Macroeconomics and financial markets

In the US NY stock market on the 13th, the Dow Jones Industrial Average rose slightly to $47 (0.14%) from the previous day. The Nasdaq Index closed 219 points (1.5%) higher.

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

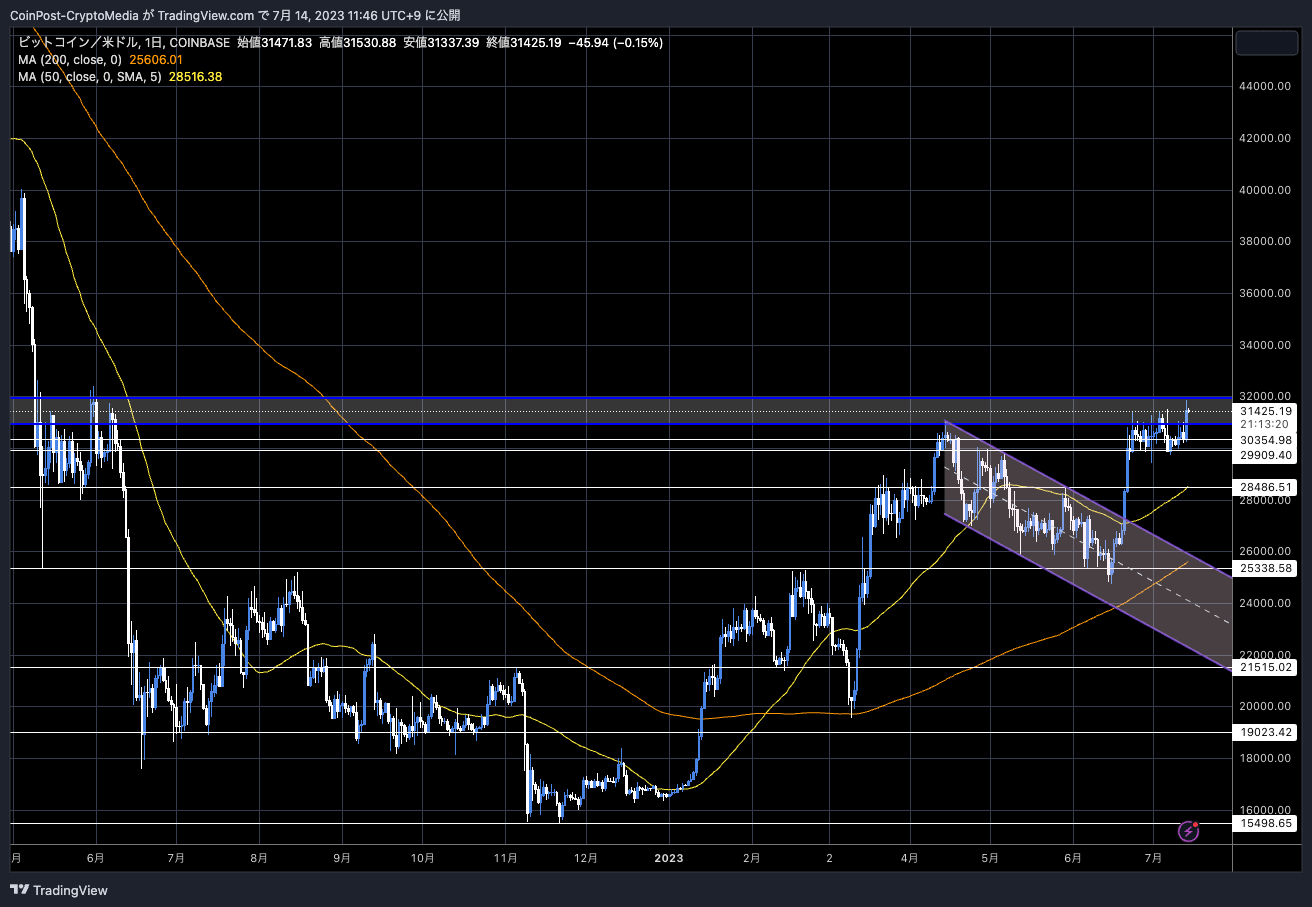

In the crypto asset (virtual currency) market, the Bitcoin price rose 3.7% from the previous day to 1 BTC = $ 31,426.

BTC/USD daily

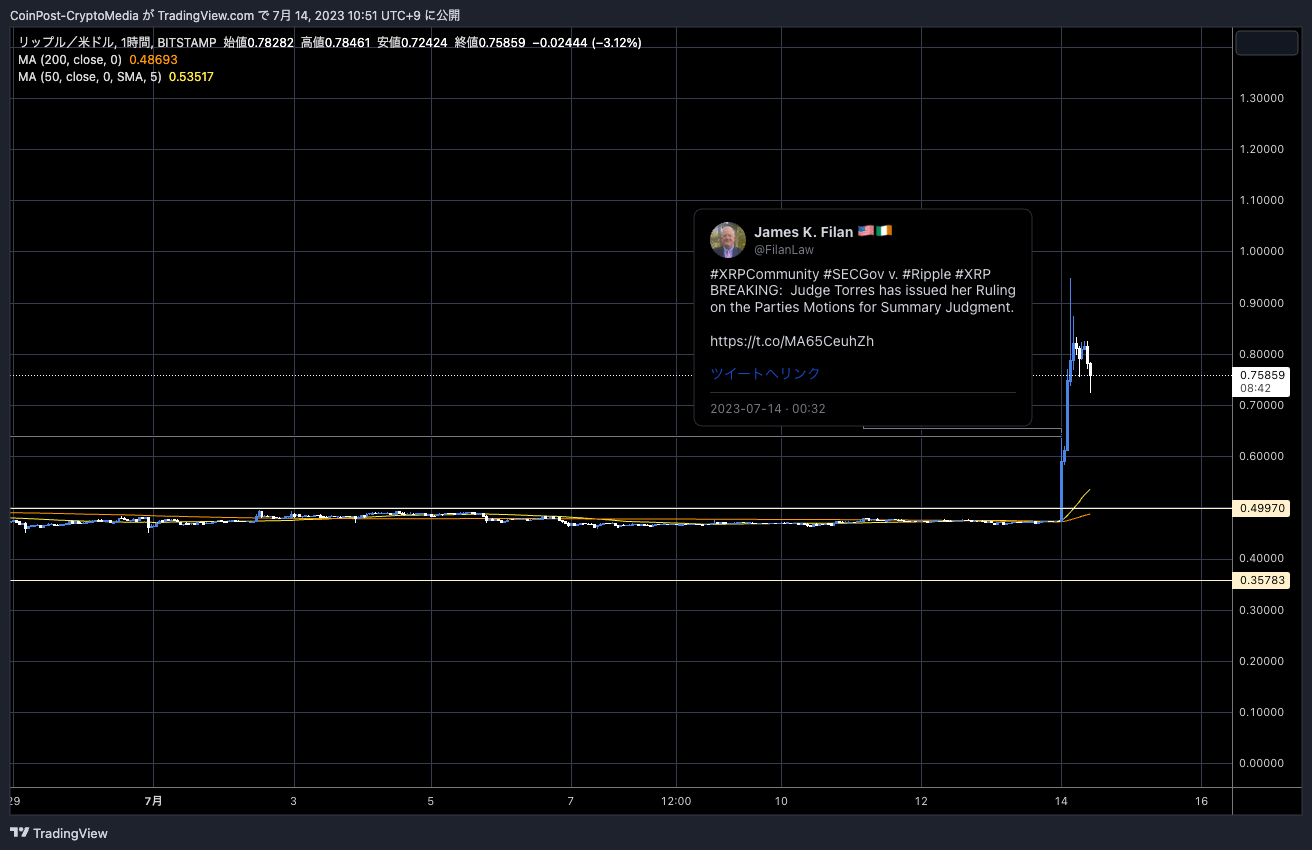

Ethereum (ETH) rose 7.7%, and XRP more than doubled from the previous day to the $0.95 (130 yen) level. Ada (ADA) jumped 25.3% while Solana (SOL) jumped 35.3%.

XEP temporarily adjusted to the 0.72 dollar (98 yen) level in reaction to the sharp rise.

XRP/USD Hourly

Judge Torres of the US District Court (Southern District Court of New York) ruled that “XRP is not a security.”

A huge win today – as a matter of law – XRP is not a security. Also a matter of law – sales on exchanges are not securities. Sales by executives are not securities. not securities.

—Stuart Alderoty (@s_alderoty) July 13, 2023

Ripple, which was sued by the U.S. SEC (Securities and Exchange Commission) in December 2020, has been fighting for two and a half years whether the virtual currency XRP constitutes “sale of unregistered securities.” The district judge held that it did not meet the criteria of the test and the security definition of an investment contract.

On the other hand, it also acknowledged the SEC’s claim that Ripple’s method of selling XRP to institutional investors “violates the Securities Act.”

connection:“The virtual currency XRP itself is not a security,” US district court rules

On this point, experts agree that both Ripple and the SEC are likely to consider an appeal.

The US SEC (Securities and Exchange Commission) has increased regulatory pressure on all altcoins, not just XRP.

When Binance, the largest exchange, filed a lawsuit in June of this year based on 13 accusations, including lack of information disclosure and manipulation of trading volumes, it identified multiple altcoins as securities.

In particular, stocks that use PoS (Proof of Stake) for their consensus-building algorithm have been hit hard, and have had a tremendous impact on the staking services provided by cryptocurrency exchanges in the United States and decisions on how to handle altcoins. The fact that the court recognized that “trading in the secondary secondary market of tokens is outside the jurisdiction of the SEC” led to the speculation that regulatory pressure would retreat.

SEC Chairman Gary Gensler has repeatedly asserted that “all virtual currencies other than Bitcoin are “securities” under the jurisdiction of the SEC.” It can be said to be good looking.

The recent decision to relist XRP by the largest US crypto asset (virtual currency) exchanges Coinbase and Kraken, which were recently sued by the SEC, also provided a tailwind.

XRP (XRP) is now live on https://t.co/CD3RBjtMAO & in the Coinbase iOS & Android apps. Coinbase customers can log in to buy, sell, convert, send, receive or store this asset.

—Coinbase Assets  (@CoinbaseAssets) July 13, 2023

(@CoinbaseAssets) July 13, 2023

From last year to this year, bad news for the crypto asset (virtual currency) industry occurred one after another. Beginning with the collapse of algorithmic stablecoins Terra (UST) and LUNA in May 2022, venture capital Three Arrows Capital (3AC) and major exchanges FTX and Alameda Research went bankrupt one after another. As a result, many altcoins crashed.

As a result of the outflow of funds from risky assets due to the effects of monetary tightening by the Fed (Federal Reserve System), many stocks have fallen nearly -90% from the record highs recorded in the bull market in 2021. It has become.

In such a situation, it can be said that the outcome of the Ripple trial has brought about a clear change in market sentiment.

Bitcoin dominance, a measure of market share, plummeted as altcoins such as XRP, Stellar (XLM) and Solana (SOL) surged.

#Bitcoin dominance (left) and $XRP (right)

This relationship change might be enough to revert us into altcoin season

This is worth watching closely – I see early reversal signals in $BTC.D pic.twitter.com/vm7wLWDEfA

— Tony “The Bull” (@tonythebullBTC) July 13, 2023

connection:What is an exchange traded trust “Bitcoin ETF” | Why the application of BlackRock attracts attention

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Some alts such as XRP soared after Ripple trial ruling, bitcoin updated high since the beginning of the year appeared first on Our Bitcoin News.

1 year ago

127

1 year ago

127

English (US) ·

English (US) ·