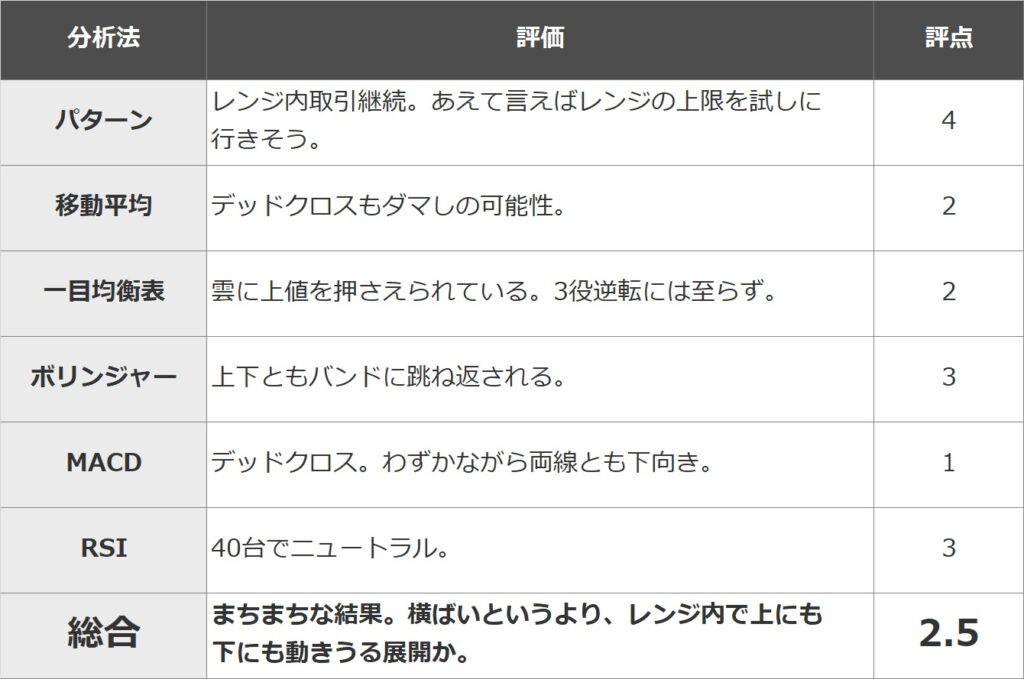

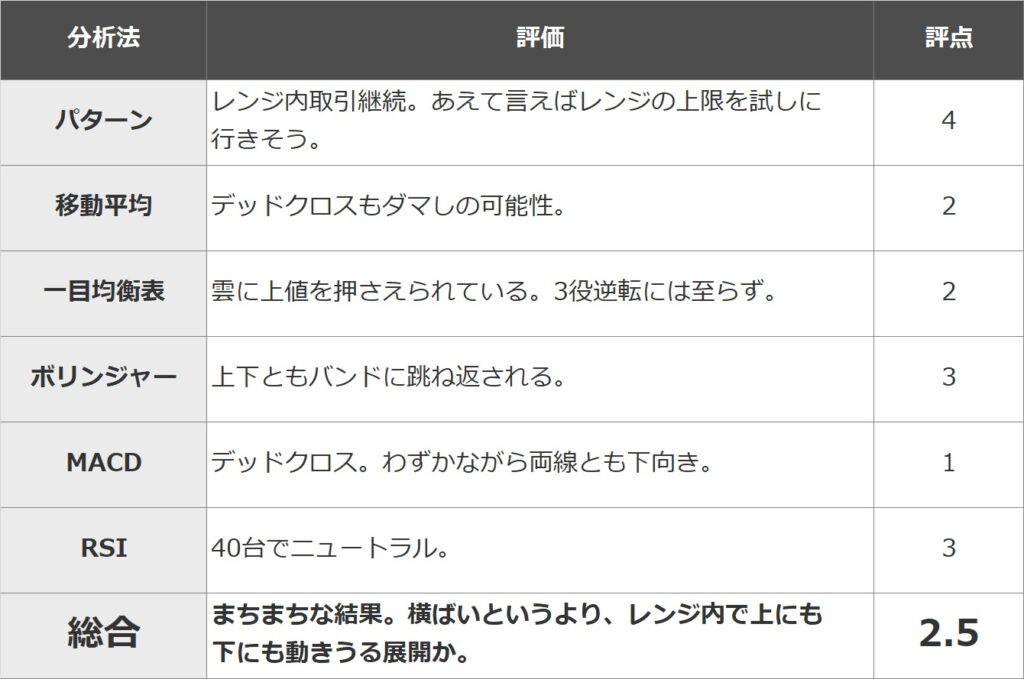

In this paper, the Bitcoin market is analyzed in 5 stages (5 → 1: Strong → Weak) using six representative technical analyzes: pattern analysis, moving average (9MA/25MA), Ichimoku Kinko Hyo, Bollinger Bands, MACD, and RSI. Evaluate the strength of the market with the average.

I believe that fixed-point observation and objectivity are important in technical analysis. The aim is to eliminate arbitrariness and improve accuracy by combining multiple representative analysis methods.

*This article is a reprint of the technical report of “Rakuten Wallet”.

summary

The overall score is 2.5, which is a little weak. Pattern analysis shows mixed results such as the upper limit try of the range, the moving average line, MACD, Ichimoku is downward, and Bollinger suggests trading within the range. I don’t have a clear sense of direction, but rather than not having a sense of direction in the future, I have an image of which direction I can move depending on the material. Where you want to respond flexibly to market movements without making decisions.

pattern analysis

Continuation of trading within the range of parallel channels. Since it is below the half price of 3.75 million yen, which rose from 3.5 million yen to 4 million yen last time, it is expected that the price will go to check the lower limit of the range. That’s right, it found support near the lower end of the range, bounced back, and is slightly above the half-price return. Will this time be an upper price try within the range?

Rating: 4

moving average

Dead cross occurs, but 25MA is upward and may be duped.

Rating: 3

Ichimoku Kinko Hyo

The pair has broken below the Ichimoku’s cloud and is holding down the topside. If the conversion line breaks below the reference line and the lagging line breaks below the candlestick, it will be a three-way reversal.

Rating: 2

bollinger bands

The band leveled off, and both the top and bottom bounced off the band, giving no sense of direction. Rather, it suggests flat trading within the band.

Rating: 3

MACD

Dead cross occurs, both lines are subtly downward and weak.

Rating: 1

RSI

No sense of direction at 40 units.

Rating: 3

grade

*This article provides information for reference in making investment decisions, but is not intended to recommend stocks or solicit investment activities. In addition, Rakuten Wallet does not solicit investment or make definitive forecasts.

*The information posted may include future forecasts, but these are the views of the individual sender, and we do not guarantee their accuracy or reliability. Please make your own final investment decisions.

| Editing: coindesk JAPAN

|Image: Rakuten Wallet

|Reprinted from: Rakuten Wallet

The post Technical Analysis by Matrix Method (2023/6/9) Bitcoin, Be Careful!A situation where both up and down are possible: Rakuten Wallet | CoinDesk JAPAN | Coin Desk Japan appeared first on Our Bitcoin News.

2 years ago

100

2 years ago

100

![Jupiter [JUP] surges amid 62% daily volume spike – Can bulls hold?](https://ambcrypto.com/wp-content/uploads/2025/08/Jupiter-Featured.webp)

English (US) ·

English (US) ·