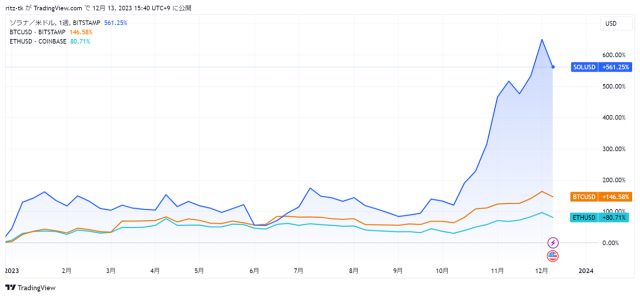

Crypto asset (virtual currency) SOL price has increased by 500% since the beginning of the year. It has outperformed Bitcoin (BTC) and Ethereum (ETH) and is emerging as an attractive investment opportunity.

Source: TradingView

Yakovenko and Mumtaz said that Solana has achieved significant results in increasing network activity and technological innovation, underlining that this has established Solana’s strong position in the cryptocurrency market. They also explained how Solana’s unique features and rich community are shaping an innovative future in the decentralized finance (DeFi) and digital asset space.

Increased network activity in Solana

According to data shared during the conversation, Solana’s network activity increased in the number of transactions from September to December 2023, reaching 21 million transactions on a seven-day moving average. The number of active addresses also increased during the same period, reaching over 450,000 on a seven-day moving average, temporarily surpassing Ethereum’s number of addresses.

Furthermore, the number of new address registrations per day on Solana reached over 200,000 at its peak in November. This represents over 30% growth over the past three months, suggesting increased activity on Solana compared to Ethereum.

Stablecoin trading volume is also notable on Solana, with USDC (USD Coin) trading volume in particular increasing tenfold from October to November, reaching approximately 4 billion on a 7-day moving average. This is about the same size as Ethereum.

DeFi activity on Solana is also increasing, with the arrival of new tokens and airdrops fueling that activity. Jupiter Jito and Pyth Network have released tokens on Solana, and DEX (decentralized exchanges) such as Whirlpool and Radium have increased activity. A synergistic effect has been created, and it is being hailed as “DeFi 2.0.”

In November, the weekly trading volume of DEX on Solana reached about $2.14 billion, which is smaller than the trade volume of DEX on Ethereum of about $10 billion, but it narrowed the difference.

connection:2024 virtual currency market forecast, shift to altcoins and increase in corporate token holdings = VanEck

Background to maintaining low fees

Through design improvements introduced a year ago, Solana has been able to effectively isolate areas of high network activity (hotspots) and protect the network from spam attacks by malicious actors. As a result, network outages, which used to occur frequently, are now rare. Solana Labs’ Yakovenko calls this result a “successful stress test.”

Behind this is Solana’s unique design of “Local Fee Market”. When the system detects high demand for block space, it prevents a single program from overusing block space by placing limits on the computing units (CUs) associated with the origin of each transaction.

This allows Solana to offer users stable rates even under conditions of high network activity, with transaction fees hovering in the order of a few yen. Maintaining these low fees further strengthens Solana’s importance as a global payments system.

Also, like Ethereum, Solana allows you to set additional fees (priority fees) in addition to the basic fees. This increases the likelihood that transactions will be prioritized within the network and confirmed quickly.

Source: Solscan

According to Yakovenko, priority fee usage provides a tangible measure of the economic activity of the network and the success of the protocol in real time. He said priority fees currently account for more than 50% of the network’s fee income, indicating that there is strong economic activity on the network and the protocol is successful.

connection:Solana’s mSOL temporarily fell 18% due to selling by large investors, what is the reasoning behind it?

Ability to process large amounts of digital assets

According to Anatoly Yakovenko, Solana’s advanced processing power allows it to efficiently handle large amounts of digital assets and develop unique applications. He specifically cited Solana’s “compression technology” as an example of its uniqueness, which he said has influenced numerous projects.

This compression technology allows Solana to issue and distribute digital assets in the millions at low cost. Rather than simply pursuing rarity, this technology functions as a tool to deepen engagement and enables the distribution of digital assets to loyal fans.

For example, the DRiP NFTs marketplace uses Solana’s compression technology to make digital assets affordable to large audiences. This approach is causing a paradigm shift in the NFT industry.

Additionally, Helium, a US operator with plans to decentralize its Wi-Fi hotspots, decided to migrate to Solana due to its ability to process large amounts of data.

connection:Bitcoin maintains high price even as FOMC approaches, SOL continues to increase due to Firedancer material

The future of Solana

Supported by technological advances, Solana’s ecosystem is more likely to evolve and grow on its own, rather than simply imitating Ethereum’s applications. A typical example is an application called “Jupiter.”

Jupiter has an “atomic relay” feature that enables instant and secure transactions between various markets on Solana’s network. This embodies Solana’s concept of a “world computer,” which unlocks overall liquidity and enables efficient trading on a network that functions like a giant block of RAM.

Jupiter also incorporates elements from Flash Bots and Lido, but it’s not just a copy of Ethereum. It was designed from the ground up, taking advantage of Solana’s unique fast block generation and programmatic delegation of staking system.

Solana founder Yakovenko said building a successful ecosystem requires not only poaching existing talent, but also new and dedicated contributors. He also emphasized that Solana’s advantage is that it attracts passionate and dedicated people with a deep understanding of the challenge of programming on the platform.

The upcoming Solana roadmap will focus on improving the developer experience, with API and RPC enhancements and plans to provide better smart contract tools. The goal is to create an environment where developers can work more easily with Solana.

Additionally, on the protocol front, a top priority is the implementation of a new node, Fire Dancer, which is expected to significantly improve network security and reduce single points of failure in the codebase.

Yakovenko concluded that the ultimate goal is to make scaling Solana as easy as adding compute resources, making the network faster and more robust.

connection:Why is Solana’s “Fire Dancer” expected to be a game changer?

The post Solana’s breakthrough, market influence of blockchain technology driving 500% annual growth appeared first on Our Bitcoin News.

1 year ago

49

1 year ago

49

English (US) ·

English (US) ·