Maintaining a full content pipeline is a laborious, subjective process, and with so many people involved, it can be hard to remain data-driven.

Generative AI tools speed up this work dramatically: Once a system is trained on your content, it will churn out keywords and ideas by the bushel, but human beings still need to separate the wheat from the chaff.

In a detailed TC+ post, Nick Zamanov, director of business development at Cyber Switching, explains how his team used OpenAI to boost site traffic, domain rating and backlinks within just a few months.

Full TechCrunch+ articles are only available to members

Use discount code TCPLUSROUNDUP to save 20% off a one- or two-year subscription

He includes several prompts they developed, along with suggestions that will help you train AI tools to produce material in your own voice.

“There is no need to reinvent the wheel, so use content you’ve already worked on to help generate better keywords, recommendations, and ultimately, your marketing strategy,” he advises.

Thanks for reading,

Walter Thompson

Editorial Manager, TechCrunch+

@yourprotagonist

Get the TechCrunch+ Roundup newsletter in your inbox!

To receive the TechCrunch+ Roundup as an email each Tuesday and Friday, scroll down to find the “sign up for newsletters” section on this page, select “TechCrunch+ Roundup,” enter your email, and click subscribe.

Click here to subscribe

It’s been a bumpy 6 months for edtech — are smoother roads ahead?

Image Credits: MirageC (opens in a new window) / Getty Images

Europe’s edtech market is having a moment.

In the first half of this year, one-third of all global edtech deal activity took place in the region, writes Rhys Spence, head of research at Brighteye Ventures.

“H1 2023 saw increased funding than the previous period in H2 2022 and many of the companies that raised big rounds in early- to mid-2021 will be coming back to the table to raise more funding,” he writes in TC+.

“This should not be seen as signs of health in the ecosystem, however…”

Early-stage SaaS startups grow the same with or without VC dollars

Image Credits: Richard Drury (opens in a new window) / Getty Images

There’s a lot of performative behavior in startup land, such as foosball tables in reception areas and kitchens with kombucha taps.

Should we add fundraising to that list?

Rebecca Szkutak covered a report by Capchase, which saw little difference in YoY growth between bootstrapped (44%) and venture-backed startups (42.8%).

“Given that the venture-backed startups raised external capital, we can safely assume that they spent more to achieve what is effectively the same growth rate as their bootstrapped peers,” she writes.

Ask Sophie: How realistic are my chances of hiring H-1B candidates at my startup?

Image Credits: Bryce Durbin/TechCrunch

Dear Sophie,

With more than 750,000 H-1B registrations this year, is it realistic for my early-stage startup to consider hiring candidates who are seeking them?

— Skeptical Startup

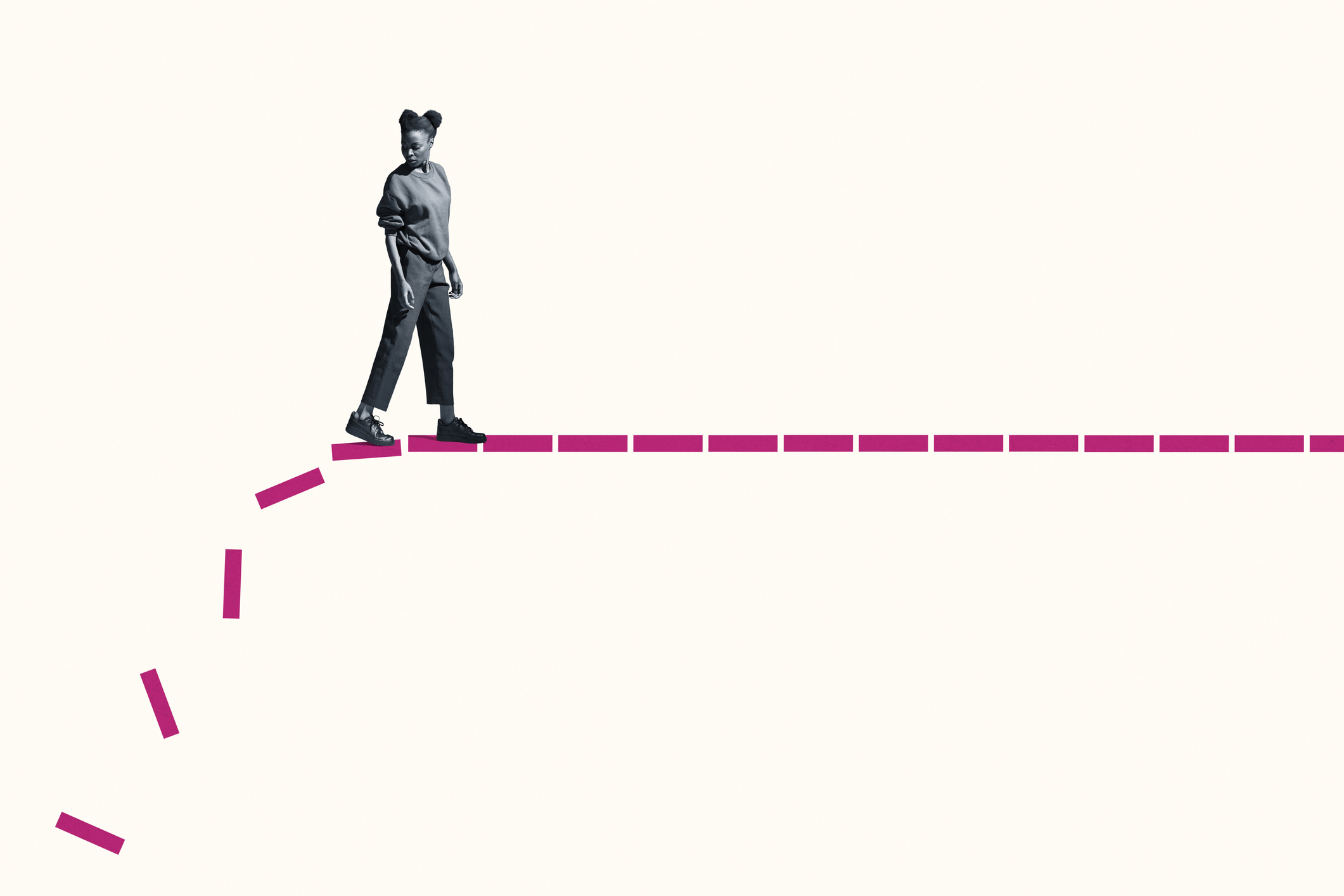

Startups with all-women founding teams raised just $1.4B in H1

Image Credits: Klaus Vedfelt / Getty Images

If your founder team includes men and women, here’s some good news:

“Mixed-gender teams picked up 28.1% of capital raised in H1, which is up from raising 16.9% in H1 2022,” reports Dominic Madori-Davis.

However, women founders aren’t faring nearly as well, raising just $1.4 billion during the same period.

“The last time companies with all-women founders raised such a low H1 amount was in 2017, when they picked up $1.2 billion.”

Fintech valuations have fallen. Where do they go from here?

Image Credits: Jordan Lye (opens in a new window) / Getty Images

Investors were hungry for fintech startups like Stripe three years ago, but a closer look at the secondary market shows that valuations have plummeted, Mary Ann Azevedo and Rebecca Szkutak report.

“Other people who are hanging on to their valuation are probably going to take longer to hit the bottom and find their way back up and have momentum,” said Greg Martin, co-founder and managing director at Rainmaker Securities.

English (US) ·

English (US) ·