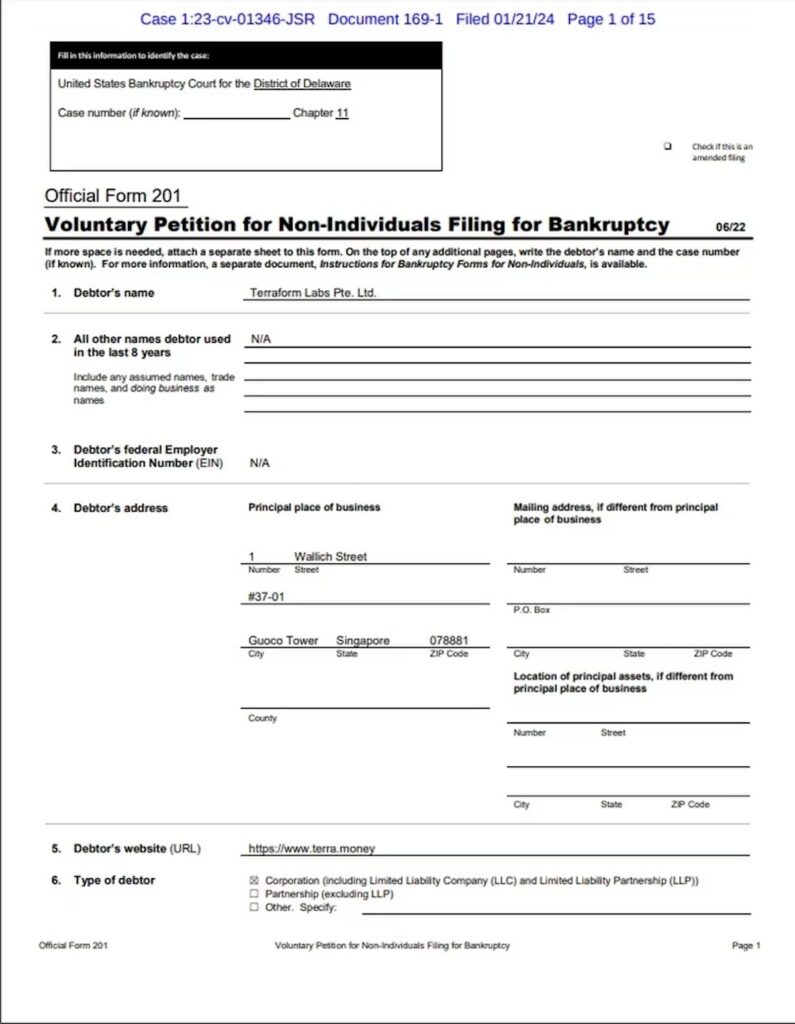

According to documents filed on January 21, crypto asset (virtual currency) issuer Terraform Labs has filed for Chapter 11 bankruptcy protection in Delaware.

This company, which issued the algorithmic stablecoin TerraUSD (UST), has assets estimated at between $100 million and $500 million (approximately 15 billion yen to 75 billion yen, at an exchange rate of 1 dollar = 150 yen), and It says in its filing that it owes the same amount. Dollar-pegged Terra USD and Terra (LUNA) went bankrupt in May 2022, with investors losing $1 billion (approximately 150 billion yen).

Terraform Labs said in a statement: “This filing allows us to pursue our business plans while navigating ongoing legal proceedings, including an ongoing class action lawsuit in Singapore and litigation in the United States. It will become so.”

(Court filings)

(Court filings)The list of unsecured creditors includes US-based crypto investment fund TQ Ventures and San Francisco-based venture fund Standard Crypto.

Terraform Labs and its co-founder Do Kwon are currently facing possible class action lawsuits in Singapore over the collapse of TerraUSD, as well as charges from the Securities and Exchange Commission (SEC) in the US. There is a possibility that

Separately, in late December, Kwon and Terraform Labs lost a lawsuit regarding the status of LUNA and Mirror Protocol (MIR) after an American judge ruled that they were securities. did.

|Translation: CoinDesk JAPAN

|Edited by: Toshihiko Inoue

|Image: Mr. Do Kwon (CoinDesk TV)

|Original text: Terraform Labs Declares Bankruptcy in Delaware

The post Terraform Labs files for Chapter 11 bankruptcy | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

81

1 year ago

81

English (US) ·

English (US) ·