Osaka Digital Exchange’s (ODX) private trading system “START” will launch on December 25th as Japan’s first secondary market for security tokens, and the purchase and sale of security tokens will begin. Daiwa Securities Group Headquarters is a shareholder of ODX, and Daiwa Securities is the underwriter for one of the two deals announced on November 20th as the first deals in Japan.

Daiwa Securities Group Headquarters Managing Executive Officer discusses how the long-awaited secondary market will affect the security token market, the significance of Daiwa Securities’ efforts in security tokens, and the potential of the real estate market, which still has a lot of room for development. We asked Atsushi Itaya, who serves as a board member.

Significance and potential of the secondary market

──The private trading system “START” of Osaka Digital Exchange (ODX), which handles security tokens, has literally started. Daiwa Securities will underwrite one of the two deals announced as the first in Japan. With the long-awaited start of the secondary market, how will the security token market change in the future?

board shopThe security token issuance market, which started in 2021, has grown significantly in just three years. The issue amount will be 7 billion yen in the first year, 15 billion yen in the second year, and 35 billion yen in the first half of this third year, approximately 45 billion yen if you include those that have already been resolved. Its growth rate is more than doubling in a year.

Furthermore, with the opening of Osaka Digital Exchange’s START, customers who wish to buy and sell already issued security tokens will have the option of buying and selling on ODX in addition to traditional over-the-counter transactions with securities companies. Since it will also be possible to check transaction prices in the market, convenience is improved and the market is expected to be revitalized. I think we will see more companies issuing security tokens in the future.

–What were the difficulties in launching the secondary market?

board shopThe concept of creating a market and connecting each securities company to it is simple. However, in reality, it was necessary to hold discussions with each participating company in order to unify administrative processes, which had been handled differently by each company. All companies worked together and made adjustments to figure out how to grow the secondary market. Although the aim was the same, adjustments were needed in the technical details. I think it turned out to be a very good market as a result.

Looking at the real estate market in Japan, there are many properties that have not yet been liquidated. Investment grade real estate in Japan is estimated to be worth 170 trillion yen. Less than 30% of these are securitized. In other words, there is room for more than 100 trillion yen to be liquidated. Then came security tokens. Currently, it is growing rapidly at a pace of several tens of billions of yen a year, but there is still a lot of room for growth.

Room for liquidity of over 100 trillion yen

— Considering that there is room for 100 trillion yen, if this year’s security token issuance is 50 billion yen, the underlying real estate is expected to be around 100 billion yen. This is only 0.1% of the 100 trillion yen that has room for liquidation.

board shopAlready this year alone, 100 billion yen of real estate has been subject to security tokens, and the cumulative total so far is about 150 billion yen, but that’s still 0.15%. Although not everything will be liquidated, the market potential is still large.

Until now, securities companies have mainly handled stocks, bonds, and investment trusts and wrap services that combine these, but in recent years, alternative assets have been added to the mix. Investment in alternative assets has a lot of room for expansion, and real estate investment is a prime example of this.

As mentioned above, there is a huge market for investment grade real estate valued at 170 trillion yen, but since most of it is not securitized, it is difficult for individual customers to purchase it. Under such circumstances, the emergence of security tokens backed by real estate is significant.

For example, the property that Daiwa Securities is underwriting this time has an asset value of approximately 7 billion yen, and there are only a limited number of customers who can invest this amount of money. However, by turning it into a security token and making it smaller, it has become a product that is easier for individual customers to purchase. Furthermore, rental income from real estate is subject to comprehensive taxation, but in the case of security tokens, the income becomes dividend income, and it is possible to choose separate taxation on self-assessment or separate taxation with source.

“From savings to investment”accelerate

—The slogan “From savings to investment” has been around for a long time, but even though stocks and bonds have become quite familiar through iDeCo and NISA, it still feels like they are not very familiar. On the other hand, Japanese people are said to like real estate, so is this background also influencing the expansion of the security token market?

board shopIt is estimated that individuals have 2,000 trillion yen in financial assets, of which half, or approximately 1,000 trillion yen, is held in cash and deposits. As stated in the government’s “Asset Income Doubling Plan”, if we create an environment where individuals can easily invest in assets with high returns, they can expand their financial asset income, and that investment will become a major growth investment for companies. By becoming a source of capital, the growth of companies is promoted.

Although deposit interest rates have shown a slight increase, they are still below the decimal point. On the other hand, the yield of real estate security tokens is around 4%, and the effect is significant.

Stocks and bonds continue to be the main products for securities companies. However, considering that 1,000 trillion yen out of the 2,000 trillion yen in personal financial assets still exists in cash and deposits, real estate security tokens are an option as an alternative investment and a new asset management method. I think it has great potential.

In addition to stocks, bonds, and investment trusts that combine these, the emergence of financial products backed by real estate will expand investment options and potentially accelerate the shift from savings to investment. thinking.

Expanding and diversifying options

──Until now, I had not been very aware of the size of the real estate investment market behind security tokens, but the potential is huge.

board shopDaiwa Securities started selling security tokens in 2021, and sales have been very strong so far. We have received feedback from customers who have not had many transactions with us in the past, saying, “I would like to purchase this kind of product.” In addition, there are many cases where people who have purchased once become repeat customers and purchase again.

Real estate security tokens can be said to be a tactile financial product because the property is tangible. Purchasing real estate as an asset not only requires a large amount of money, but also requires time and effort to manage, such as having to recruit for rooms when they become available. You can earn a stable income without any of that hassle.

Even for companies involved in the real estate business, in the past, even if they wanted to liquidate real estate and sell it widely to individual investors, the only options available were listed real estate investment trusts (REITs). Unlike REITs, security tokens make it easier to create liquidation products for individuals, which means that companies will have more options for liquidation. In this way, security tokens bring new benefits not only to investors but also to issuers.

──As ODX’s START transaction begins and recognition of security tokens spreads, the market will further expand.

board shopIn addition to expanding the market, from the perspective of expanding investment options, the assets eligible for security tokens are not limited to current real estate and corporate bonds. For example, the government aims to significantly increase the share of renewable energy by 2030. Traditionally, institutional investors have mainly provided funds for building new solar power plants, wind power plants, geothermal power plants, etc., but there is still a need to build many more facilities. We believe that it will be difficult to provide funding from institutional investors alone.

By converting various infrastructure assets into security tokens and making them available for sale to individual customers, funding methods can be diversified. Once operational, the cash flow will be stable, so I think it will become a new investment target for individual customers. I think it can gain popularity not only from the perspective of asset management but also from the perspective of SDGs such as global warming countermeasures. The Daiwa Securities Group has companies that invest in renewable energy and infrastructure such as water supplies, airports, communications, and ports, as well as companies that are involved in various real estate businesses, and we would like to aim to collaborate with such companies. There is.

Challenge wallet and public blockchain

──Starting with this project, we have started using the security token wallet “Crossllet” developed by Daiwa Institute of Research. What is “Crosslet”?

board shopWhen handling security tokens, it is necessary to connect the securities company’s system to a blockchain issuance and management infrastructure called a “platformer” such as Progmat, ibet for fin, and Securitize. In the future, as the size of the security token market expands and the number of platform operators increases, we believe that there will be a need for a highly scalable and flexible wallet that can connect with a variety of platform operators.

The basic functions, such as managing private keys and viewing blockchain data, are similar to other wallets, but the design is designed to allow easy connection to more blockchains. We also plan to support stablecoins when they appear in the near future. We thought that developing this kind of infrastructure would lead to an increase in the number of securities companies and issuers entering the security token market.

We believe that the development of infrastructure such as wallets and platforms through collaboration rather than competition among companies will lead to the development of the market and industry.

──More recently, the company announced a demonstration experiment for issuing security tokens on a public blockchain in collaboration with Ginco, which has a reputation for building financial systems using blockchain.

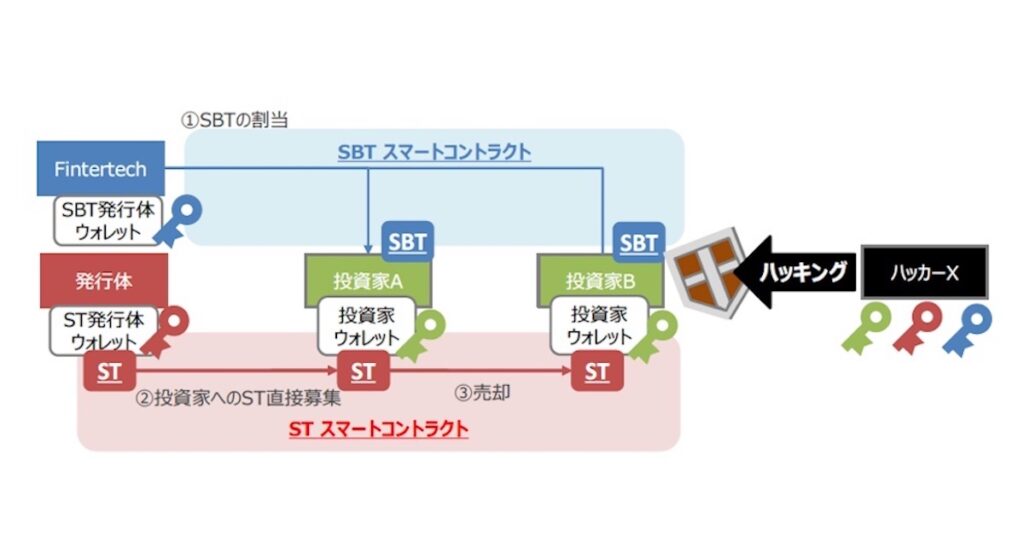

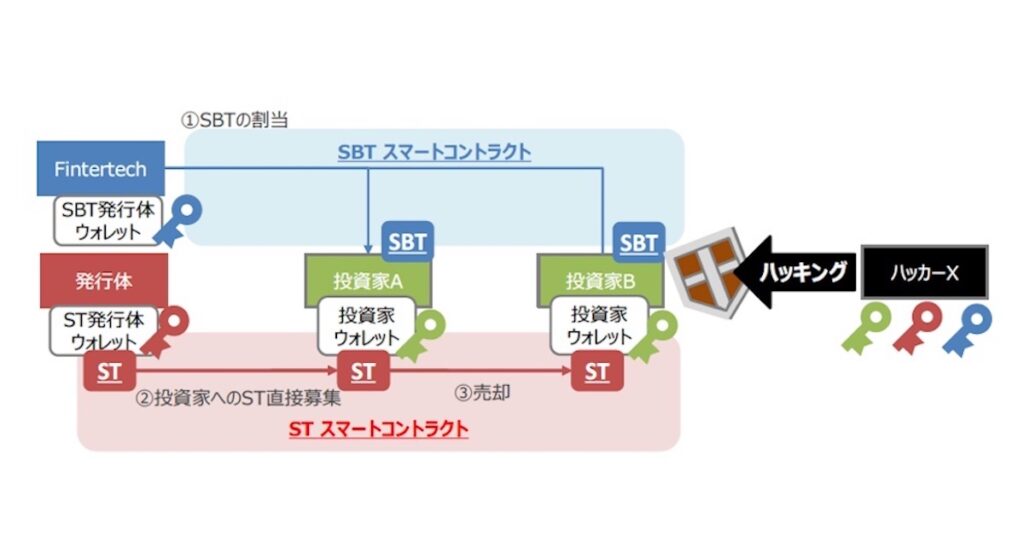

board shopCurrently, the platform for issuing and managing security tokens is a consortium-type permissioned blockchain, but we believe that if security tokens based on a public blockchain can be realized, it will be useful from the perspective of transparency and interoperability. We decided to conduct a demonstration experiment in collaboration with our subsidiaries Fintertech and Ginco. If security tokens are issued on a public blockchain, it will be the first such initiative in Japan.

In this demonstration experiment, a smart contract will ensure that only investors who have been granted Soulbound Tokens (SBT) can sell and acquire security tokens. Through these efforts, the aim is to solve the problem of “the leakage of private keys due to hacking”, which is an issue when using public blockchains.

There will be debate over whether public or permissioned blockchains are better, but it’s good for both investors and us to keep our options open. We believe that these efforts will allow us to attract new customers and players to the market.

|Text: CoinDesk JAPAN Advertisement Production Team

|Photographer: Airi Okonogi

The post [ST Frontline]Untapped real estate market of 100 trillion yen, sleeping cash of 1,000 trillion yen. Daiwa Securities is opening up a market with huge potential with security tokens! | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

151

1 year ago

151

English (US) ·

English (US) ·