If someone said “startup” while we were playing a word association game, I’d respond with “fundraising.” (I bet you would, too.)

Asking people for money is a key aspect of every founder’s journey, but Techstars Managing Director Collin Wallace says it can also “accelerate your demise.”

For example, raising a round to rev up engineering, sales and marketing sounds positive — but what if the business itself has negative unit economics?

Full TechCrunch+ articles are only available to members

Use discount code TCPLUSROUNDUP to save 20% off a one- or two-year subscription

“Most of the time, what stands between a company and its ability to achieve scale is not a lack of money,” writes Wallace in TC+.

“It’s better to ask: Do we have hustle problems? Product problems? Process problems? People problems? Is my business model fundamentally flawed?”

In this article, he examines four scenarios that often lead entrepreneurs to seek out new cash and explains why getting “a clear picture of what is fueling losses” is much more important.

Thanks for reading,

Walter Thompson

Editorial Manager, TechCrunch+

@yourprotagonist

Software investors must (re)learn these 3 ideas before getting into deep tech

Image Credits: Christian Sturzenegger (opens in a new window) / Getty Images

Because VCs turned “software investing into a low-margin finance game,” it might be a net positive that so many are “unable to move forward and invest in the next big thing: deep tech,” according to Champ Suthipongchai, co-founder and general partner at Creative Ventures.

A SaaS mindset just isn’t relevant for deep tech investment, which means traditional VCs must recalibrate their behavior (and expectations) before diving in.

“Software investors’ founder-first mantra is simply wrong in the world of deep tech,” writes Suthipongchai.

“This type of magical thinking is exactly why their software playbook is doomed to fail.”

Blank Street cracked the code on making coffee shops attractive to VC

Image Credits: Getty Images

Tech investors don’t tend to back physical businesses because they have so many literal moving parts: SaaS startups can’t get a flat tire or fail a health inspection, and they certainly don’t need foot traffic.

“But Blank Street claims to have cracked the code on how to make a chain of more than 65 physical coffee shops have the right metrics to attract venture capitalists,” writes Rebecca Szkutak.

“They recently closed on a $20 million Series B round amid a year where fundraising has taken a nosedive — even for companies with low overhead costs.”

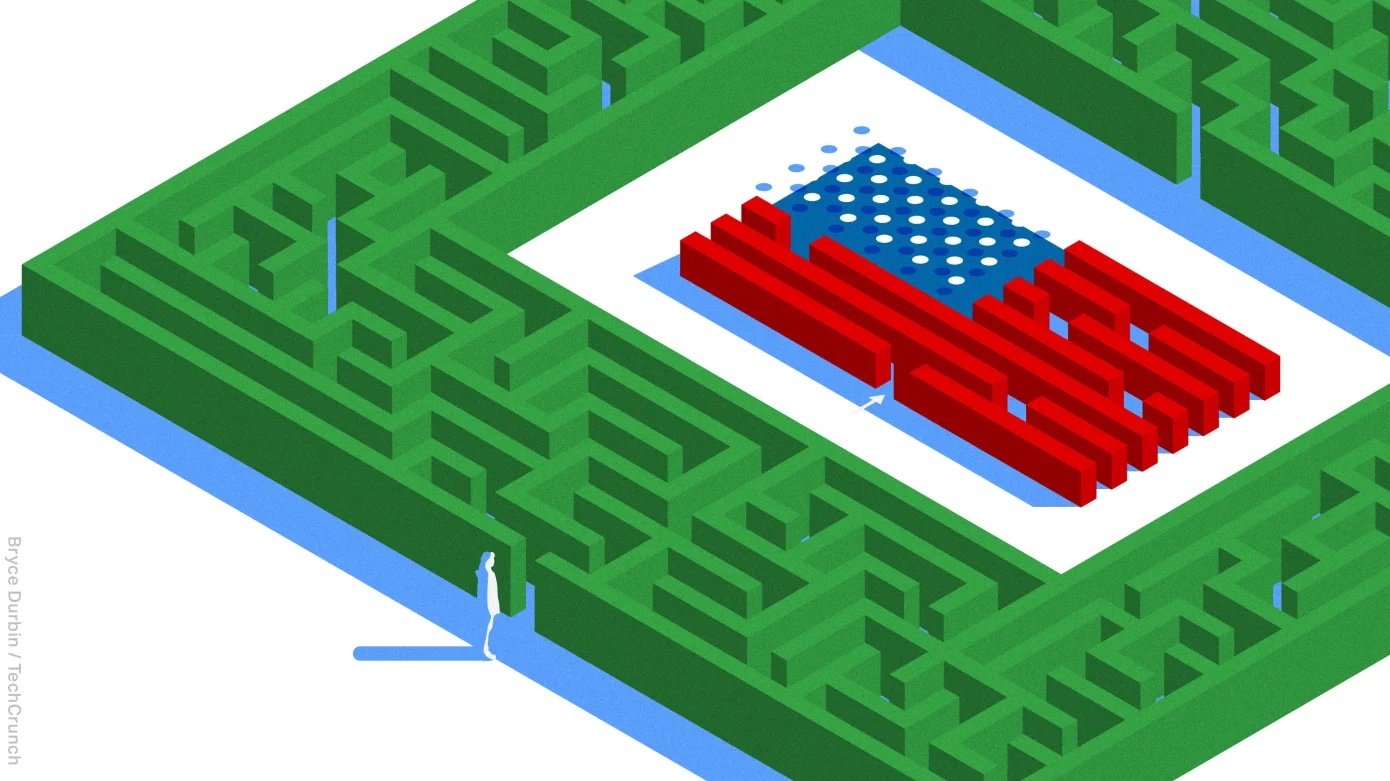

Ask Sophie: Can I launch a startup if I’m in the US on a student visa?

Image Credits: Bryce Durbin / TechCrunch

Dear Sophie,

I just found out that I’ve been accepted to an American university, which was my first choice!

One day, my dream would be to create my own startup in the U.S. Is there any groundwork I am allowed to lay to make my dream come true?

— Forward-Looking Founder

TechCrunch+ roundup: Deep tech tips for SaaS VCs, toxic fundraising, student visa startup options by Walter Thompson originally published on TechCrunch

English (US) ·

English (US) ·