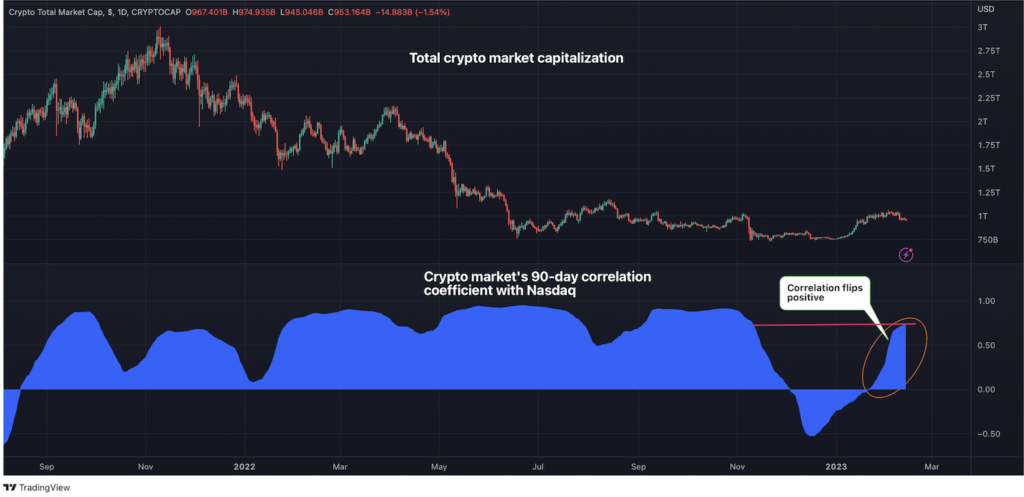

The correlation between the cryptocurrency market and the tech-heavy Nasdaq Composite has turned positive, suggesting that crypto investors are refocusing on Wall Street’s risk appetite.

According to TradingView data, the 90-day correlation coefficient between crypto market capitalization and the Nasdaq index rose from -0.12 to 0.74 in four weeks, the highest since early November.

In other words, the crypto markets are moving in tandem with tech stocks once again. On days when tech stocks trade high, cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH) are likely to do the same. Conversely, a fall in technology stocks could drag down the cryptocurrency market.

Speculation that the US Federal Reserve (Fed) will cut interest rates later this year is likely behind the rekindled correlation of liquidity-dependent risk assets. Thanks to the collapse of Sam Bankman Fried’s crypto exchange FTX, where crypto investors dumped their tokens despite Wall Street’s risk reset, a long-lasting positive relationship It fell apart in November.

Correlation is determined by comparing the returns or general price movements of two assets or commodities over a specified period of time. A correlation close to 1 indicates that the two assets are moving in unison in the same direction. A negative correlation, on the other hand, means that the two assets are moving in opposite directions.

A positive correlation suggests that cryptocurrencies are becoming more sensitive to factors affecting stock markets, such as US CPI announcements. (CoinDesk/TradingView)

A positive correlation suggests that cryptocurrencies are becoming more sensitive to factors affecting stock markets, such as US CPI announcements. (CoinDesk/TradingView)The new positive correlation means cryptocurrencies are becoming more sensitive to macroeconomic data releases, such as the US Consumer Price Index (CPI), which creates volatility in the stock market. Last year’s CPI release date was a volatile day for U.S. equities, according to MarketWatch.

Reuters estimates obtained from FXStreet said CPI data released Tuesday by the U.S. Bureau of Labor Statistics (BLS) will likely see inflation fall to 6.2% in January from 6.5% in December. Looking. Core CPI, which excludes the volatile food and energy sectors, is forecast to decline from 5.7% to 5.5%.

A better-than-expected number could dash tech stocks and cryptocurrencies by dashing hopes for a so-called Fed pivot in favor of monetary easing.

“Tuesday’s CPI release looks set to be big numbers. If CPI rises higher than expected, given the recent NFP surprises, this suggests that risk assets are quite bearish. ,” Gregoire Magadini of cryptocurrency data provider Amberdata wrote in a report published Sunday.

Meanwhile, CPI data is likely to be lower than expected, according to Andreas Steno Larsen, founder and CEO of Steno Research. If that happens, the speculation of a rate cut by the Fed will strengthen.

In a note to subscribers last week, Larsen said, “Based on our models and indicators (leading and lagging indicators), we are projecting headlines and cores to be around 6.1% and 5.3% respectively. “It has said.

“Wages are slowing in every meaningful forward-looking indicator, but housing is striking relative to reality in the CPI, which is a big downside in the core relative to the headlines,” Larsen said. It means that it will be able to do so,” and is expected to contribute positively to energy, commodity prices including used cars, and a sense of fatigue over fair prices.

The market capitalization of the crypto-asset market recently soared to a six-month high of $1.6 trillion (approximately ¥140.5 trillion) and, at the time of writing, began the year at $948 billion (approximately ¥125.66 trillion). has risen 25% from The Nasdaq is up 12% this year.

|Translation: coindesk JAPAN

|Editing: Toshihiko Inoue

|Image: CoinDesk/TradingView

|Original: Correlation Between Crypto Market and Nasdaq Turns Positive Ahead of US CPI Release

The post The correlation between crypto assets and Nasdaq is at the highest level since November ── Focus on US CPI | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

151

2 years ago

151

English (US) ·

English (US) ·