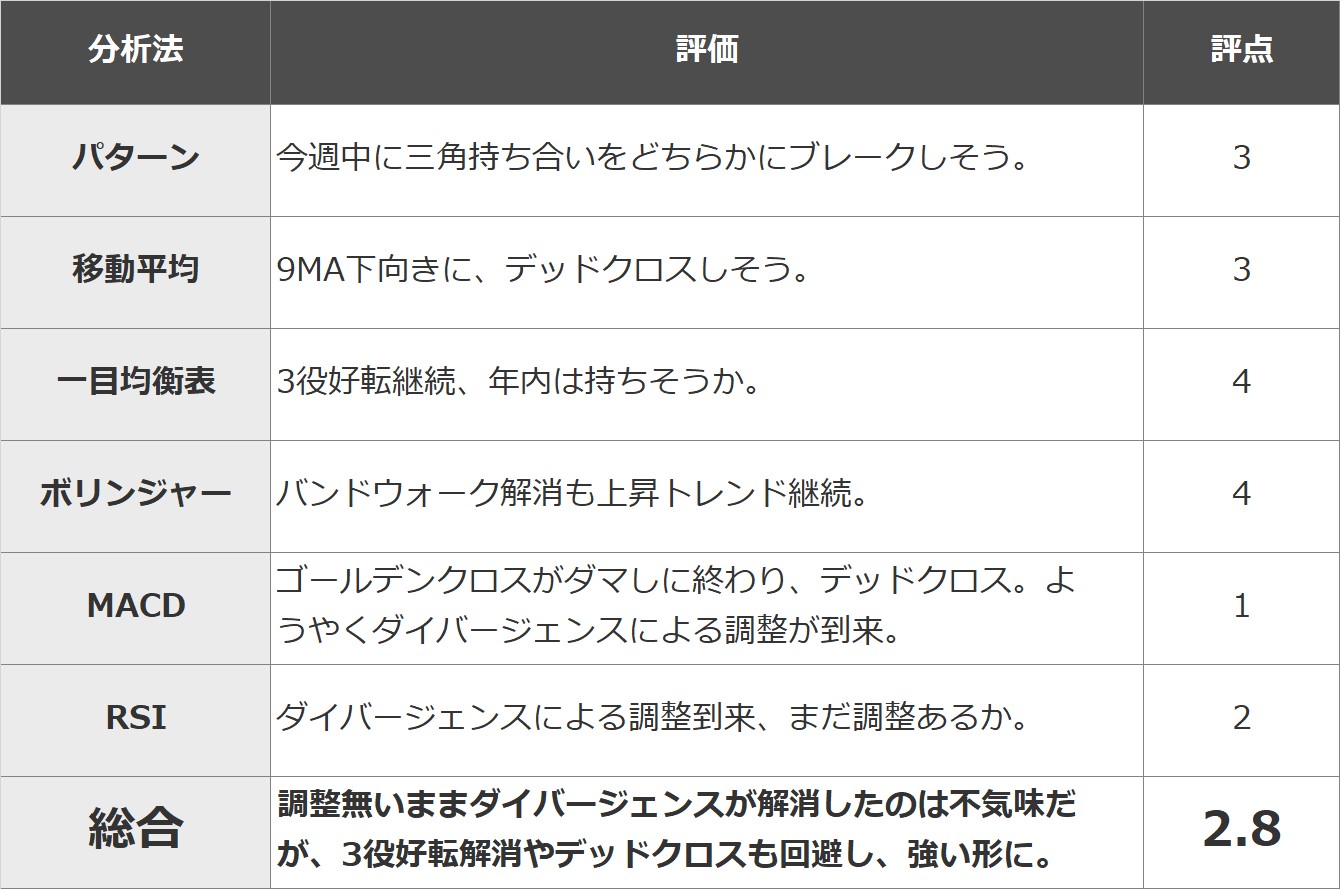

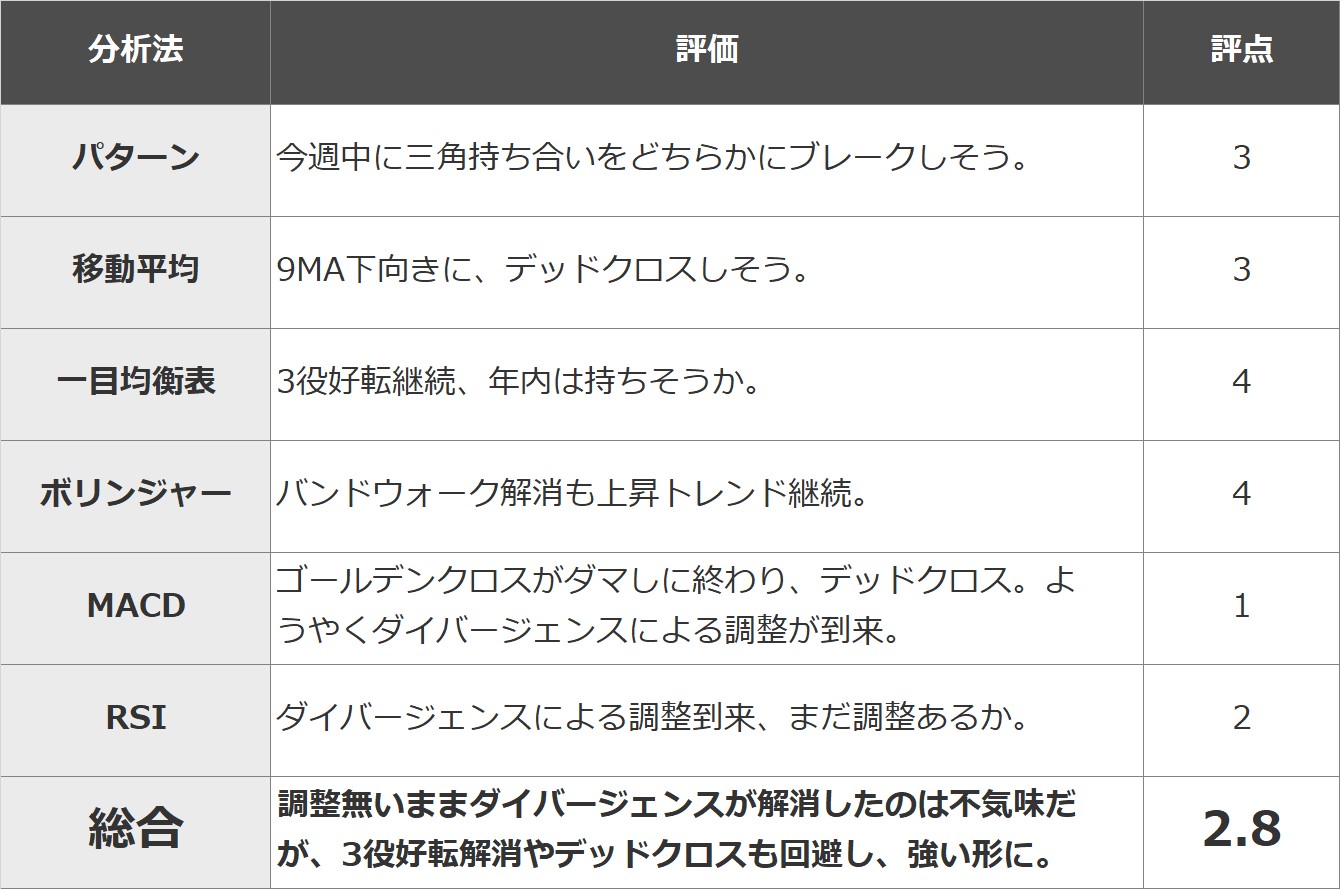

In this article, we will evaluate the Bitcoin market using 1) pattern analysis, 2) moving average line (9MA/25MA), 3) Ichimoku Kinko Hyo, 4) Bollinger Bands, 5) MACD, and 6) 6 types of RSI typical technical analysis in 5 stages (5 → 1: strong → weak). The strength and weakness of the market is evaluated based on the average.

I believe that fixed point observation and objectivity are important in technical analysis. The aim is to eliminate arbitrariness and increase accuracy by combining multiple representative analysis methods.

summary

The overall score is 2.8, which is close to neutral.The possibility of an adjustment due to MACD/RSI divergence has been pointed out since the latter half of November, and it appeared to have resolved last week, but this resolution turned out to be a false positive and there has been a major adjustment. The timing of the adjustment was a surprise, but it was an adjustment that was expected to come.

The correction is also supported at the level that should be supported, and Ichimoku and Bollinger are suggesting a continuation of the uptrend, but MACD and other indicators are suggesting a continuation of the correction.Which direction will break the current small triangular holding? I would like to find out.

pattern analysis

As I introduced last time, the price broke above the triangular cross-shareholding level, reached a doubling level as per theory, and stopped rising, forming a large parallel channel that has continued since mid-October. The initial drop in the week was supported by the lower limit of this channel and the upper limit of the triangle cross-shareholding that broke at the beginning of the month, suggesting a continuation of the uptrend. On the other hand, in the short term, a small triangular cross-holding is formed, and a break is likely to occur in either direction this week. If you think about it normally, it looks like it will break upwards and aim for the upper limit of the channel, but it is also possible that it will break below and aim for the upper limit of the triangle cross holding again.

Rating: 3

moving average line

It was close to a golden cross, but the 9MA turned downward and if it continues like this, it will likely become a dead cross.

Rating: 3

Ichimoku Kinko Hyo

3 roles continue to improve. Although he has lost momentum, he seems likely to improve his role as a third-tier player by the end of the year.

Rating 4

bollinger bands

The sharp decline at the beginning of the week has been resolved by the band walk, and the price is being pulled back to the middle of the band. The expansion is still continuing and the upward trend continues, but the momentum is fading.

Rating: 4

MACD

I have been pointing out the possibility of a divergence and adjustment since mid-November, but last week a golden cross occurred and I thought the divergence was false, but it turned out that the golden cross was actually false. A dead cross suggests continued adjustment.

Rating: 1

RSI

In this case, it seemed that the divergence that had been occurring since the beginning of November had been resolved without any noticeable adjustment, but this resolution was more of a slump and was successfully adjusted. It’s not oversold yet, so I wouldn’t be surprised if it adjusts a bit more.

Rating: 2

Rating

*This article is a reprint of the Rakuten Wallet technical report.

*This article provides information for reference when making investment decisions, but is not intended to recommend stocks or solicit investment activities. Furthermore, Rakuten Wallet does not solicit investments or make definitive predictions.

*The information posted may include future predictions, but it is the opinion of the individual sender, and its accuracy and reliability are not guaranteed. Please make your own final investment decisions.

The post Technical analysis using matrix method (2023/12/15) Will Bitcoin continue to be adjusted? Will the upward trend continue? : Rakuten Wallet | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

82

1 year ago

82

English (US) ·

English (US) ·