Digital coins flourished today as the crypto market cap reclaimed the $2 trillion level after a 3.18% increase in the past day.

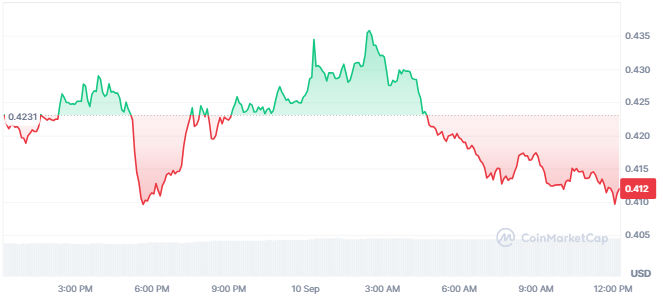

While such sentiments catalyzed significant gains in the altcoin space, Starknet (STRK) displayed struggle, losing 2.97% in its daily chart to hover at $0.4137.

Why is STRK down?

The ongoing Three Arrows Capital bankruptcy proceedings contribute to Starknet’s bearishness.

Arkham Intelligence data shows the insolvent company’s liquidation address moved over 2.07 million STRK tokens, worth approximately $856K) to Wintermute for over the counter (OTC) sale on 9 September.

Teneo: 3AC Liquidation Address: 0xC7…3741 transferred 2.07 million STRK (about $856k) to Wintermute for OTC sale on September 9. The address also transferred 1.12 million ARB to Binance Deposit on September 10, worth about $583k. platform.arkhamintelligence.com/explorer/addre…

While the motive behind the transaction remains speculative, firms in the crypto space often send tokens to exchanges ahead of liquidations. Thus, enthusiasts will track the possible effect of the asset transfer on price actions.

3AC’s bankruptcy developments

Three Arrows Capital filed for bankruptcy following the Luna-driven market crash of 2022. Amid the liquidation proceedings, Teneo joined to navigate the challenges of the case.

That has attracted substantial transfers of cryptocurrencies from the company as it stares at massive debts.

Meanwhile, the latest report reveals enormous altcoin movements to exchange Binance. Besides yesterday’s 2.07 million STRK transactions, the Teneo wallet sent 1.12 million ARB tokens to Binance today (10 September).

Meanwhile, 3AC’s liquidations have directly impacted around 150 creditors, claiming $3.4 billion from the debacle company. However, liquidation officials confirmed that the creditors will likely get about 45.74% of the claims.

Three Arrows Capital’s investigations

3AC’s regulatory developments have attracted the crypto community and regulatory authorities.

Founder Su Zhu’s arrest and imprisonment on 29 September 2023 and the freezing of assets worth $1.1 billion reflect the crucial intersection between regulation and finance in the growing cryptocurrency industry.

⚖️ 3AC founders slapped with $1B worldwide asset freeze 💰🔴 🗒️Quick Takes: 1. Breaking: Singapore’s Three Arrows Capital faces a major setback as a court in the British Virgin Islands freezes over $1.14 billion in assets belonging to co-founders Su Zhu and Kyle Davies.

STRK’s current price action

Starknet traded at $0.4137 after losing nearly 3% of its value within the past day. Its performance attracted attention as the broad market recorded rallies, with Bitcoin jumping 3.55% in the last 24 hours to trade above $57K.

Source: STRK 1D Chart on Coinmarketcap

Source: STRK 1D Chart on CoinmarketcapStarknet’s downside follows the significant asset transfer by the insolvent Three Arrows Capital, which highlighted an upcoming dump.

3AC-associated wallet transferred over 2.07 million STRK tokens on 9 September amid its liquidation proceedings. The company is possibly preparing to offload the assets to repay its debts.

Thus, STKR could experience increased selling momentum, hindering its revivals amid broad market recoveries.

The altcoin will likely plummet further from its current prices, according to the 200-EMA on the 4-hour timeframe.

Meanwhile, crypto enthusiasts will watch how 3AC’s liquidation developments impact STRK prices and whether ARB will pause its ongoing bounce-back and join Starknet’s declines.

The post Starknet (STRK) plummets 3% amid broad market surges; here’s why appeared first on Invezz

English (US) ·

English (US) ·