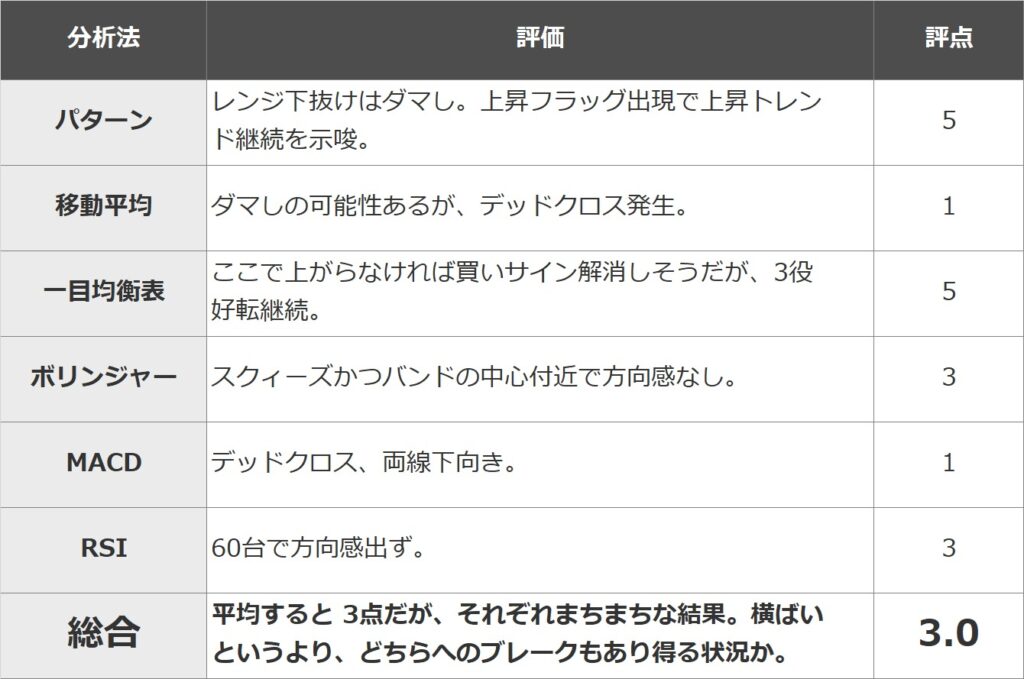

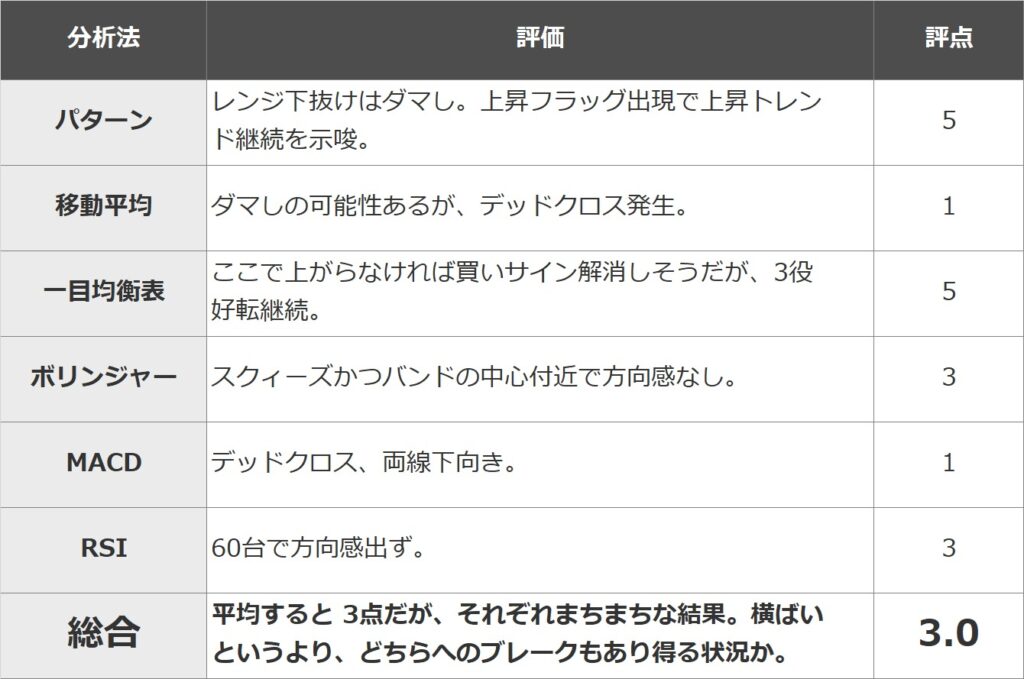

In this article, the Bitcoin market is analyzed in 5 stages (5 → 1: Strong → Weak) using six representative technical analyzes: pattern analysis, moving average (9MA, 25MA), Ichimoku Kinko Hyo, Bollinger Bands, MACD, and RSI. Evaluate the strength of the market with the average.

I believe that fixed-point observation and objectivity are important in technical analysis. The aim is to eliminate arbitrariness and improve accuracy by combining multiple representative analysis methods.

*This article is a reprint of the technical report of “Rakuten Wallet”.

summary

The overall score is 3 and completely neutral. However, the contents are strong in patterns and Ichimoku, weak in moving averages and MACD, and neutral in Bollinger. In such a case, it means that one of the indicators is correct and the other is false, and it should be interpreted as a situation where the market can break either up or down rather than leveling off.

pattern analysis

Although it broke below the newly formed range of 4.25 to 4.55 million yen, it quickly rebounded. The break ended in failure. On the other hand, a “rising flag” emerges in which the market price rises and forms a downward channel. This is a form that suggests a continuation of the uptrend and a breakout in the future.

Rating: 5

moving average

There is a possibility that the 25MA will be bullied by the upward trend, but it suggests a further decline immediately after the dead cross formation.

Rating: 1

Ichimoku Kinko Hyo

It seems that the lagging line will be on the candlestick and will disappear if it does not rise to some extent in the near future.

Rating: 5

bollinger bands

The band is squeezed, the lower end of the band is returned to the center, and there is no sense of direction.

Rating: 3

MACD

After the dead cross occurred, both lines are downward and the sell sign is lit.

Rating: 1

RSI

It has not reached the overbought zone at 60 units.

Rating: 3

grade

*This article provides information for reference in making investment decisions, but is not intended to recommend stocks or solicit investment activities. In addition, Rakuten Wallet does not solicit investment or make definitive forecasts.

*Information sent may include future forecasts, but this is the opinion of the individual sender, and we do not guarantee its accuracy or reliability. Please make your own final investment decisions.

| Editing: coindesk JAPAN

|Image: Rakuten Wallet

|Reprinted from: Rakuten Wallet

The post Technical Analysis by Matrix Method (July 14, 2023) Bitcoin, the appearance of rising flags is likely to be both up and down: Rakuten Wallet | CoinDesk JAPAN | Coin Desk Japan appeared first on Our Bitcoin News.

1 year ago

78

1 year ago

78

English (US) ·

English (US) ·