Bitcoin Market Report (March 14-20)

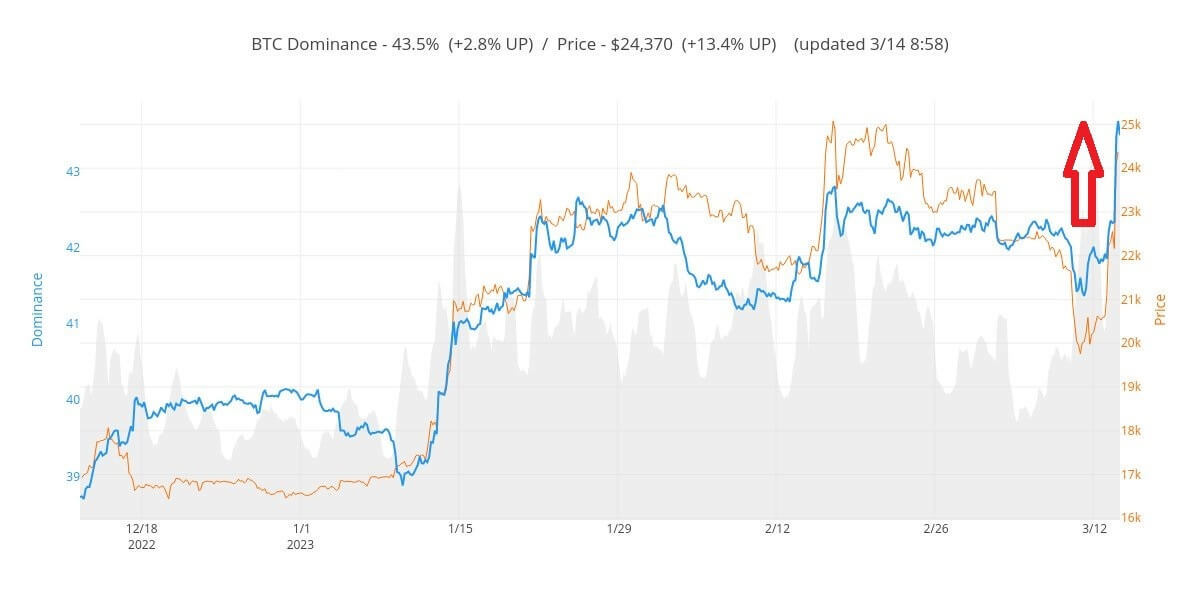

Bitcoin fell below $20,000 at one point on March 9 after the announcement of the voluntary liquidation of Silvergate Bank, which has many transactions with crypto-asset-related companies, and the loss of major miner Riot. With the announcement of the bankruptcy of Silicon Valley Bank, where part of the collateral of the stablecoin “USDC” is deposited, the credit anxiety of USDC spread, and BTC became a place to escape funds and rose.

Furthermore, from the 13th, stock prices, mainly bank stocks, fell, and US Treasury bonds, which are safe assets, were bought, and interest rates fell, which became a tailwind for BTC and led to a streak. BTC is near $24,000 at the time of writing.

feet

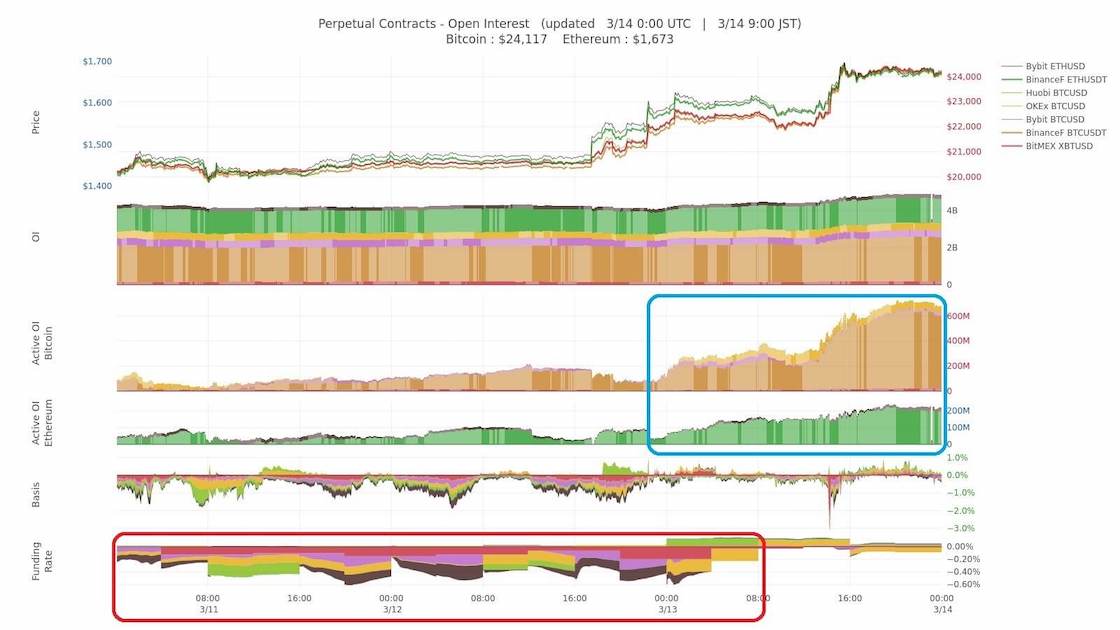

Looking at the funding rate, there was a bias toward short positions until the 13th (red frame in the image below), but it is now flat. On the other hand, the active OI (open interest) of market orders has increased rapidly (blue frame in the image below), and it can be said that price fluctuations are likely to occur.

Source: BTC Status Alert  (https://twitter.com/btc_status)

(https://twitter.com/btc_status)

External environment

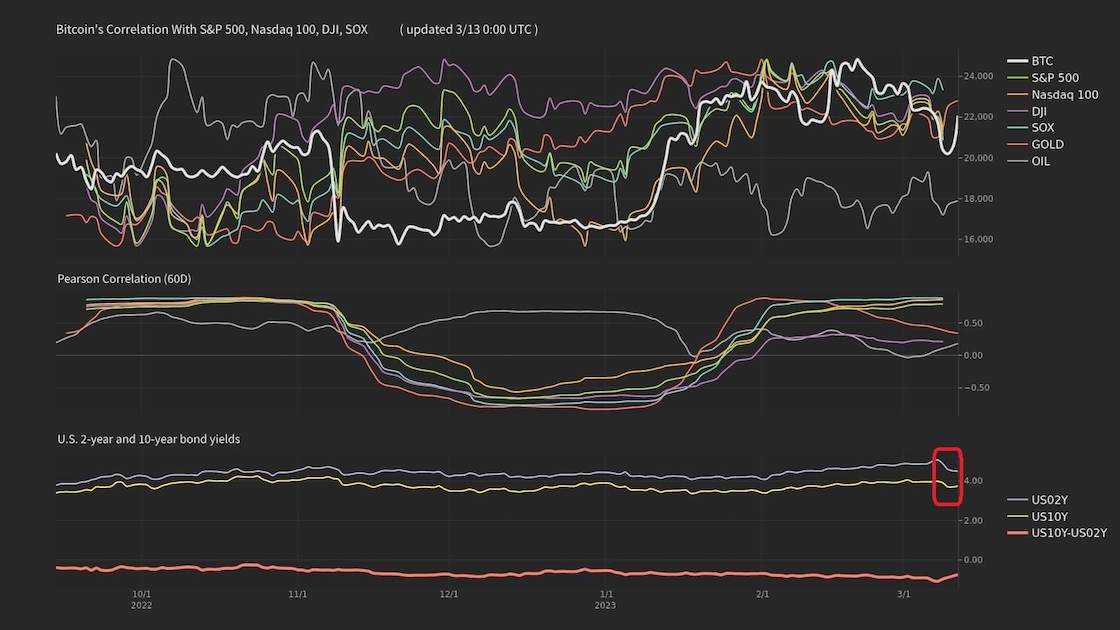

Recently, Bitcoin has become a unique move. Since Silvergate Bank, Silicon Valley Bank, Signature Bank and U.S. banks have liquidated or gone bankrupt one after another, U.S. stocks, which are risk assets, have been sold and U.S. bonds have been bought, and U.S. interest rates have fallen.

As a result, falling interest rates have become a tailwind for Bitcoin, which is believed to have led to its recent rise.

Source: BTC Status Alert  (https://twitter.com/btc_status)

(https://twitter.com/btc_status)

derivatives market

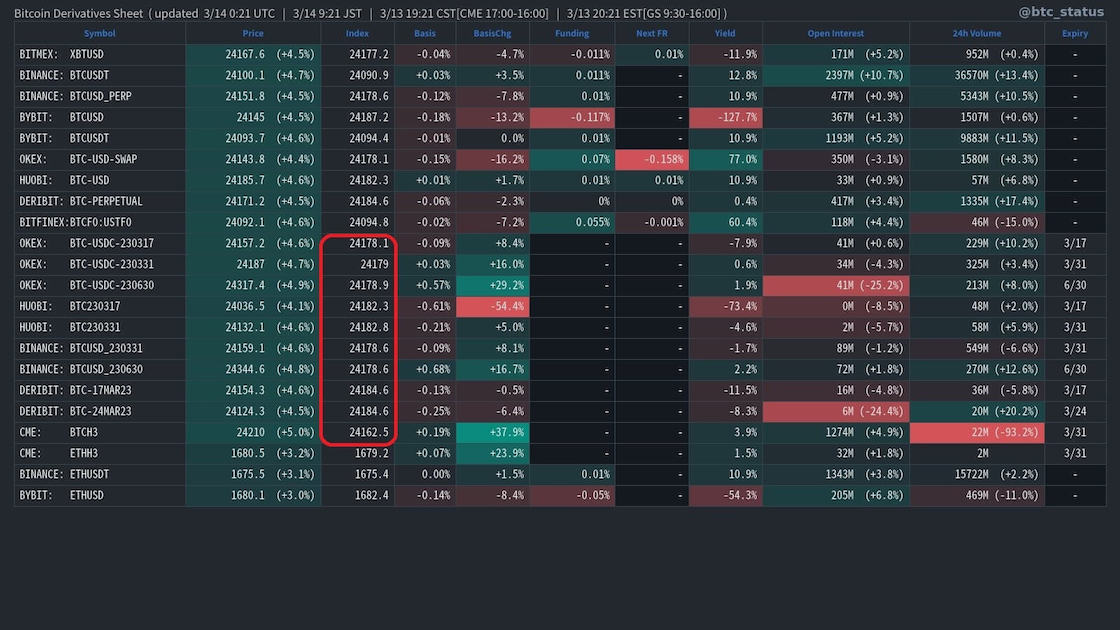

Since the 11th, the futures price has been considerably lower than the spot price, but recently the price difference has almost disappeared. Although there is still excess demand, supply and demand are trending toward excess supply.

Source: BTC Status Alert  (https://twitter.com/btc_status)

(https://twitter.com/btc_status)

spot market

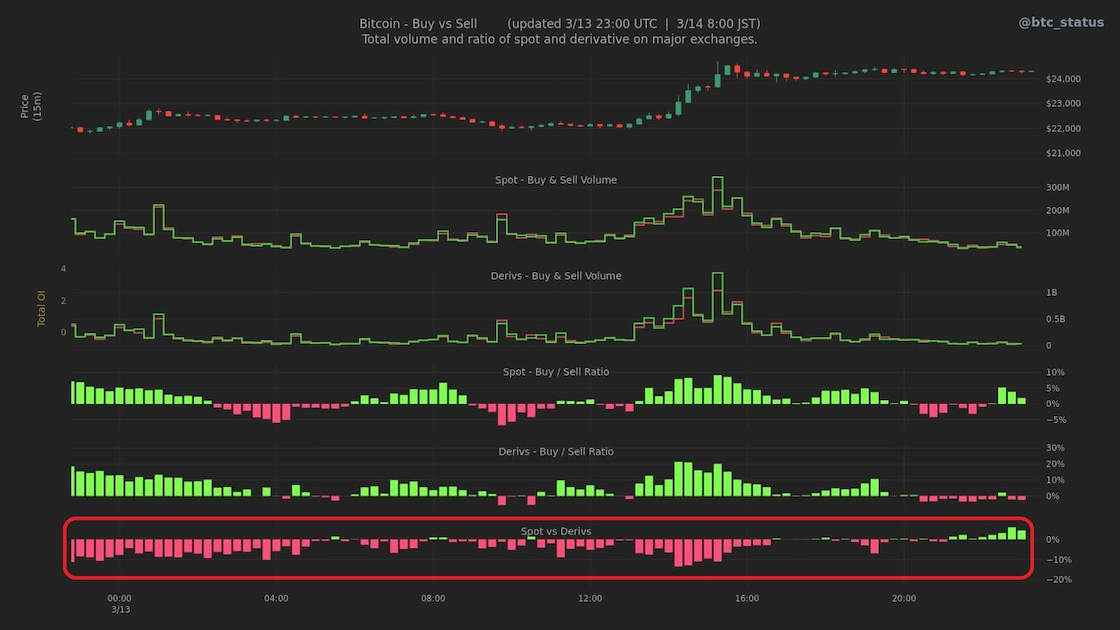

In market trading, spot buying (red frame in the image) continues to exceed buying in the derivatives market. Since there was a bias in short positions, it is thought that this was due to short covering (buying back of selling).

Source: BTC Status Alert  (https://twitter.com/btc_status)

(https://twitter.com/btc_status)

On-chain environment

Since March 11th, PooledTX has remained low, and we have not seen any active Bitcoin inflows and outflows.

Source: BTC Status Alert  (https://twitter.com/btc_status)

(https://twitter.com/btc_status)

In addition, Bitcoin’s dominance (percentage of the cryptocurrency market) has risen sharply, and it is believed that BTC is being bought as a safe haven for stablecoin funds that are spreading credit uncertainty.

Source: BTC Status Alert  (https://twitter.com/btc_status)

(https://twitter.com/btc_status)

options market

Due to Riot’s announcement of a loss, a major miner, the PCR ratio, which is the ratio of puts and calls, temporarily rose, and although there was a bearishness in trading in the physical delivery market, the PCR ratio sharply increased due to the recent price rise. is declining (red frame in the image below), and it is thought that minors are turning bullish.

Source: BTC Status Alert  (https://twitter.com/btc_status)

(https://twitter.com/btc_status)

hash rate

The next difficulty forecast is +0.64%, which is almost unchanged, but the hash rate is still at a high level.

Recent Crypto Indicators

- March 14 U.S. Consumer Price Index (CPI): February 2011 Results

- March 15 Shanghai implementation on Ethereum “Goerli” testnet

- March 16 European Central Bank (ECB) Policy Rate

Optimism Bedrock Upgrade Estimated Date - March 17 Flare Drop Distributions first billable date

Summary

With the flight of funds due to the credit uncertainty of stablecoins and the decline in government bond yields due to the decline in stock prices centered on banks, bitcoin rose by about 500,000 yen between March 12 and 13. Although there is still a slight excess demand, it is gradually disappearing, and the internal environment is approaching a flat state. However, as an external factor, depending on the results of the Consumer Price Index (CPI) announced at 9:30 p.m. .

The post The background of the Bitcoin surge is a professional analysis of the virtual currency derivatives market | Contributed by virtual NISHI appeared first on Our Bitcoin News.

2 years ago

142

2 years ago

142

English (US) ·

English (US) ·