Approximately 70% of the total is profitable

On the 30th, Aerial Partners Co., Ltd., which provides accounting, tax, and data management services for crypto assets (virtual currency), announced the results of a survey regarding the investment status of digital assets and tax returns.

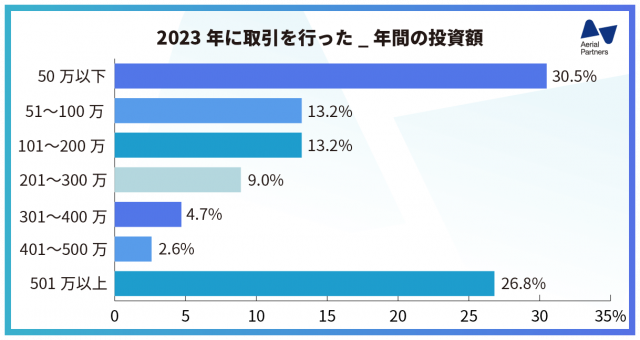

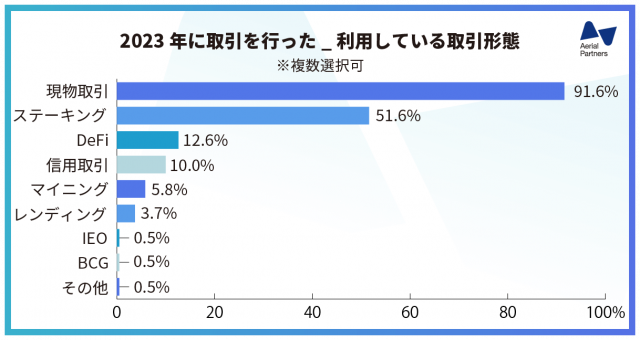

The survey found that investors who traded cryptocurrencies in 2023 mainly used spot trading and staking of PoS stocks. Regarding the investment amount, 31% said it was “less than 500,000 yen” and 27% said “more than 5,010,000 yen”, revealing a polarized trend. Approximately 70% of respondents will earn profits within 2023, increasing the need to file tax returns.

Source: Aerial Partners

The survey was conducted from November 10 to 16, 2023, and received online responses from 231 email newsletter members. The breakdown of respondents was 203 men, 24 women, and 4 others/no response. By age group, there were 88 in their 40s, 60 in their 50s, 48 in their 30s, 29 in their 60s and above, 6 in their 20s, There were 0 teenagers.

According to the survey results, approximately 80% of respondents said they had traded crypto assets in 2023. Of these, the mainstream type of trading is “spot trading”, which is carried out by 92% of respondents. In addition, “staking transactions” were also used by 52% of respondents, making this the second most common type of transaction.

Staking refers to a system in which people receive rewards by holding crypto assets and contributing to blockchain operations using them. Aerial Partners noted that staking, a relatively new concept, is being used by about half of respondents, which “feels like a huge number.”

Source: Aerial Partners

The advantage of staking is that it allows you to earn passive income just by depositing long-term crypto assets, and demand from investors has been increasing in recent years. In order to deal with this, competition among domestic virtual currency exchange companies is intensifying and the quality of their services is increasing.

For example, SBI VC Trade supports all 9 types of virtual currency staking, and differentiates itself by having no lock-up period and the ability to cancel mid-term.

connection:Explaining the advantages of staking and accumulation services and the advantages of virtual currency exchange “SBI VC Trade”

Many people have no experience filing tax returns.

In 2023, Bitcoin (BTC) and altcoins have risen significantly since the beginning of the year, so it is likely that many users will be facing their first “tax return.” The importance of understanding and responding to crypto asset transactions is increasing.

Although 99.1% of Gtax users understand the necessity of filing tax returns, many voiced concerns. Issues cited include lack of knowledge, discrepancies with information from tax offices, and difficulty understanding new transaction forms. Furthermore, it has been pointed out that there is a shortage of tax accountants who are familiar with crypto asset taxation.

In Japan, investment profits from virtual currencies, including rewards from staking, are classified as “miscellaneous income” and are subject to comprehensive taxation. This refers to a method in which investment income is added together with salary and other income to calculate the tax amount. As income increases, tax rates increase progressively between 15% and 55%. Additionally, for staking rewards, it is necessary to record the market value at the time they are granted.

According to Aerial Partners, “Gtax” is a tool that automates the profit and loss calculation of crypto assets, and is available in an individual version and a corporate/sole proprietor version. It also supports the import of NFT-related data, which is said to be useful for those filing their first tax return.

connection:[Final tax return special feature 1]A tax accountant explains the taxes on virtual currency that you should know | Contributed by Aerial Partners

Detailed information on the 2023 “Crypto Asset Investment Situation and Tax Return” survey results can be found at the following link:

The post Survey on “Crypto Asset Investment and Tax Returns”, Approximately 70% of investors will profit from transactions in 2023 appeared first on Our Bitcoin News.

1 year ago

98

1 year ago

98

English (US) ·

English (US) ·