Tether (USDT) has increased its market cap by about $1 billion ($130 billion) as investors have pulled back from rival Binance USD (BUSD).

According to CoinGecko, USDT’s market cap has increased from $68.5 billion to $69.5 billion since February 13. It is the highest level since last June’s turmoil when traders put USDT down.

Meanwhile, BUSD’s market cap has fallen 11% from $16.1 billion to $14.3 billion.

BUSD, issued by Paxos under the Binance brand, is rapidly declining in circulation, while USDT is increasing in circulation.

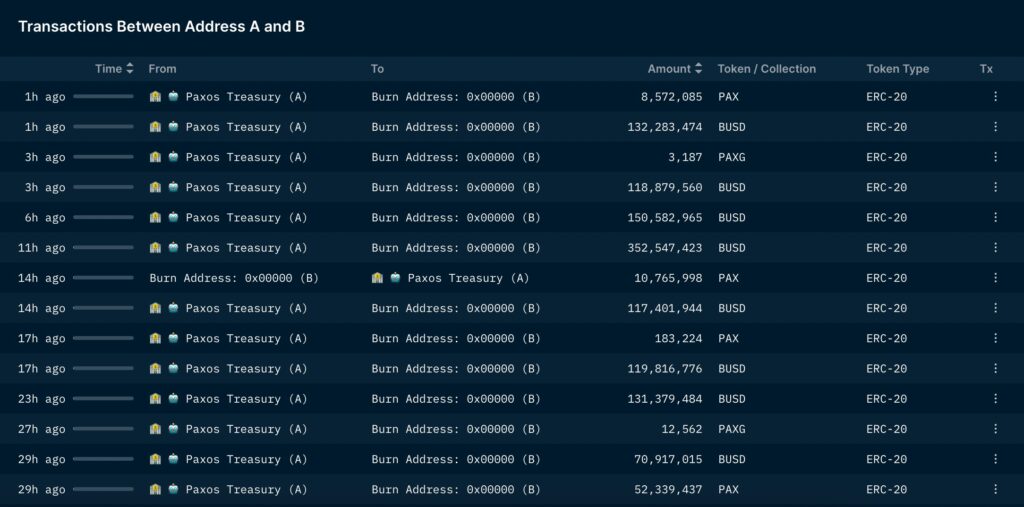

Paxos has burned more than $1.8 billion of BUSD since Wednesday, according to Nansen data.

(Nansen)

(Nansen)USDT wins

Another Paxos stablecoin, the seventh-largest market cap Paxos Dollar (USDP), has evaded regulatory scrutiny, but has still lost 11% of its circulation, or about $100 million.

If demand for a stablecoin falters, issuers will burn some of it out of circulation and reduce supply in order to keep it pegged to the dollar.

Other leading stablecoins, such as Circle’s USD Coin (USDC) and MakerDAO’s Dai (DAI), have been less affected, with investors either shifting from BUSD to USDT or investing in fiat currencies and other cryptos. It can be seen that it has been converted into an asset.

Kyco analyst Conor Ryder said earlier this week that USDT would be the “clear winner” of the stablecoin market consolidation.

|Translation: coindesk JAPAN

|Editing: Takayuki Masuda

| Image: Nikhilesh De/CoinDesk

|Original: Tether’s USDT Gains $1B as Paxos Burns Over $1.8B of Binance USD Stablecoins

The post Tether’s market cap increased by $1 billion, Binance USD decreased by $1.8 billion | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

147

2 years ago

147

English (US) ·

English (US) ·