SushiSwap Goes Perpetual Trading

SushiSwap (SUSHI), a decentralized crypto asset (virtual currency) exchange, plans to release perpetual trading on the L1 blockchain Sei Network, it was revealed on the 27th.

Sei Network is built using the software development kit (SDK) Tendermint core and is custom-made for trading, including a matching engine built into the chain.

Jared Gray, lead developer of Sushiswap, said at the Quantum Miami conference in the United States that Sei “has a focus on having an order book and matching engine in the consensus layer, so it’s a good place to release perpetual trading.” It’s very reasonable,” he said.

Perpetual trading is a type of derivative trading that allows leverage trading such as Ethereum (ETH). There is no deadline, and you can hold your position semi-permanently by paying a fee.

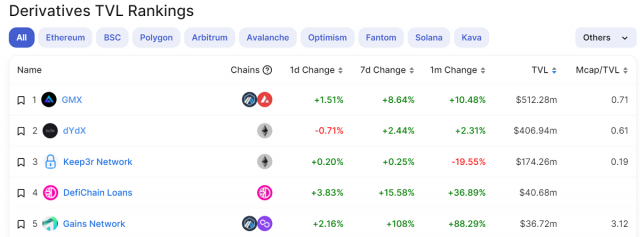

FTX, a centralized exchange that had been a major market for perpetual trading, went bankrupt in November 2010. As a result, the decentralized derivatives market has attracted attention, and the usage of DYDX, GMX, Canto, etc. is increasing.

Source: DeFillama

According to DeFiLlama, perpetual trading is one of the fastest growing TVL sectors in DeFi (decentralized finance).

For Sushiswap, which has mainly focused on spot trading, the aim is to increase commission income by expanding into the derivatives market.

Read how we’re revitalizing @SushiSwap in 2023! https://t.co/KTnNgtUMaw

—Jared Gray (@jaredgrey) January 16, 2023

Sushiswap announced its roadmap for 2023 at the beginning of the year, and revealed plans to release an aggregation service that aggregates multiple DEXs. Assuming that the current share is about 2% of the DEX (AMM) market and about 0% of the aggregation market, we set a goal to increase each market share by 10 times within the year.

Relation:SushiSwap begins vote of confidence for new project leader

About Sei Network

Sei Network was founded by Goldman Sachs former Jeff Feng and Jog, a former software engineer at investment app Robinhood. It was built to fill the transparency flaws exposed at Robinhood when GameStop stocks soared in 2021.

In addition to the order book, it also has a function to prevent front runs, which is often regarded as a problem in the DEX market, and a high-speed finality (600 ms on devnet) that contributes to improving the trading experience.

It also has interoperability because it is Cosmos-based. The Sei testnet, which launched in May 2022, supports the Cosmos Interoperability Standard (IBC) and has already connected to dozens of chains on Cosmos.

Sei Network completed a 650 million yen ($5 million) funding round in August 2022. Major investors include Multicoin Capital, Coinbase Ventures and Delphi Digital. In January 2011, Singapore’s cryptocurrency exchange MEXC invested 2.5 billion yen ($20 million) in Sei Network’s ecosystem fund.

Relation:SushiSwap Partners with Cosmos Foundation Kava to Join $1.8 Billion Developer Program

The post SushiSwap Partners with Sei Network to Offer Perpetual Trading appeared first on Our Bitcoin News.

2 years ago

161

2 years ago

161

English (US) ·

English (US) ·