Virtual currency market this week from 4/8 (Sat) to 4/14 (Fri)

Mr. Hasegawa, an analyst at the major domestic exchange bitbank, illustrates this week’s bitcoin chart and analyzes the future outlook.

table of contents

- Bitcoin on-chain data

- Contributed by bitbank

Bitcoin on-chain data

Number of BTC transactions

Number of BTC transactions (monthly)

Number of active addresses

Number of active addresses (monthly)

BTC mining pool remittance destination

Exchange/Other Services

bitbank analyst analysis (contribution: Yuya Hasegawa)

Weekly report from 4/8 (Sat) to 4/14 (Fri):

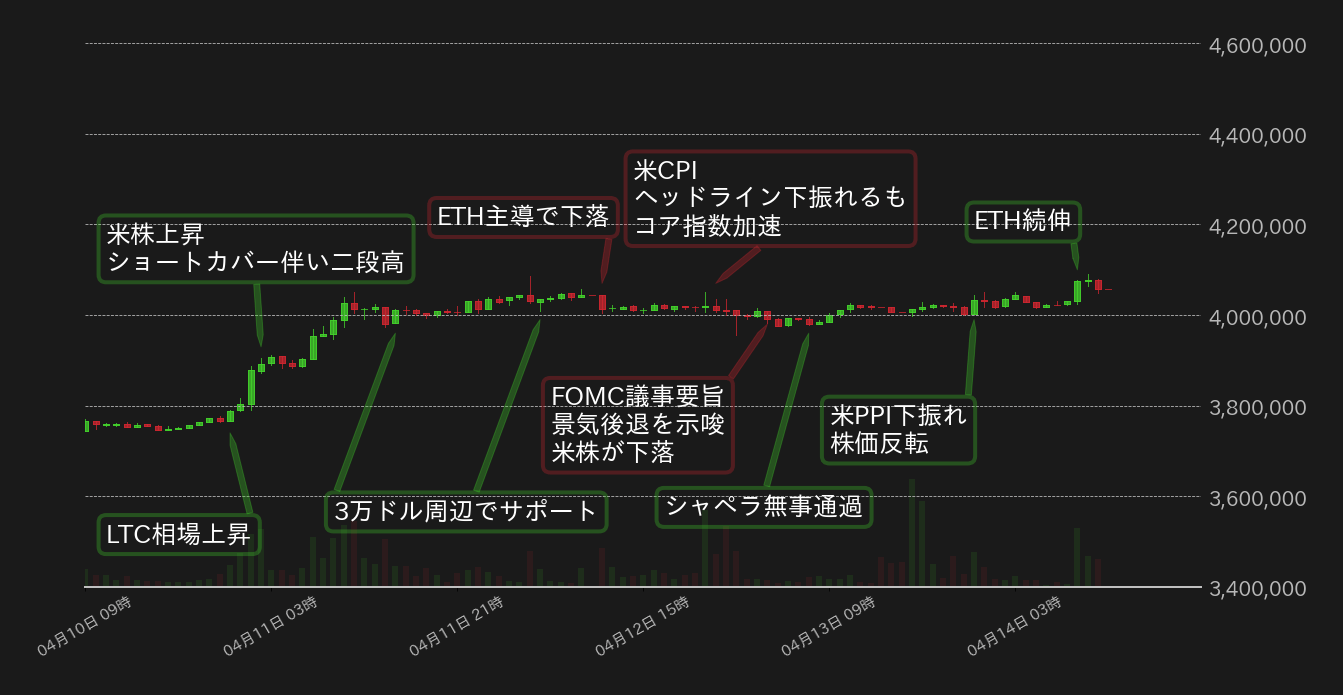

This week’s Bitcoin (BTC) vs. Yen exchange rate has succeeded in breaking out from the turmoil around 3.7 million yen, which lasted for about three weeks, and has renewed the year-to-date high (3.863 million yen). It is on the 4 million yen level for the first time in 10 months.

With the U.S. Consumer Price Index (CPI) in March and the upgrade of Ethereum’s Shanghai (Chapella) ahead, the price of Litecoin (LTC), which is about to halve in the summer from the beginning of the week, rises, and BTC is tangled. When the price recovered, the rise in US stocks also became a tailwind, and the short cover played a two-step high, putting it on 4 million yen.

After that, although the price continued to be reluctant to rise, it was supported by buying at the milestone level of 30,000 dollars denominated in dollars, and remained firm.

In the middle of the week, ETH-led BTC’s top price was slightly heavy before the upgrade, and after the CPI passage, it fell after volatile fluctuations.

While the headline CPI slowed more than expected, core indices confirmed the persistence of inflation. Furthermore, when the minutes of the U.S. Federal Open Market Committee (FOMC) in March were released, it was revealed that participants in the meeting pointed out a gradual recession in the economy in the second half of the year caused by financial instability. It became a weight, and BTC fell slightly below 4 million yen.

On the other hand, the ETH market did not move much even after the Shanghai upgrade of Ethereum, and when BTC turned to a solid trend due to a sense of security, the ETH market later surged and rebounded.

The US Producer Price Index (PPI) on Thursday also fell below market expectations, and the BTC against the yen temporarily stalled due to the impact of the weaker yen against the dollar, but was supported by a rebound in US stocks. In Tokyo time on Friday, the ETH market continued to rise, and BTC also touched 4.09 million yen at a high level.

[Fig. 1: BTC vs Yen chart (1 hour)]

Source: Created from bitbank.cc

The downswing in US economic indicators from last week fueled concerns about an economic recession, and the US stock market softened. , and the end of the rate hike phase is conscious.

The minutes of the FOMC meeting also raised a sense of caution about the economy immediately after its release, but the content was not hawkish, and it can be said that it implied that the interest rate hike would be the last in May.

After the Shanghai upgrade of Ethereum, there was concern that ETH, which was locked up by staking, would become selling pressure, but ETH did not sell strongly, and when buying was made from a sense of security, the price rose to a new high since the beginning of the year. bottom. Due to this rise in the ETH market, there is a trend of circulation, and the BTC market is looking for room for an upside in the near future.

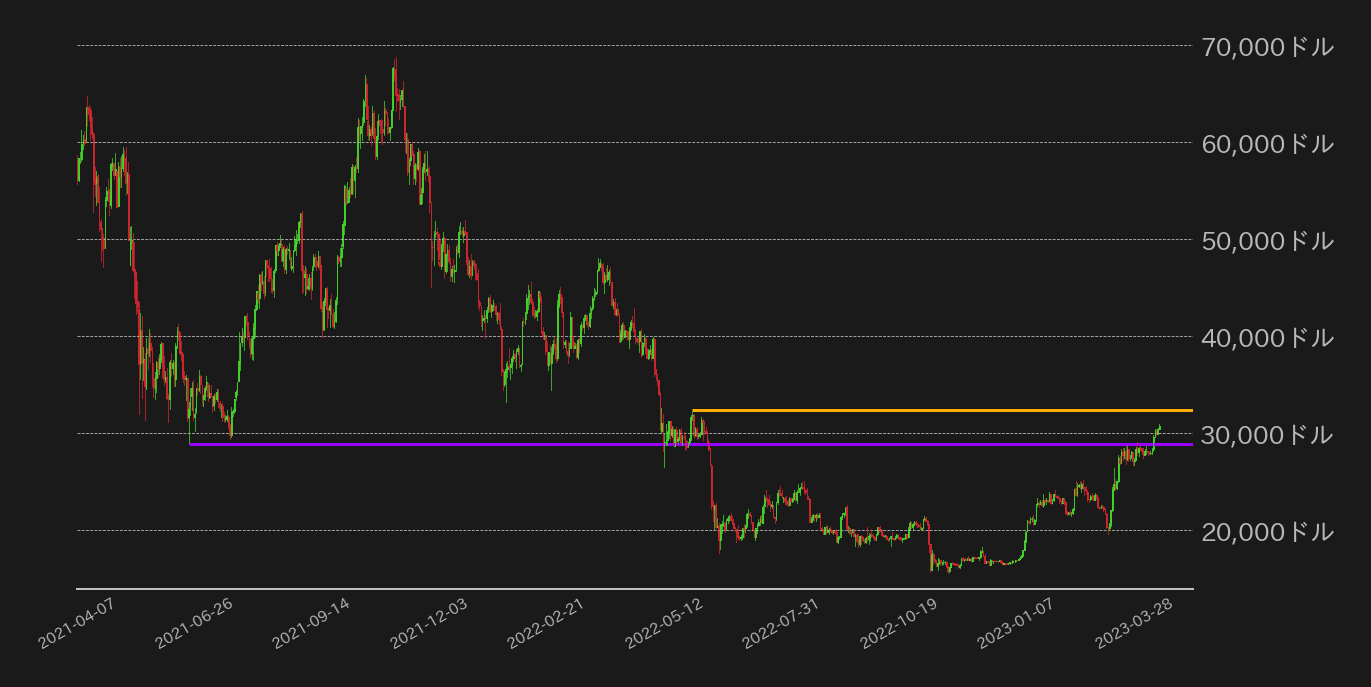

With this week’s rise, BTC against the US dollar has successfully broken out of the 2021 low, which has been a resistance so far. (Fig. 2). However, next week may be a week with few clues such as events and important indicators, so I would like to pay attention to profit taking after the market rises.

[Fig. 2: BTC vs. USD chart (daily)]

Source: Created from Glassnode

connection:bitbank_markets official website

Last report:Bitcoin price may move significantly from the middle of next week

The post Successful breakthrough of Bitcoin 2021 low, possibility of missing clues next week | bitbank analyst contribution appeared first on Our Bitcoin News.

2 years ago

164

2 years ago

164

English (US) ·

English (US) ·