- The market capitalization of stablecoins has started to rise for the first time since May 2022, with Tether (USDT) in particular reaching a record high of nearly $90 billion (approximately 13.5 trillion yen, equivalent to 150 yen per dollar).

- Analysts say the change in trend is a sign that liquidity in the crypto asset (virtual currency) market is improving as more capital enters the ecosystem.

First change in 18 months

The stablecoin market is expanding for the first time in more than 18 months, and new capital is flowing into crypto assets, as symbolized by Tether (USDT)’s market capitalization reaching a record high of $89 billion.

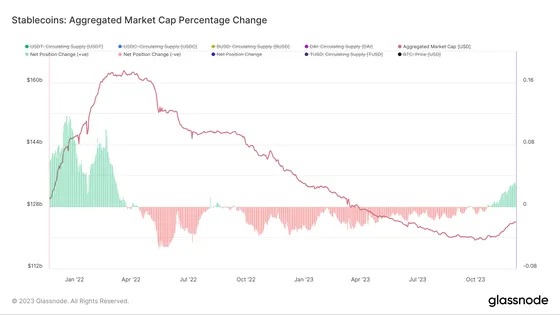

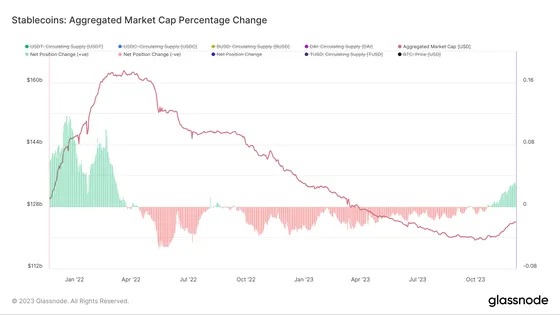

The total market capitalization of major stablecoins has increased by about $5 billion over the past month to $124 billion, according to data from Glassnode.

The increase marks a major reversal from the downtrend that began in May 2022, roughly coinciding with the beginning of the harsh “crypto winter.”

(Glassnode)

(Glassnode)Stablecoins act as a bridge between fiat currencies and blockchain-based crypto assets, providing market participants with liquidity for trading and lending.

In other words, a trend reversal in stablecoin market size is a bullish signal about the overall health of the recent crypto market rally.

“This uptrend can be interpreted as a leading indicator of increased on-chain liquidity, indicating an environment where more capital can be deployed,” said Coin Metrics analyst Tanay Ved. ” he said.

USDT supply is at record high level

Tether (USDT) is the largest stablecoin by market capitalization and is primarily used for transactions on centralized exchanges and in developing countries. USDT supply has increased by $7 billion since September, with issuance increasing “in a meaningful way” since mid-October, crypto asset service provider Matrixport notes. .

In fact, USDT’s market capitalization has continued to grow for most of 2023, surpassing its all-time high in 2022 and now approaching $90 billion, data from CoinGecko shows. But for stablecoins as a whole, the decline of competitors such as USD Coin (USDC) and Binance Coin (BUSD) has offset USDT’s growth until recently.

Noelle Acheson, analyst and author of the newsletter “Crypto Is Macro Now,” said: “The trend is up, indicating growing investor interest,” said Noelle Acheson, an analyst and author of the newsletter “Crypto Is Macro Now.” I would say it’s bullish.”

However, Acheson added, “Stablecoin market capitalization is still in its infancy, well below where it was at the beginning of this year, when the outlook was arguably much more bleak than it is now.”

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

|Image: Stablecoin market capitalization (Coin Metrics)

|Original text: Fresh Money Flows to Crypto as Stablecoin Market Expands After 1.5 Years Downtrend

The post Stablecoins reverse the downward trend of 18 months ─ New funds flow into crypto assets | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

97

1 year ago

97

English (US) ·

English (US) ·