Tensor, a Solana-centric NFT trading platform, has raised $3 million in a seed round led by Placeholder, the team exclusively shared with TechCrunch.

The startup was co-founded by Ilja Moisejevs and Richard Wu, bringing a collective 10 years of experience in working on trading infrastructure and data-intensive systems. Until this point, Tensor was bootstrapped off about $60,000-$70,000 in prize money from winning two Solana hackathons in 2022, Moisejevs shared.

“We’re essentially trying to define the next meta for Solana NFTs,” Wu said. “A lot of things that have been done on Solana are carbon copies of Ethereum and we think Solana NFTs can be so much more.”

Investors in the seed round include Solana Ventures, Alliance DAO, Big Brain Holdings and Solana co-founders Anatoly Yakovenko and Raj Gokal, among others.

Tensor started raising capital around the time when FTX collapsed, Moisejevs said. Half of the money came from small angel investors or customers who have been using the platform “since day one,” he added.

“Going through the round, toward the end we didn’t really need the money ’cause at that point we were making quite a bit in fees,” Wu said. “We just crossed $1 million in annual run rate and we’re a three-person team now, so that covers more than our expenses and then some.”

Solana is the third largest blockchain for NFTs by sales volume with over $3.7 billion in sales all-time, according to data on NFT aggregator CryptoSlam. In the past 30 days, Solana NFT sales volume fell about 47.7%, to $76.5 million, the data showed.

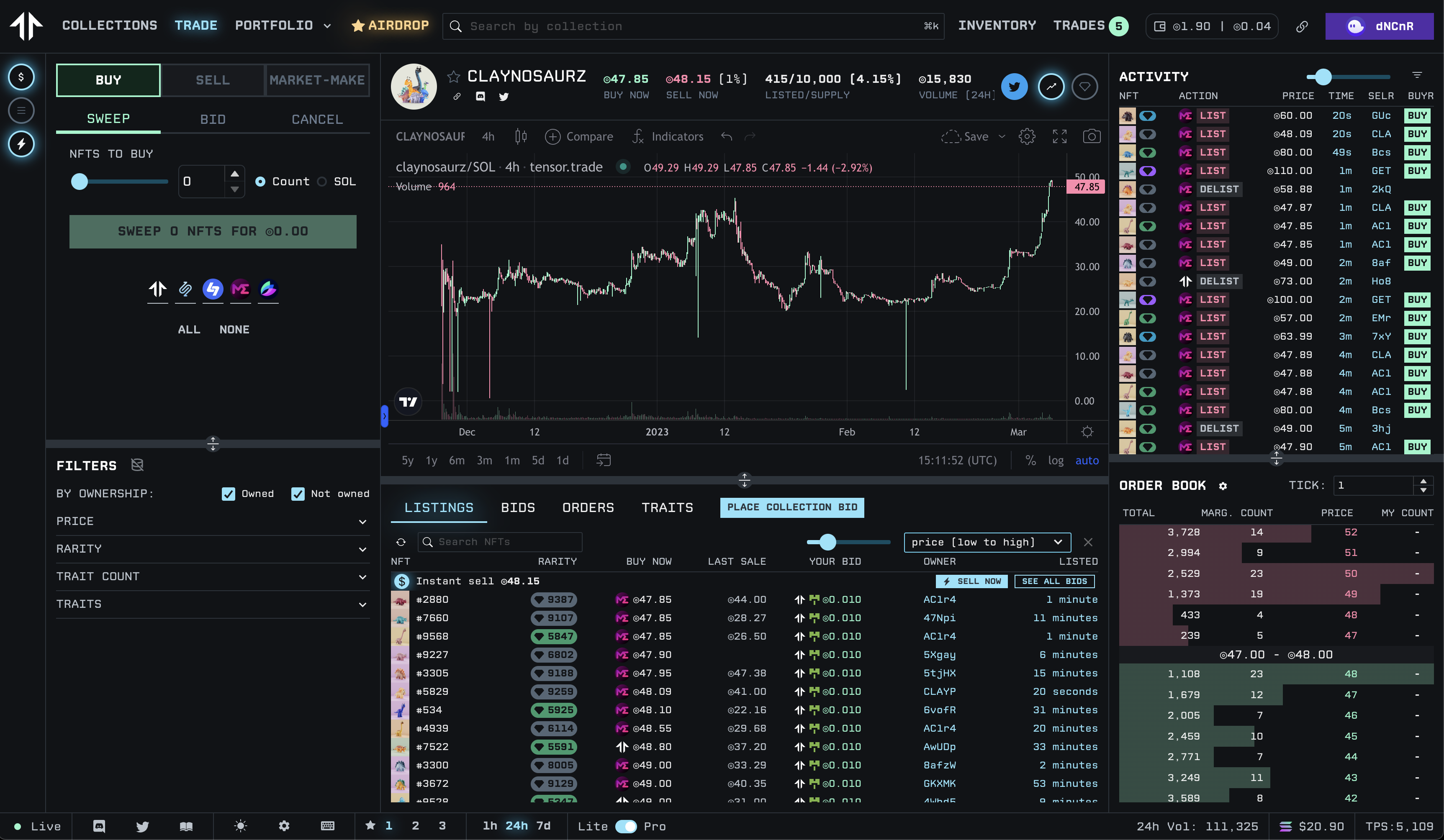

The trading-focused platform offers advanced functionalities like TradingView integration, collection-wide bids and market making orders, Wu shared. It launched in private beta mode in June of 2022 and opened to the public the next month. Since then, Tensor has grown to over 30,000 monthly active users and has traded over $6.6 million in NFT volume, Moisejevs said.

Image Credits: Tensor (opens in a new window)

“What’s interesting about Solana NFTs, and NFTs in general, is that despite macro conditions there’s still excitement in the space and that’s indicative that NFTs aren’t a fad, there is something here,” Wu said. “For us, we want to provide the trading infrastructure and technological infrastructure for NFTs going forward. We think this is going to be the next trillion-dollar asset class and we want to be the financial trading rails for it.”

In recent months, Ethereum-focused NFT marketplace Blur stirred up some controversy in the ecosystem as it implemented a 0.5% creator royalty fee, which is so nominal to many that some view it as essentially zero. This small fee was a trigger that caused other major NFT marketplaces like OpenSea to amend their fee structure to include zero-cost trading for a “limited time” and minimal-at-best creator royalties — or risk losing even more market share.

While Blur is a part of the Ethereum NFT ecosystem, Tensor hopes to become a “similar but different” version of Blur in the Solana world, Moisejevs said. The Solana-focused platform allows collections the option to opt-in to a 1% fixed creator royalty on every trade, he added. Of that 1%, a majority, or 0.9% would go to the creator and 0.1% would go to Tensor.

To date, a handful of collections have opted-in to the fixed creator royalty, but the co-founders expect about 80% of collections to agree to the standard within three months. The platform also launched an incentive plan on Monday that will provide rewards and “boxes” with NFTs in them to community members, among other things, Wu said.

“In web3, your customers are your partners. You have to align them financially, motivationally and in many different ways,” Moisejevs added. “We’ve seen with other ecosystem participants and large marketplaces that they have failed to do it because they’ve shown up to web3 with a web2 mindset that they’re going to abstract value out of customers…We want to be the polar opposite of that and build a product that is owned by the community.”

Tensor raises $3M for Solana-focused NFT trading platform by Jacquelyn Melinek originally published on TechCrunch

English (US) ·

English (US) ·