- The market capitalization of the stablecoin market has risen to about $140 billion for the first time since late 2022.

- Circle Inc.’s USD coin has increased its market capitalization by more than $2.5 billion in the last month, outpacing Tether’s growth over the same period.

As new capital continues to flow into the digital asset market, the expansion of the stablecoin market has accelerated this year, which has also accelerated the rise in crypto assets (virtual currencies).

According to data from CoinMarketCap, the market capitalization of the stablecoin market exceeded $140 billion (approximately 21 trillion yen, at an exchange rate of 150 yen to the dollar) in February. This is the highest level since December 2022, according to DefiLlama data.

Stablecoins are tokenized versions of cash that bridge traditional fiat currencies and blockchain-based markets, providing liquidity for trading and lending to market participants. Stablecoins therefore play an important role in the digital asset market, and their market capitalization expansion is an important milestone for the crypto market as a whole.

“Changes in the supply of stablecoins measure whether money is flowing into or out of the crypto ecosystem,” said Vetle Lunde, an analyst at K33 Research, in a market report on Friday. It becomes a thermometer.”

The stablecoin market began expanding rapidly in early November, ending a brutal 18-month downward trend. Since then, the market capitalization has grown 12%, or about $15 billion, with about $10 billion of that increase since this year, Runde noted.

Resurrection of USD coin

According to data from CoinGecko, Tether (USDT), the No. 1 stablecoin by market capitalization, has increased by about $2 billion in the past month to a record high of $98 billion (approximately 14.7 trillion yen). Accelerated growth.

Stablecoin growth at the end of last year was primarily driven by Tether, but this year’s growth is occurring more broadly.

According to CoinGecko, USD Coin (USDC), the second-largest stablecoin by market capitalization issued by Circle and backed by U.S. cryptocurrency trading giant Coinbase, has made a comeback, with a total of 24 billion yen since the beginning of the year. It has grown from US$28.5 billion to over US$28.5 billion (approximately 4.275 trillion yen). It has gained nearly $2.5 billion over the past month, outpacing Tether's growth over the same period.

David Shuttleworth, research partner at Anagram, wrote on It was pointed out that this accounted for more than half of the total. He said, “More liquidity and more users are steadily entering the space, and USD coin is gradually regaining market share.”

One contributing factor to the USD coin resurgence may be that Bitcoin (BTC)'s rally this year was driven by strong demand from American investors. USD coin is more popular among American traders. Meanwhile, Tether is dominant among traders in Asia, Africa, and Latin America on offshore exchanges such as Binance.

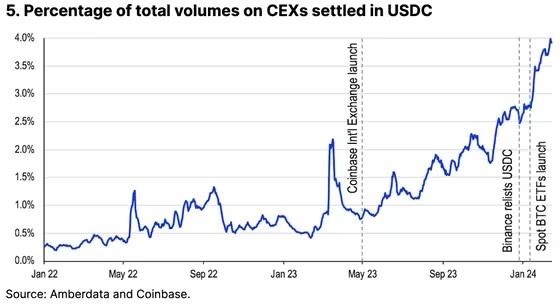

This growth also occurred around the time that Binance relisted several USD coin trading pairs late last year, and Coinbase announced that a Bitcoin spot ETF (exchange traded fund) was being launched in the United States. This was pointed out in a market report on the 26th. Many ETFs reportedly use Coinbase for Bitcoin payments.

USD Coin market share in trading volume of centralized crypto asset exchanges (Coinbase)

USD Coin market share in trading volume of centralized crypto asset exchanges (Coinbase)The report shows that the USD coin has a growing (albeit still moderate) presence outside of the US market, and that its market share in derivatives and spot trade settlements on global centralized exchanges will reach mid-2023. He pointed out that the increase has increased from less than 1% to nearly 4%.

|Translation and editing: Rinan Hayashi

|Image: K33 Research

|Original text: Stablecoin Market Cap Hits $140B, Highest Since 2022 Amid USDC Resurgence, Tether Growth

The post Stablecoin market capitalization exceeds $140 billion – highest since 2022 due to revival of USD coin and growth of Tether | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

175

1 year ago

175

ETHDenver (@Mega_Fund)

ETHDenver (@Mega_Fund)

English (US) ·

English (US) ·