Movements of large investors regarding mSOL

In the early hours of the 13th, it was confirmed that the price of “mSOL”, one of the liquid staking tokens of the cryptocurrency Solana (SOL), would temporarily drop by up to 18% due to a large-scale sale by large investors (whales). Ta.

Source: CoinMarketCap

mSOL is a liquid version of SOL provided by Marinade Finance, and the price of 1mSOL has typically traded around 1.14SOL. However, in the early hours of the 13th, that value fell below 0.99 and the premium was lost.

The price of mSOL quickly recovered due to arbitrage by traders anticipating the return of the peg. Whale converted mSOL worth a total of $8 million (approximately 1 billion yen) into the stablecoin “Tether (USDT),” but a market sell with an 18% price drop can be said to be an unprofitable exit strategy.

With liquid staking, while receiving staking rewards that are normally locked up, it is possible to secure liquidity and earn interest through other investment methods or sell them. According to price data, in the early hours of the 13th, mSOL’s price briefly fell from about $77 to below $67 in about 30 minutes, and then quickly recovered to $77.

What is staking?

A system in which by owning a specific virtual currency, you contribute to the management of that currency’s blockchain network and receive compensation in return. Strictly speaking, it is not only necessary to hold virtual currency, but also to deposit it on the network. It can be said that it is similar to a system where you save legal currency in a bank account and receive interest after a certain period of time. Furthermore, staking can be done with currencies that use the PoS (Proof of Stake) consensus algorithm.

Virtual currency glossary

Virtual currency glossary

connection:Liquid staking (LSD) tops DeFi market, ETH staking demand increases

Eliminating leverage farming?

So far seems like:

1. Funded a bunch of SOL from MEXC two months ago

2. Deposited some into Solend and did a few swaps

3. Woke up today and decided to sell everything depegging mSOL in the process https://t.co/N460VwbwsA pic.twitter.com/IL64jgwfnu

— Anders

(Jito Bull) (@ponzirespecter) December 12, 2023

(Jito Bull) (@ponzirespecter) December 12, 2023

This latest sale by a large investor (whale) may have been carried out as part of deleveraging. Specifically, the purpose is to eliminate the high-risk leverage strategy of borrowing SOL using mSOL as collateral.

This strategy enables the process of earning rewards for Marinade Finance Governance Token (MNDE) by borrowing SOL with collateral and providing liquidity (so-called “farming”). It is presumed that this sale is a withdrawal from this leverage strategy.

The cryptocurrency SOL is up 445.4% over the past year, and over the past month SOL is up 74.8%. In response, Solana’s liquid staking has gained popularity, and related protocols such as Marinade Finance and Jito have seen a rapid increase in deposited SOL since October.

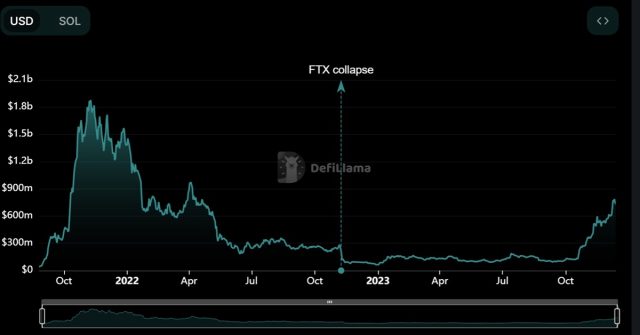

Source: DeFillama

According to DeFillama, Marinade Finance’s total amount under custody (TVL) is approximately $728 million (over 100 billion yen) at the time of writing, accounting for approximately 90% of Solana’s TVL. There are 10 million SOL tokens locked on Marinade, with TVL surging by 66.5% over the past month.

Marinade Finance today announced a cross-chain ecosystem fund partnership with Web3 investment firm Borderless and blockchain platform Wormhole, aiming to build a more converged and interconnected Web3 ecosystem. After this announcement, Marinade.Finance’s native token MNDE soared more than 20% in one day.

connection:What is behind the sudden increase in demand for liquid staking of the virtual currency Solana?

CoinPost Special feature for virtual currency beginners

CoinPost official app (1.7.15) has been released on iOS and Android

・iOS17 compatible

・Improved display of in-app WebView

・Improved behavior when tapping notifications

Such… pic.twitter.com/Y8dikLRBe7

— CoinPost (virtual currency media) (@coin_post) November 15, 2023

The post Solana’s mSOL temporarily fell 18% due to selling by large investors, what is the reasoning behind it? appeared first on Our Bitcoin News.

1 year ago

121

1 year ago

121

English (US) ·

English (US) ·