SUI was among the top gainers on Tuesday as cryptocurrencies attempted recoveries after last week’s double-digit declines.

The altcoin gained over 5% within the previous day to reclaim the psychological mark at $4.50.

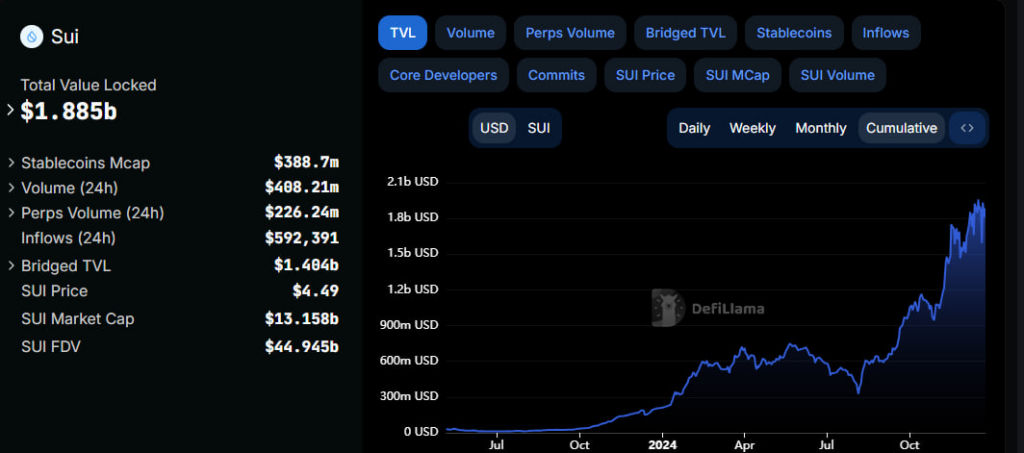

With the total value locked (TVL) maintaining uptrends over the past month, SUI’s price displays stability.

The prevailing momentum could extend the asset’s current uptrend and surpass $5.

That could encourage more buyers, propelling SUI to $5.71 – a 25.49% increase from current prices – by 2024 end.

Sui Network TVL signals stable growth

Amid SUI’s robust recoveries, one metric grabbed the attention of traders.

DeFiLlama data shows the altcoin’s TVL nears the $2 billion landmark after remarkable uptrends over the past month.

The metric is $1.885 billion today, reflecting impressive growth and ecosystem stability.

Source – DeFiLlama

Source – DeFiLlamaMoreover, the over $400 million in 24-hour trading volume signals impressive trader interest in the project.

With the stablecoin market capitalization approaching $400, SUI price appears poised for extended growth in the upcoming sessions.

SUI price outlook

The altcoin displays a bullishness, trading at $4.55 during this publication.

Source – Coinmarketcap

Source – CoinmarketcapMeanwhile, yesterday’s gains saw SUI forming a bullish engulfing candlestick and finalizing a morning star setup.

The pattern propelled the token to the daily peak of $4.75.

Meanwhile, the 4H timeframe reveals buyer control at a local support barrier, establishing two successive engulfing candlesticks.

The recovery rally overcame the 50% FIB mark, but buyer exhaustion triggered declines beneath the mark.

SUI signals near-term dips before potential rallies to new highs.

With three successive bearish candlesticks, the slight intraday dip forms a black crow pattern.

The setup suggests a potential 3% dip towards the 50 Exponential Moving Average at $4.42.

Trend-based FIB levels support the short-term retracement, targeting a retest of $4.20 (38.29% FIB level).

Nonetheless, solid barriers at local support zones and the strengthening demand, according to TVL, hint at possible rallies toward $5.

Moreover, the ascending channel setup indicates potential upswings towards the upper border at $5.71 (78.60% FIB mark).

Thus, SUI exhibits what it takes for a 25% surge by month-end despite potential near-term retracements and broad crypto market volatility.

Meanwhile, VanEck forecasts massive bull runs for cryptocurrencies next year.

The investment manager believes SUI will surpass $10 in early 2025.

VanEck is predicting that SUI could reach $10 in Q1 of next year as a cycle top. Over or underestimate?

The SUI/USD weekly chart supports this narrative.

The timeframe reveals a head-shoulder setup, demonstrating massive bullish comebacks.

SUI breached the pattern to the upside after prices crossed the $2.62 neckline with robust volumes.

Traders add the pattern’s max height to the breakout zone, $2.62 in SUI’s case, to determine the inverse head-shoulders bullish target.

The principle suggests that SUI/USD could surge to $9.56 by early next year – a price level matching the 2.618 Fibonacci retracement level.

The post SUI price eyes 25% surge as Sui TVL approaches $2B milestone appeared first on Invezz

English (US) ·

English (US) ·