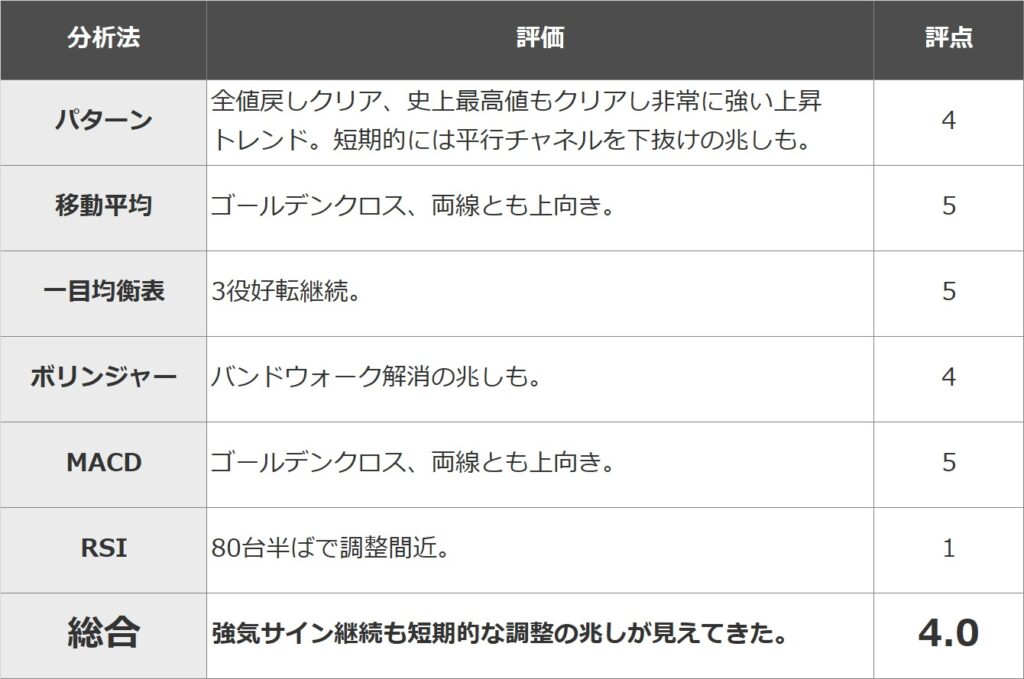

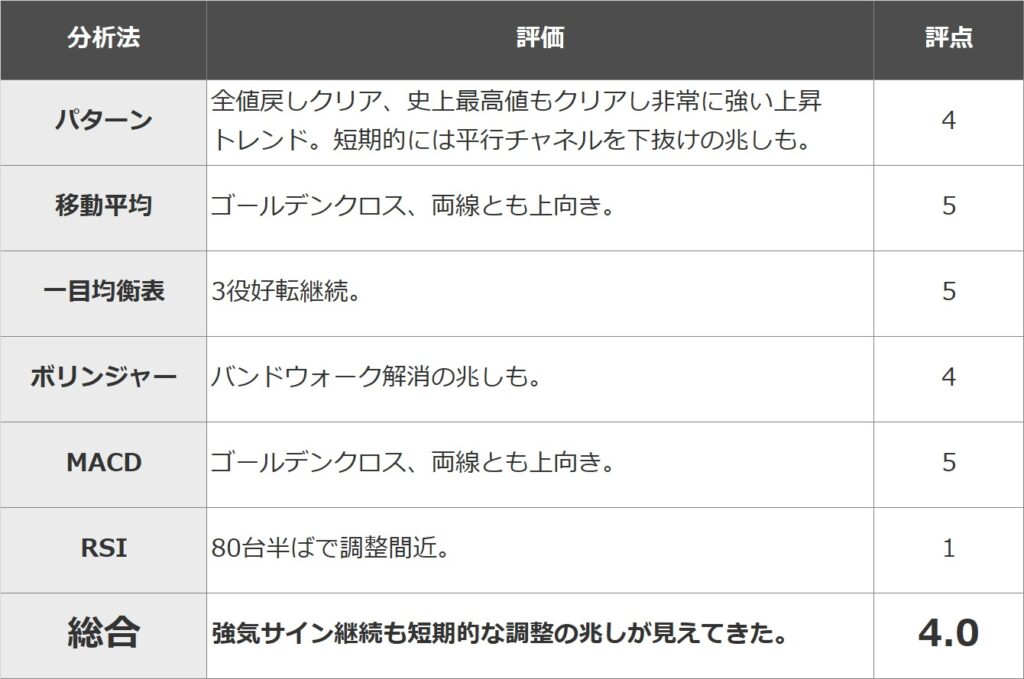

In this article, the Bitcoin market is evaluated in 5 stages (5 → 1: strong → weak) using 1) pattern analysis, 2) moving average line (9MA, 25MA), 3) Ichimoku Kinko Hyo, 4) Bollinger bands, 5) MACD, and 6) RSI. , and evaluate the strength or weakness of the market based on the average.

I believe that fixed point observation and objectivity are important in technical analysis. The aim is to eliminate arbitrariness and increase accuracy by combining multiple representative analysis methods.

summary

The overall score is 4.0. Last time, I gave a bullish forecast saying that the stock is “perfect'' and “the target is a full return of 7.15 million yen,'' and it easily surpassed that level and set a new all-time high. Reflecting this momentum, all trend systems are showing bullish signs, but there are also signs of a slight change compared to the previous week. The RSI is in the mid-80s, suggesting a correction is near.

In addition, here we use the chart of BTCJPY from Rakuten Wallet's margin exchange. Please refer to the BTCUSD chart here (link is to TradingView's website).

pattern analysis

It cleared the half-price reversal that was the resistance, and stopped once at the full price reversal of 7.15 million yen, but it easily broke out and cleared the all-time high. With this, there seems to be no prospect of a significant upside, and if I had to say, it would be 8.6 million yen, which would double the decline from 7.15 million yen to 5.7 million yen. There is a strong uptrend in a sharp parallel channel, but it looks like it will break below the channel in the short term.

Rating: 4

moving average line

After the golden cross, both lines go up.

Rating: 5

Ichimoku Kinko Hyo

The buy signal of the 3-way turnaround continues.

Rating: 5

bollinger bands

Band walk continues. Bands are also expanding, and although there are no signs of the trend converging yet, it does seem like the band walk is subtly on the verge of dissolving itself.

Rating: 4

MACD

A golden cross has occurred, and both lines are pointing upwards.

Rating: 5

RSI

It has entered a strong overbought zone and is in the mid-80s, suggesting a correction.

Rating: 1

Rating

*This article is a reprint of the Rakuten Wallet technical report.

*This article provides information for reference when making investment decisions, but is not intended to recommend stocks or solicit investment activities. Furthermore, Rakuten Wallet does not solicit investments or make definitive predictions.

*The information posted may include future predictions, but it is the opinion of the individual sender, and its accuracy and reliability are not guaranteed. Please make your own final investment decisions.

|Edited by coindesk JAPAN

|Image: Rakuten Wallet

|Reprinted from: Rakuten Wallet

The post Technical analysis using the matrix method (2/16/2024) Bitcoin remains bullish, but there is also a short-term adjustment: Rakuten Wallet | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

83

1 year ago

83

English (US) ·

English (US) ·