- Starknet's STRK fell more than 50% on the first day of trading, indicating that many recipients may have sold as soon as they received their allocations.

- The token unlock schedule for development teams and investors has been criticized by market observers.

Layer 2 Scaling Solution Starknet Token “STRK” Will Surround 2022 Token Generation Eventcontinued criticismIt lost half of its value after it began trading on February 20th.

According to the data, STRK fell by about 55% in 24 hours, and trading volume exceeded $1.2 billion (approximately 180 billion yen, at an exchange rate of 1 dollar = 150 yen). Only $3 million worth of STRK futures were liquidated, suggesting that most of the selling pressure was spot-driven.

On the 20th, 728 million STRKs were distributed to approximately 1.3 million addresses based on predetermined criteria such as blockchain and community participation. This selling pressure suggests that those who received the tokens likely sold them prematurely.

As of the 20th, over 100,000 wallets had claimed 220 million STRK, the team said.mentioned in X.

Starknet is an Ethereum rollup platform that allows applications to scale using zero-knowledge proof techniques that prove the truth of datasets without exposing the data itself.

50.1% of STRK's supply is allocated to the Starknet Foundation for community airdrops, grants, and donations. 24.68% of the total supply was distributed to early contributors and investors, and 32% was allocated to developer StarkWare's employees, consultants, and development partners.

The tokens will be unlocked monthly for 31 months starting in April, potentially increasing selling pressure.

However, the unlock schedule by the team and investors is part of the crypto industry.arousing criticism.

Last week, market observers appeared to discover that Starknet's actual token generation event took place in November 2022, initially with a one-year vesting period, and was later postponed to April 2024.

Stealth launch token onchain, count it as TGE and release token 2 years later but count that as vesting start date.

We see a lot of shit in token land, but that has to be one of the sketchiest moves yet.

— Adam Cochran (adamscochran.eth) (@adamscochran) February 14, 2024

According to Starknet developers, this generation event was mentioned in technical documentation, but the market seems to have missed it. But some critics say this is deliberate obfuscation and could benefit insiders over the community.

Ideally, such a vesting period would begin after the token goes live on an exchange or is issued close to the trading date. In the case of STRK, the unusual step was taken to issue the token nearly two years before it went public.

Buyers of $STRK beware, you are the exit liquidity.

1 of the most cynical, rug-pull token drops in the history of crypto. Is this a third tier shitcoin? No, it's a first-tier project backed by @paradigm & others who are about to get rich off the backs of unsuspecting investors https://t.co/HHdgqeP0rD

— Alex Pruden (@apruden08) February 15, 2024

This means core contributors and investors will have 13.1% of supply unlocked in April 2024, and 13.1% or more of supply unlocked every month thereafter. The first unlock is worth more than $2.6 billion at current prices, according to Token Unlocks data.

Starknet is following previous decisions and has not changed the vesting date as of February 21st.

|Translation: CoinDesk JAPAN

|Edited by: Toshihiko Inoue

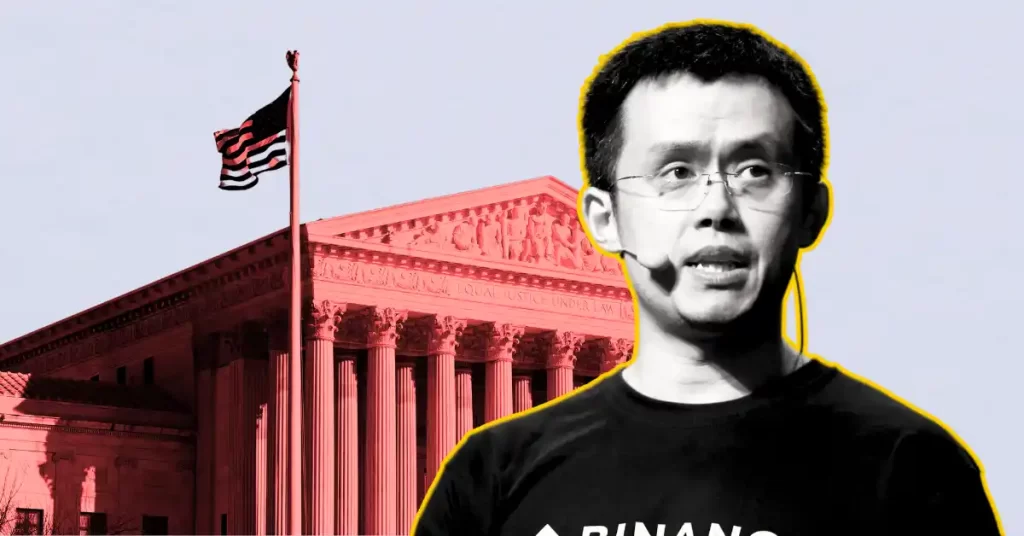

|Image: Starkware co-founder and president Eli Ben Sasson (left) and CEO Uri Kolodny. (StarkWare)

|Original text: Starknet's STRK Drops 53% Amid Token Issuance Criticism

The post Starknet's STRK drops more than 50% on first day of trading amid criticism of token issuance | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

142

1 year ago

142

English (US) ·

English (US) ·