Macroeconomics and financial markets

In the US NY stock market on the 3rd, the Dow closed at $327 (0.98%) higher than the previous day and the Nasdaq at $32 (0.27)% lower.

The additional production cut by OPEC Plus, which consists of the Organization of the Petroleum Exporting Countries (OPEC) and non-member oil-producing countries such as Russia, was an unexpected surprise for the market, and crude oil futures prices soared. Prices in Europe and the United States, rising energy prices, and concerns about prolonged monetary tightening have emerged.

connection:Energy stocks rise due to high crude oil prices, Tesla and coinbase stock prices fall | 4th Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin rose 0.78% from the previous day to $27,940.

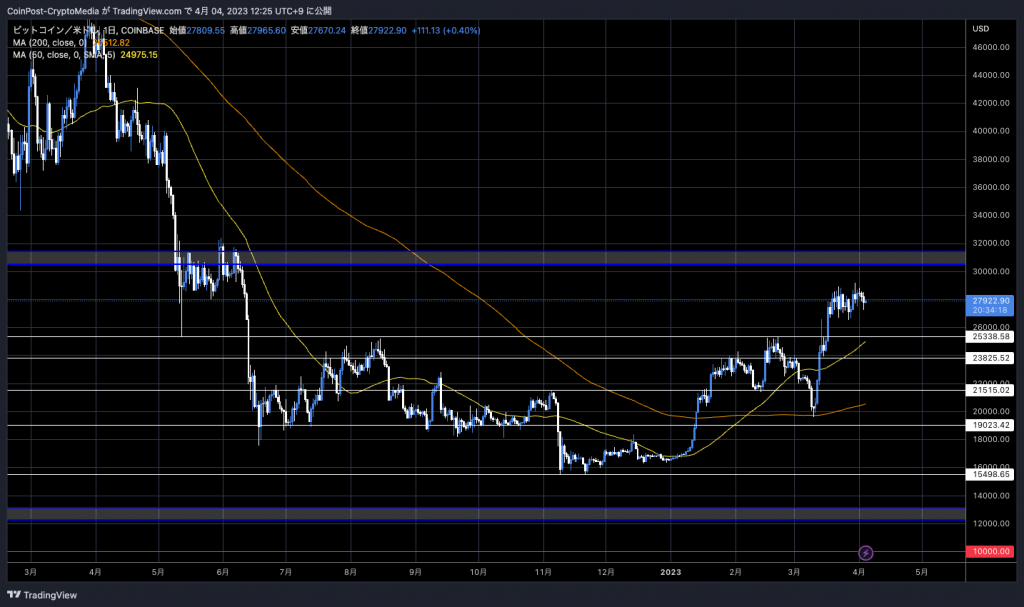

BTC/USD daily

According to a report by data analytics firm kaiko, the correlation coefficient between Bitcoin and gold has reached over 50%, the highest in years.

Bitcoin’s correlation to Gold is the highest that its been in years, surpassing its correlation to the S&P

(h/t @KaikoData) pic.twitter.com/5TDOtlm5zq

—Will Clemente (@WClementeIII) April 3, 2023

In contrast, the correlation coefficient of the US stock index (S&P 500), which showed strong correlation during last year’s risk-off phase, has been cut.

In the background, the bankruptcy of Silicon Valley Bank in the United States, etc., triggered the spread of financial instability to Credit Suisse and Deutsche Bank, and the impact of the global inflation (high prices) and the depreciation of the legal currency.

Bitcoin is categorized as a risky asset like stocks, but since there is no specific issuer and the market supply is finite, it is considered digital gold as an inflation hedge or an alternative asset when currency instability rises. may be

In January 2020, US asset management company VanEck stated in a report titled “The Investment Case for Bitcoin” that Bitcoin, which has “permanence, scarcity and anonymity,” already has monetary value. It is pointed out that it has hidden potential as digital gold.

In April 2019, an economist at Mizuho Bank commented that the gold standard, which began in the 1700s, “reflected the ‘right of resistance’ to the state, and that the Fed’s (Federal Reserve Board) credibility has been shaken.” That’s what caused the price of Bitcoin to soar.”

connection:“The essence of virtual currency is resistance” An economist at Mizuho Bank considers the reason for the surge in Bitcoin

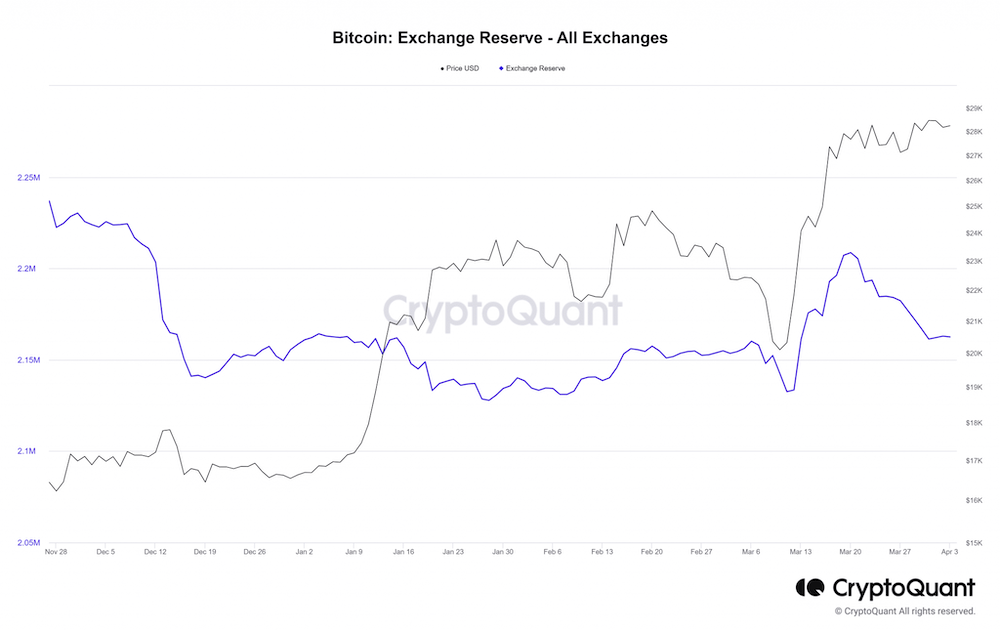

According to CryptoQuant data, bitcoin foreign exchange reserves within cryptocurrency exchanges are on a downward trend.

CryptoQuant

About 46,000 BTC worth $1.24 billion was transferred off exchanges in the last 10 days. A significant increase in outflow means a decrease in short-term selling pressure, suggesting that funds are being transferred to external cold wallets, etc. on the premise of long-term holding.

In the foreign exchange market, the dollar is expected to weaken further against the backdrop of decelerating inflation and lower US interest rates. The “Dollar Index,” which indicates the strength of the dollar against major currencies, reached 114.7 points in September 2010, but has since peaked out, and has fallen to 102.1 as of April 2011.

DXY/USD Weekly

altcoin market

Dogecoin (DOGE) surged more than 25% from the previous day in major alts. It hit a four-month high.

It was triggered by CEO Elon Musk changing the Twitter icon, the blue bird, to Dogecoin’s Shiba Inu, Kabosu.

Elon Musk’s lawyers on March 31 requested that the plaintiffs in the Dogecoin (DOGE) lawsuit dismiss allegations that they “manipulated the market and caused harm to investors.” .

Elon Musk, who has 130 million followers, has caused a lot of controversy in the past as his free-spirited remarks can have a large impact on the crypto-asset market, such as the prices of Dogecoin and Bitcoin, due to their large influence.

connection:Elon Musk Denies Plaintiffs’ Allegations in Dogecoin Lawsuit

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post The correlation coefficient between Bitcoin and gold reaches a record high, Dogecoin soars due to the influence of Twitter appeared first on Our Bitcoin News.

2 years ago

164

2 years ago

164

English (US) ·

English (US) ·