Open finance continues to be a significant theme in the world of fintech as businesses tap APIs to access customers’ financial accounts and provide a gamut of integrated and embedded financial services. In the latest development, Stitch — one of the prominent players building and operating these APIs in Africa — confirmed to TechCrunch that it has raised $21 million in Series A funding.

This news follows the $4 million Stitch raised out of stealth in February 2021, a prequel to the $2 million extension round it secured four months ago, bringing its seed round to $6 million. In total, Stitch has raised $27 million to date.

The South African API fintech enables businesses to build, optimize, and scale financial products. Per a statement released by the company, it plans to create a “financial graph” ecosystem across Africa with the new funding.

The company describes the financial graph as an infrastructure for financial building blocks that allow businesses to write code once, launch in multiple markets and scale faster based on interoperability across regions, providers, banks, and other types of financial accounts.

“We sort of view the broader financial ecosystem as a bunch of different nodes–bank accounts, merchants such as fintechs or end-users–which are all intrinsically connected,” Stitch CEO Kiaan Pillay said to TechCrunch in an interview. “Often, we think about the fact that these connections between geographies and institutions don’t exist yet. And a lot of what we try to do is to bridge those connections and to make those connections ubiquitous.”

Stitch views this graph in three stages. The first is what it launched from stealth: the pure infrastructural play of connecting financial and bank accounts with an API. The second seeks to acquire merchants and businesses to build use cases and applications on top of that infrastructure. And the last is getting end consumers to link their accounts via these businesses.

“On the high level, people moving from cash to digital for the very first time causes more fragmentation. Our view is that encompassing this all in one network or graph helps to open the space up and break down the silos,” said Pillay. “And the way we ultimately think about that is that people can easily move money between various applications between various geographies and institutions.”

Stitch’s provides solutions for e-commerce companies, marketplaces & platforms and its leading clientele, fintechs. As with other years, African fintechs outperformed other startups in raising venture capital, particularly in a record-breaking 2021 where they raised 50-60% of total VC funding per reports. Their importance can’t be overstated and infrastructural players such Stitch, Mono, Okra, Plaid and OnePipe —all who raised money within the past year, some in seed and others, Series A — are pivotal to that collective growth of driving financial inclusion and ease of payments across the continent.

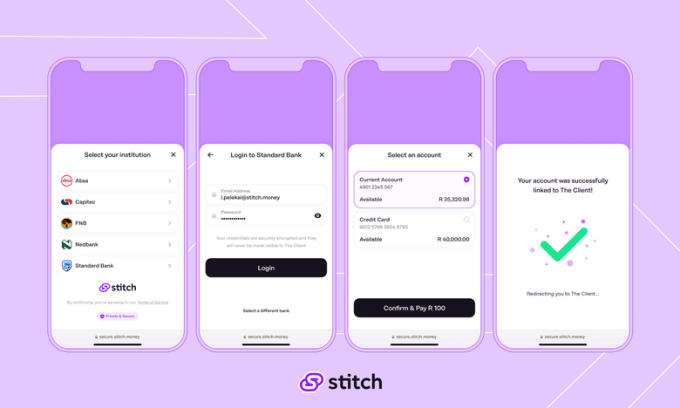

These business customers use Stitch for use cases such as KYC & onboarding, personal and business financial management, lending, wallet top-ups and e-commerce checkouts. The platform’s data, and identity products allow businesses to access customer transaction histories and balance data, verify account information, and perform fraud checks. The payments product enables bank-to-bank transfers for one-click pay-ins and payouts.

Some customers include wallet-based companies such as Chipper Cash and Luno; embedded finance providers like ImaliPay; subscription platforms like FlexClub; and payment aggregators like Yoco.

Image Credits: Stitch

In April 2021, Stitch launched its payments product in South Africa and noticed a 50% month-on-month growth in payments volume the following six months. In October, Stitch expanded the payment product to Nigeria and, at the time, was on track to facilitate $10 million in monthly payments by December.

On the call, Pillay, who co-founded Stitch with Natalie Cuthbert and Priyen Pillay, didn’t give any update on this metric but said Stitch had seen a 104% month-on-month growth in payments value since launching the product last April. And in Q4 2021, the platform witnessed a 44% month-on-month customer growth and a 72% month-on-month increase in linked financial accounts.

“We’re proud of the partners and customers we have here as we continue to deepen the payments product and look at monthly and recurring payments, which are interesting feature sets for us,” said Pillay.

“We recently had a few customers go live in Nigeria, which has been very exciting for us. We just offer payments there but are eager to deepen the products. We will look at adding data and identity this year, as well as deepening the payments set similarly to how we have it in South Africa.”

New York-based long-term investment firm The Spruce House Partnership led this round of funding. The round also welcomed participation from new and existing investors like PayPal Ventures, TrueLayer, firstminute capital, The Raba Partnership, CRE Venture Capital, Village Global, as well as fintech founders and companies such as TrueLayer, founders of Chipper Cash, Quovo and Unit, and Guillaume Pousaz’s Zinal Growth.

“We have been following startups in Africa for many years. Our diligence was very clear that this is one of the most talented teams on the continent, and we are excited to be a part of what they are building at Stitch,” said Ben Stein, co-founder of The Spruce House Partnership.

Pillay says raising money from VC firms and operators that have scaled fintech products across multiple geographies gives the company “something pretty special” as it enters its next growth phase. The funding, Stitch said, will allow it to expand its team across offices in Cape Town, Johannesburg and Lagos, launch new product offerings and enter new markets across the continent.

English (US) ·

English (US) ·