How half-life affects miners

Cryptocurrency investment firm CoinShares has released a report analyzing the financial statements of publicly traded mining companies and private miners to determine the cost and profitability of Bitcoin production after the next halving. .

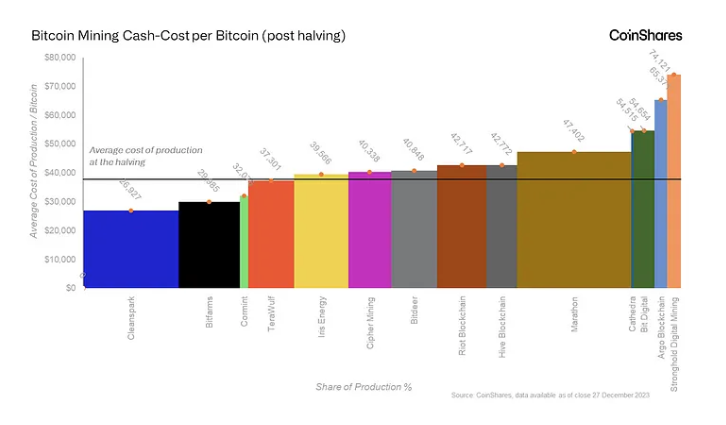

After the mining reward is halved, high-cost miners may find themselves in a difficult situation due to decreased revenue, and the average Bitcoin production cost for miners after the halving is 1 BTC = $37,856. The company predicted that the break-even point would be approximately $40,000 (approximately 5.8 million yen).

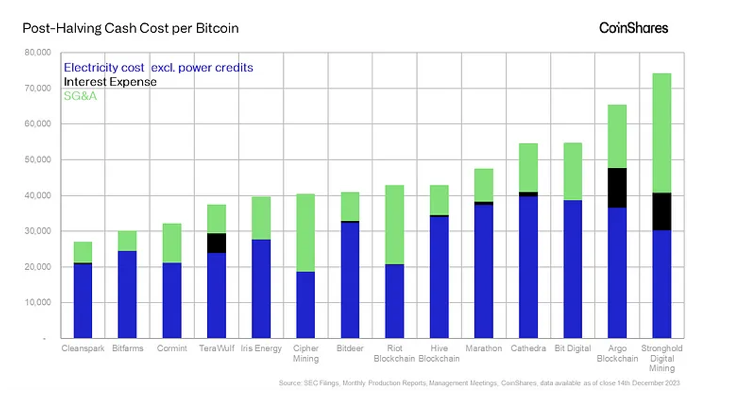

He pointed out that expanding selling, general and administrative expenses will be a challenge going forward, and that cost reductions will be necessary to maintain profitability.

The report estimates the average cost including the direct production cost of Bitcoin by miners and the operating costs of mining equipment. In the third quarter of 2023, they were $16,800 (2.347 million yen) and $25,000 (3.626 million yen), respectively, but with the halving, these costs will increase significantly and will be $27,900 (4.047 million yen). It is predicted that the price will be 37,800 dollars (5.483 million yen).

After the Bitcoin halving scheduled for April this year, mining rewards will decrease from the current 6.25 BTC to 3.125 BTC.

According to CoinShares, the Bitcoin mining network has seen significant growth in the last year, with its hashrate soaring 104%. However, the company notes that such rapid network expansion raises concerns about environmental and revenue sustainability.

In terms of profitability, although many companies have improved their mining fleet efficiency, mining the same amount of Bitcoin as before the halving requires increased power consumption, so It is said that the cost structure will not improve.

In addition, mining companies with high hash rates have a higher probability of obtaining block rewards and transaction fees, leading to competition among companies to expand equipment and requiring larger data centers. The cost will be covered by large-scale capital expenditures, which will impact Bitcoin’s total production cost.

Dominant mining companies

According to CoinShares, most mining companies are facing challenges due to rising SG&A expenses and need to cut costs to maintain profitability.

The company defines “runway” as the number of days it can withstand paying cash operating expenses using cash and Bitcoin reserves. US mining giant Riot, with its efficient cost structure and “long runway,” is said to be “best positioned” to address the challenges of the halving.

connection:US NASDAQ-listed Bitcoin mining company Riot orders over 60,000 mining machines

Furthermore, if the overall Bitcoin price cannot maintain above $40,000, only a handful of mining companies will be able to make a profit, and we predict that many companies will be forced to withdraw from business due to lack of funding.

The following five companies were rated by CoinShares as being profitable for less than 1 BTC = $40,000:

- Bitfarms

- Iris

- CleanSpark

- TeraWulf

- Cormint

CoinShares predicts that other mining companies will use up their “runway” and rely on equity issuance or loan financing, ultimately leading to a decline in stock prices. .

connection:Australia’s Iris Energy to expand Bitcoin mining capacity with latest mining machine

connection:Terrawolf launches 100% nuclear-powered Bitcoin mining facility

The post The break-even point for miners after the next Bitcoin halving is 1 BTC = $40,000 | CoinShares Report appeared first on Our Bitcoin News.

1 year ago

76

1 year ago

76

English (US) ·

English (US) ·