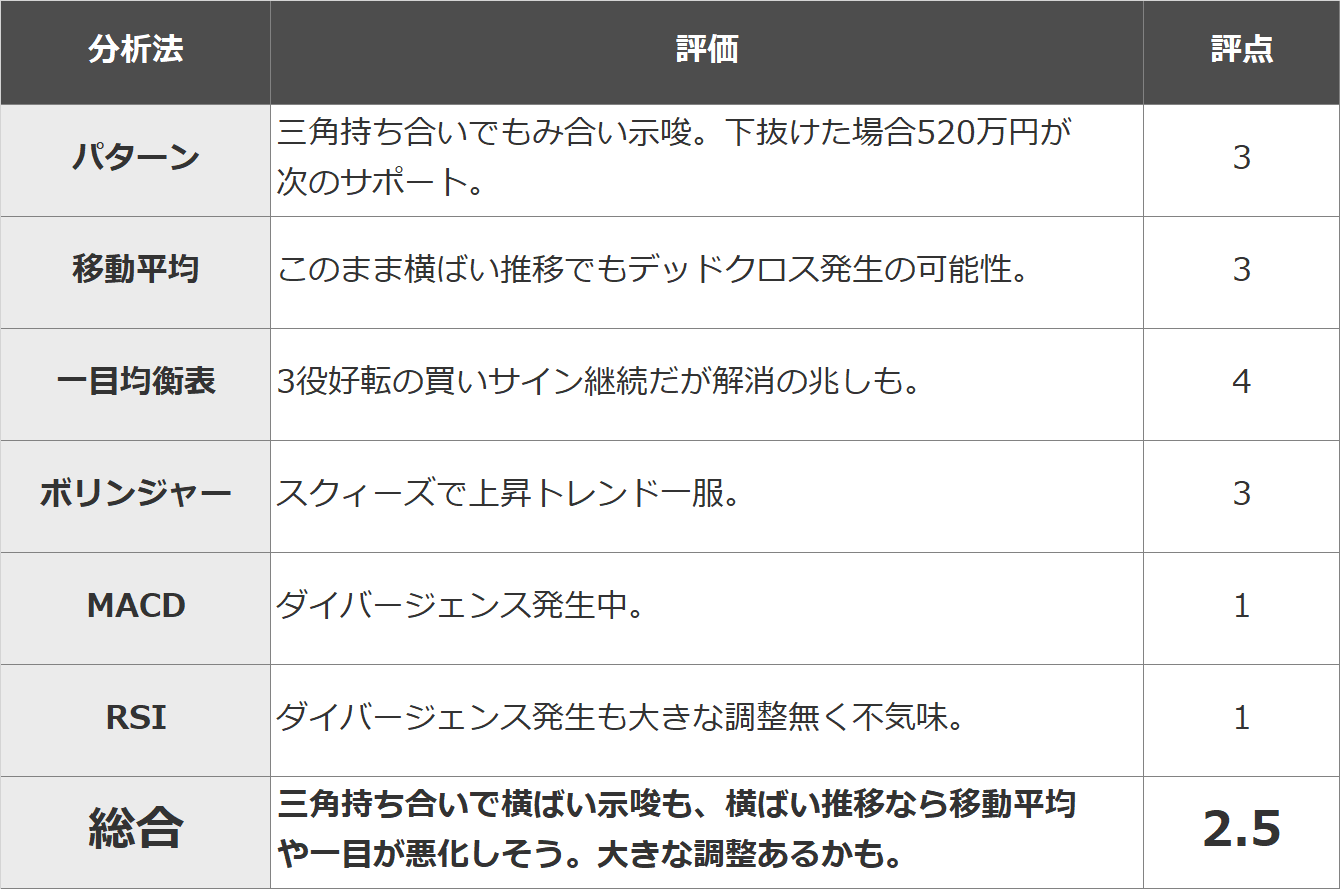

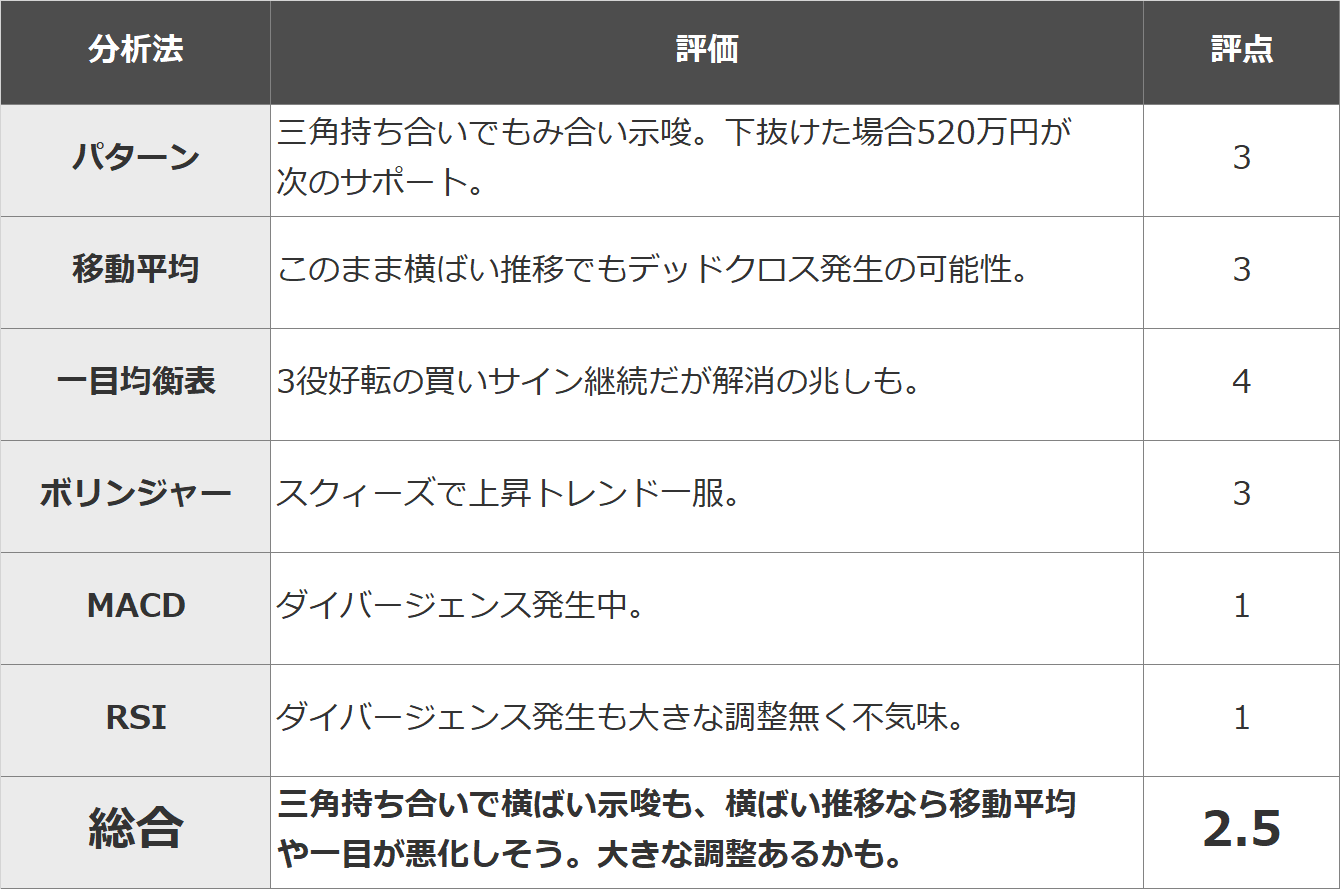

In this article, we will evaluate the Bitcoin market using 1) pattern analysis, 2) moving average line (9MA/25MA), 3) Ichimoku Kinko Hyo, 4) Bollinger Bands, 5) MACD, and 6) 6 types of RSI typical technical analysis in 5 stages (5 → 1: strong → weak). The strength and weakness of the market is evaluated based on the average.

I believe that fixed point observation and objectivity are important in technical analysis. The aim is to eliminate arbitrariness and increase accuracy by combining multiple representative analysis methods.

summary

The overall score is 2.5. The triangle holdings suggest that it will remain flat, but if it continues to be flat, the moving average may reach a dead cross and Ichimoku’s three-role upturn may be resolved. Although there are divergences in MACD and RSI, there are no major adjustments. Above all, there is an eerie feeling that there is a disconnect between the market’s bullish atmosphere and the deterioration of the technical situation. Depending on the material, a breakout may be possible, but we would like to see an adjustment to the lower limit of the range of around 5.2 million yen due to a breakout below.

pattern analysis

A triangular cross-holding was formed between the support line that has been going on since late October and the resistance at $38,000 in dollar value (5.65-5.75 million yen in yen price). This suggests that prices will remain in the high range until mid-December. Even if it falls below this support, the 5.2 million yen mark on November 14th becomes support, forming a range of 5.2 million to 5.75 million yen. however. When the price breaks below 5.2 million yen, a double top is completed and the trend changes, and the next support is halved at 4.7 million yen.

Rating: 3

moving average line

The 9MA is flat, the 25MA is upward, and both lines are approaching each other. Even if it remains flat, there is a possibility of a dead cross.

Ichimoku Kinko Hyo

3 The improvement continues, but the change line and the reference line are getting closer. If it continues to trend sideways, there is a possibility that the lagging line will catch up with the candlestick.

bollinger bands

The band continues to squeeze. The upward trend has stopped.

MACD

Dead cross continues. The candlesticks are flat but slightly upward, MACD is downward, and the divergence continues, suggesting a market reversal.

RSI

Like the MACD, the RSI is also undergoing a divergence, and there is no major adjustment, making it a bit ominous.

Rating

*This article is a reprint of the Rakuten Wallet technical report.

*This article provides information for reference when making investment decisions, but is not intended to recommend stocks or solicit investment activities. Furthermore, Rakuten Wallet does not solicit investments or make definitive predictions.

*The information posted may include future predictions, but it is the opinion of the individual sender, and its accuracy and reliability are not guaranteed. Please make your own final investment decisions.

The post Technical analysis using matrix method (2023/11/24) Bitcoin, technical condition worsens contrary to market atmosphere: Rakuten Wallet | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

82

1 year ago

82

English (US) ·

English (US) ·