The post The Best Venture Capitals In 2023 appeared first on Coinpedia Fintech News

The Venture Capital industry has grown, during the last 10 years and this is because the number of Startups and early-emerged companies have experienced significant growth.

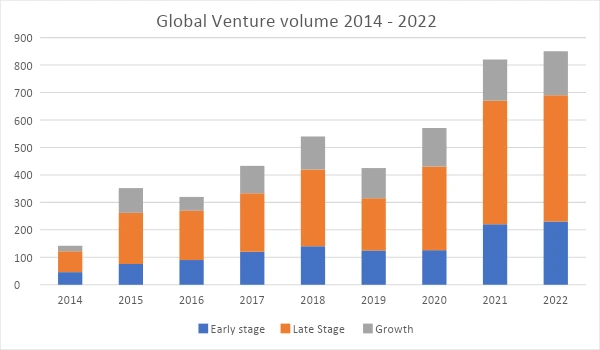

Ventures capitals play a big role in the success of projects and innovative ideas and these days investors prefer to invest in this field because of its favourable benefits in the long term. experts and businessmen realized the importance and the potential of this field at the beginning of the flowering. Fig 1 The global venture volume from 2014 to 2022 source: intelligent

Why VCs are important?

Each startup and company with innovative ideas and fantastic technological solutions need a fund-rising process and enough capital to implement their ideas and start growth. VC firms can provide plenty of services to unicorns (companies that are worth less than $1 billion) and even big-tech companies. Additionally, VCs can provide features more than money like technologies and infrastructural services as solutions for your startup. It’s better to say that the Venture capital industry is an integral part of startups and companies. In this article, we want to speak about the best VCs in the world with many fantastic ideas.

After world war II the private equity industry especially the Venture capital field was being grown because of the high volume of investments in startups and newly emerged technologies. Furthermore, some regulators lead to the prosperity of this industry in the 20th century.

As we mentioned, startups and companies need VC for growth especially, the startups that don’t have access to banks and financial institutions for fund rising process. Let’s read more…

Top 5 VCs in 2023

The following list is 5 VCs with innovative ideas and high transparency in their capitals:

Accel

Accel is an American private equity and Venture capital company that works with startups and valuable companies and innovative ideas. Startups can start fundraising with Accel in Seed, Early, and Growth-stages. The Accel has many offices in Palo Alto, California, and San Fransisco, London, India, China, etc.

Accel was founded in 1983 and by entering Kohlberg Kravis Roberts in 2000, the company focused on technological investments in middle-market companies with more than $14 billion in assets under management.

Accel has plenty of successful investments in American, European, Indian, and Egyptian companies like Meta Platforms (Facebook), Lynda.com, Vox Media, Slack, Cloudera, and Instabug. Furthermore, Accel always concentrates on the following technology sectors:

Saas

Mobile

Media

Infrastructure

Security

E-commerce

Enterprise software and other sectors.

Accel’s pros

- Comfortable and user-friendly

- Professional support team

- High variety of funds

- Accessible offices

Accel’s Cons

- Some of the features of the web application are difficult to find.

- Some funds are high risk

Sequoia Capital

Sequoia Capital is a VC firm that invests in startups in the energy, financial, enterprise, healthcare, internet, and mobile industries. Sequoia is a fantastic VC in the world and it is famous for having backed companies that are now controlling more than $1.4 trillion of the total combined value of the stock market. Sequoia is an American VC firm that is headquartered in Menlo Park, California. Sequoia’s total assets under management were nearly $85 billion.

Sequoia specialized in seed, early, and growth-stage investments in startups across technology sectors. Sequoia has many successful investments like Apple, Cisco, Google, Instagram, PayPal, etc. so, that shows this company is fantastic and with a professional team.

The company was founded in 1972 by Don Valentine in Menlo Park, California. It’s amazing to know Sequoia was an early investor in Atari in the 1975s. furthermore, this company was one of the first investors of Apple in 1978.

Sequoia has offices in the US, Southeast Asia, India, China, and Israel. Furthermore, this company made her the first female investing partner in the US in 2016. Moreover, Sequoia was the most active VC fund company in India.

Sequoia Capitals Pros and Cons

- More than 34 investment funds

- More than $35 billion total fund raised

- 52 technology products and services

- Global reach

- Not a professional and flexible website

Benchmark

Benchmark Capital is a venture capital firm that provides funding to early-stage and growth-stage technology companies. The firm was founded in 1995 by a group of successful entrepreneurs, including Andy Rachleff, Bruce Dunlevie, Kevin Harvey, and Bob Kagle.

Benchmark Capital has made investments in several notable technology companies, including Twitter, Uber, eBay, Yelp, Dropbox, and Snapchat. The firm is known for its hands-on approach to working with portfolio companies and has a reputation for being one of the most successful and influential venture capital firms in Silicon Valley.

Benchmark Capital typically invests in companies that have the potential to disrupt existing markets or create new ones. The firm focuses on companies in the enterprise software, consumer internet, and mobile sectors. Benchmark Capital has offices in San Francisco, New York City, and Europe, and has over $5 billion in assets under management.

One of its best investments of Benchmark was in e-Bay company which could reach $12 million to more than $6 billion from 2011 to 2019.

Benchmark Capital has a strong track record of successful investments in notable technology companies, which is a testament to its expertise and experience in the industry.

Benchmarks Pros and Cons

- Benchmark Capital is known for its hands-on approach to working with portfolio companies. This level of involvement can provide valuable guidance and support to startups.

- With offices in San Francisco, New York, and Europe, Benchmark Capital has a global reach, which can provide valuable connections and resources to portfolio companies.

- This company focuses on investing in disruptive technologies that have the potential to change the industry. This can be an advantage for startups that are developing cutting-edge technology.

- High standards can make it difficult for some startups to secure funding from the firm.

- Limited industry focus

- Pressure to perform: Because of its reputation and track record, there may be pressure on portfolio companies to perform and deliver results.

- Limited involvement

Intelligent Ventures

Intelligent Ventures is an innovative and AI-based Venture Capital that is provided via Intelligent protocol with many fantastic features. In Intelligent Venture clients can invest in Startups in different industries and fields like AI, Biotech, Fintech, IOT, Green Energy, healthcare, and Blockchain.

Intelligent Ventures includes professional industry experts and Ai-based technologies for researching and discovering high-potential early-stage startups.

Intelligent Ventures was founded in 2023 by providing innovative ideas like decentralized investments. Furthermore, Intelligent Protocol clients can invest in each fund which is visible on the platform as an order. It is headquartered in London and San Fransisco. Intelligent Ventures has many types of funds including:

Intelligent VC:

This fund includes Intelligent protocol investments in high-potential startups and some startups that intelligent is the owner of them. So, intelligent protocol clients can start investing in this fund if intelligent’s Robo-adviser allows taking risks. So, let’s grow with Intelligent.

Intelligent Blockchain fund:

A blockchain startup fund is an investment fund that specializes in providing capital to early-stage companies that are focused on developing innovative applications of blockchain technology. Blockchain is a distributed ledger technology that allows for secure, transparent, and immutable record-keeping. “Intelligent protocol”

Some of the main Intelligent products like Tokenized Share, D-Trust, and Perpetual DEX, are listed in this fund.

Intelligent AI fund

An AI fund is a type of investment fund that focuses on startups involved in the development and application of artificial intelligence (AI) technologies. this fund is designed to provide investors with exposure to the growth potential of the AI industry, which is expected to have a transformative impact on various sectors of the economy. In this fund, clients can experience investing in AI-based startups that are developing AI technologies such as ML, NLP, Robotics, etc.

Intelligent has many other funds like Biotech, Green Energy, and Healthcare.

Intelligent protocols Pros and Cons

- High-tech and AI base

- Hands-on approach

- Professional team

- Newly founded

| Accel | Intelligent Venture | Benchmark | Sequoia Capital | |

| The ai-based due diligence process |  | |||

| High diversity |  |  |  |  |

| Megatrend Portfolios |  | |||

| Decentralized investment section |  | |||

| User-friendly |  |  |  | |

| Unlimited involvement |  |  | ||

| Accessible |  |  |  |

As conclusion, we analyzed the top 4 Ventures in 2023-24 by our methods because we believe that, this field will continue to grow in the years ahead. On the other hand, you should do your own research in each investment process and then start investing. I hope this article was useful.

| Disclaimer: This is a guest post. Coinpedia does not endorse or is responsible for any content, accuracy, quality, advertising, products, or other materials on this page. The image used in this article is for informational purposes only and is provided to us by a third party. Coinpedia should not be held responsible for image copyright issues. Contact us if you have any issues or concerns. Readers should do their own research before taking any actions related to the company. |

2 years ago

130

2 years ago

130

English (US) ·

English (US) ·