Blur has surged in the past week

Fast-growing NFT (non-fungible token) marketplace Blur has surpassed industry leader OpenSea in trading volume over the past week.

According to DappRadar data, Blur’s trading volume has increased 361% over the past week to $548 million. Meanwhile, OpenSea’s trading volume rose 12% over the past week, but remained at $100 million.

Both occurred on the crypto asset (virtual currency) Ethereum (ETH) blockchain, and in the past 24 hours, they were the top two (Blur in first place, OpenSea in second place) in terms of gas usage on the network. ing.

Blur uses a zero-fee, high-speed aggregation model. Traders are rapidly gaining traders with the convenience of collectively trading NFTs sold on other NFT marketplaces such as OpenSea, X2Y2, and LooksRare, and the UI/UX specialized for trading.

On February 14th, an airdrop (free distribution) of the original token BLUR will be held. In addition, about one month from the same day was called “Season 2”, and a campaign was started to double the “loyalty points” that users receive by bidding and listing actions.

connection:Fast-Growing NFT Market Blur Overtakes OpenSea in Daily Trading Volume

Popular NFT collection traded

No official announcement has been made on the detailed mechanics of Season 2 yet, but it is explained that loyalty points affect the “luck” that affects the BLUR reward rate.

According to the outline of the airdrop project announced in December 2010, the number of loyalty points earned varies depending on the action, but especially for the top collection, “items in the price range close to the floor” will be bid at a “price below the floor”. This will give you the most rewards. In addition, up to 2.5x boost will be applied to the top 100 bidders in 24 hours.

Complementing this design, Blur has a unique feature called “Bidding Pools” that enables bulk trading of NFTs. With these tools, NFT trading appears to be more efficiently executed by point-seeking whales.

Example of how Blur airdrop farming distorts the NFT market:

Whale buys 21 Lil Pudgys and dumps them into the bidding pool. Eats a small loss but racks up points. It’s a game of musical chairs, fake sales volume and influencers telling you “we’re so back” until the charade ends. pic.twitter.com/SSKP13BAa7

—John Jimenez (@johnj1138) February 11, 2023

An investor in the popular NFT collection “Pudgy Penguins” pointed to the whale’s practice of dumping the 21 NFTs he purchased into a bid pool, earning points while suffering losses.

Also, if you look at the trading history of Blur Season 2’s current top scorer “MachiBigBrother”, he buys BAYC and Otherdeed from somewhere and sells them in bulk.

According to the data site CryptoSlam, MachiBigBrother has made a total of 1,277 sales worth $4.32 million in the past week just from the new metaverse Otherside virtual land “Otherdeed NFT” of “Bored Ape Yacht Club (BAYC)”.

Source: Cryptoslam

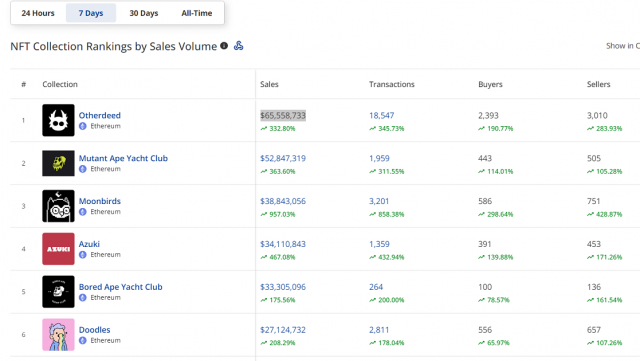

Influenced by Blur traders, top collection volumes have increased across the board over the past week. Regarding the top-ranked Otherdeed NFT, the number of transactions increased by 343% in the past week, and the transaction volume also increased by 321% to 65 million dollars (8.8 billion yen).

connection:Can OpenSea’s stronghold be destroyed?What is the strategy of the NFT market “Blur” for professional traders?

The post The background behind the emerging NFT market “Blur” exceeding OpenSea in weekly trading volume appeared first on Our Bitcoin News.

2 years ago

141

2 years ago

141

English (US) ·

English (US) ·