Macroeconomics and financial markets

In the US NY stock market on the 30th, the Dow closed at $75 (0.77%) lower than the previous weekend. With the 6th consecutive day of growth, the US Federal Open Market Committee (FOMC) was ahead of the US Federal Open Market Committee (FOMC), and it became a selling predominance.

Among crypto-asset (virtual currency)-related stocks, Coinbase stocks, which had rebounded to nearly double since the beginning of the year, dropped 8.48%. Marathon Digital fell 10.59% and MicroStrategy fell 4.9%.

Relation:U.S. Stock Market and Virtual Currency Overall Down | 31st Financial Tankan

Virtual currency market

Selling also spread to the crypto asset (virtual currency) market, and Bitcoin (BTC) dropped 3.2% from the previous day to $22,878. Ethereum (ETH) fell 3.77% to $1,574, and major alts fell across the board.

BTC/USD daily

Bitcoin has risen 40% since the beginning of the year, and recently, the RSI (Relative Strength Index) and the alt market have been overheated, so it seems that the adjustment of the position position, which had expanded due to the decline of the US index, took precedence. .

In the futures interest rate market, the next FOMC scheduled to be announced at 4:00 (Japan time) on the 2nd of next month is pricing in an interest rate hike of 0.25bp, which will be the second consecutive meeting to slow down. Uncertainty in the market remains smoldering, such as the outlook for the oil market and geopolitical risks in the situation in Ukraine.

Nonetheless, as we approach the “terminal rate” that is the ultimate goal of the policy interest rate, how far will the negative impact on GDP (gross domestic product) and corporate performance be as a side effect of the unprecedented pace of interest rate hikes in the future? Or whether the global economy, led by Europe and the United States, will fall into mid- to long-term stagflation is likely to become a focus.

“Most of the buying in European equities has come from algorithm-driven funds, which are just buybacks rather than bullish new buys,” Reuters reported, citing JPMorgan analysts.

Significant premium in Nigeria

Bitcoin (BTC) is soaring in Nigeria on the African continent. Temporarily +60% premium (price divergence) recorded $ 37,235. The recent high in the US is $23,966.

#Bitcoin is Hope!!

BREAKING:  Bitcoin is selling for a 60% premium in Nigeria (37,235 USD) because of increased demand.

Bitcoin is selling for a 60% premium in Nigeria (37,235 USD) because of increased demand.

Central Bank of Nigeria started limiting cash withdrawals to $44 per day earlier this month.

Central Bank of Nigeria started limiting cash withdrawals to $44 per day earlier this month.

Now leads the world in Google searches for “Buy #Bitcoin ” pic.twitter.com/SI861WUhVy

—SHIB Bezos (@BezosCrypto) January 29, 2023

According to Google Trends, Nigeria has jumped to the top of the world when it comes to Google searches for “Buy Bitcoin.”

BREAKING: Nigerian central bank introduces new cash withdraw limits (20,000 naira ~ $44 daily) and announced that all old naira bills will be worthless at the end of January.

Nigeria is leading the „How to buy #Bitcoin“ search worldwide  pic.twitter.com/O26si2nHde

pic.twitter.com/O26si2nHde

— Carl ₿ MENGER

(@CarlBMenger) January 18, 2023

(@CarlBMenger) January 18, 2023

In the background, the central bank of Nigeria has implemented restrictions on cash withdrawals from automated teller machines (ATMs) and over-the-counter (OTC) transactions since January. have spurred the confusion of

Although the country’s economy is one of the largest in Africa, the amount that can be withdrawn is limited to 20,000 naira (about 5600 yen) per day.

The government aims to eliminate the risk of money laundering and reduce the inflation rate as the purpose of the withdrawal limit, but the country’s legal currency “Naira” is in a situation where the currency depreciation does not stop, and alternatives such as Bitcoin and gold We can also get a glimpse of the circumstances in which the movement to evacuate funds into assets is rapidly increasing. In December 2010, the inflation rate reached 21.3%.

In October 2021, the Federal High Court of Nigeria approved the introduction of the digital currency (CBDC) “e-Naira” by the Central Bank of Nigeria, but due to delays in awareness and infrastructure development, the adoption rate as of last year was only 0.5%. And so on, the spread is not progressing as expected.

Relation:Nigeria Approves Issuance of Central Bank Digital Currency ‘eNaira’

altcoin market

Japan’s major crypto asset (virtual currency) exchange bitbank has announced the listing of Oasys (OAS), a chain specializing in games from Japan.

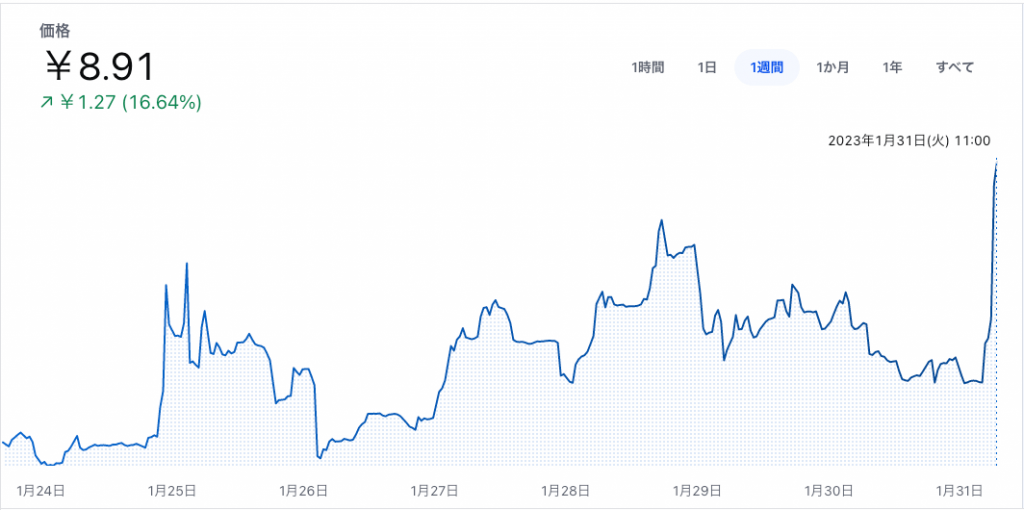

The OAS price rose 8.22% from the previous day and 16.02% from the previous week to 8.87 yen.

OAS/USD

Relation:First listing in Japan, bitbank announces handling of game specialty chain Oasys (OAS)

Oasys is a blockchain built for gaming IP (intellectual property) holders and gamers based on the concept of “Blockchain for The Games”. Free transaction fees (Gas fee) for game players and speeding up transaction processing, which have been major issues so far.

Initial validators (approvers) of Oasys (OAS) include major domestic listed game companies such as Square Enix, Sega, Bandai Namco Labs, and GREE, as well as three leading domestic web companies such as bitFlyer and Aster.

Relation:What is “Oasys (OAS)” that even beginners can understand? | Explanation of features and mechanism

In December 2010, Galaxy Interactive, South Korean game giant Nexon, and ZOZO founder Yusaku Maezawa’s MZ Web3 fund completed funding in a strategic investment round. OKX, Kucoin, Bybit, Gate, and Huobi have already listed OAS, but this is the first time that it has been handled in Japan.

Click here for a list of market reports published in the past

The post Stocks and cryptocurrencies fall before the FOMC, behind the surge in BTC premium in Nigeria appeared first on Our Bitcoin News.

2 years ago

156

2 years ago

156

English (US) ·

English (US) ·