Macroeconomics and financial markets

In the US NY stock market on the 22nd, the Dow Jones Industrial Average fell 140 dollars (0.42%) from the previous day and the Nasdaq Index closed at 62.8 points (0.5%) higher.

Regarding the Fed (Federal Reserve System)’s monetary tightening, while speculation about a temporary suspension of interest rate hikes is increasing, St. Louis Fed President Bullard, who is known as a hawk, said on the 22nd, “We should raise interest rates by 0.25% two more times this year.” dominated the market as

Jamie Dimon, chief executive of US bank JP Morgan, said that US interest rates could rise further from the current 5% to as high as 7%. For the time being, the US Federal Open Market Committee (FOMC) meeting in June is likely to be the focus of attention.

Regarding the debt ceiling issue, President Biden and Speaker of the US House of Representatives Kevin McCarthy are continuing negotiations to raise the debt ceiling, but it is still difficult to reach an agreement.

Treasury Secretary Janet Yellen has issued a letter warning that the United States is at risk of default as early as 10 days.

If the negotiations are entangled until the last minute of the deadline, past experience could shake the trust of the United States (government bonds).

If it leads to a sharp rise in short-term borrowing costs or a downgrade in credit ratings, there is a risk that it will spread to the financial and economic world outside the United States, and that private companies such as banks, which are suffering from financial instability, will be seriously affected.

connection:U.S. IT and cryptocurrency-related stocks continue to rise Expectations rise due to talks on debt ceiling issue | 23rd Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin rose 1.3% from the previous day to $ 27,020.

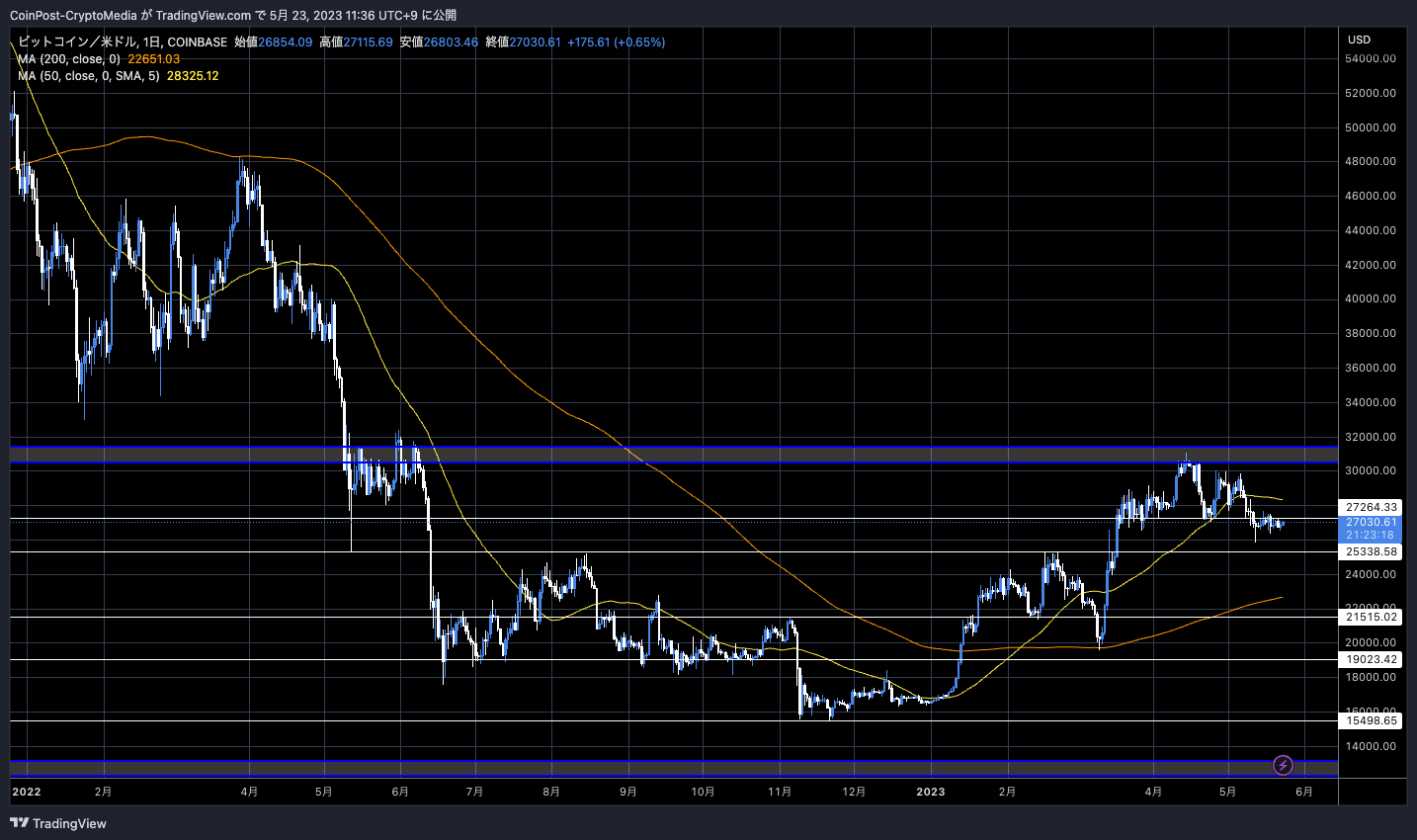

BTC/USD daily

There were also some solid price movements contrary to the view of bears who expect a sharp drop against the background of technical weakness, such as lowering the top price. Ethereum (ETH), the second largest market capitalization, has also rebounded by 1.95% from the previous day, and is in a stalemate.

With the decline in market participants’ interest, the weekly trading volume of BTC and ETH has reached a record low level since September 2019, and thin trading continues.

The largest assets in #crypto are seeing historically low levels of weekly trading volume. #Altcoin volume, in particular, has really dried up. $BTC & $ETH volume, this is the 2nd lowest threshold we are seeing since September, 2019. https://t.co/1V2tPno7jD pic.twitter.com/tegItbDuen

The largest assets in #crypto are seeing historically low levels of weekly trading volume. #Altcoin volume, in particular, has really dried up. $BTC & $ETH volume, this is the 2nd lowest threshold we are seeing since September, 2019. https://t.co/1V2tPno7jD pic.twitter.com/tegItbDuen

—Santiment (@santimentfeed) May 22, 2023

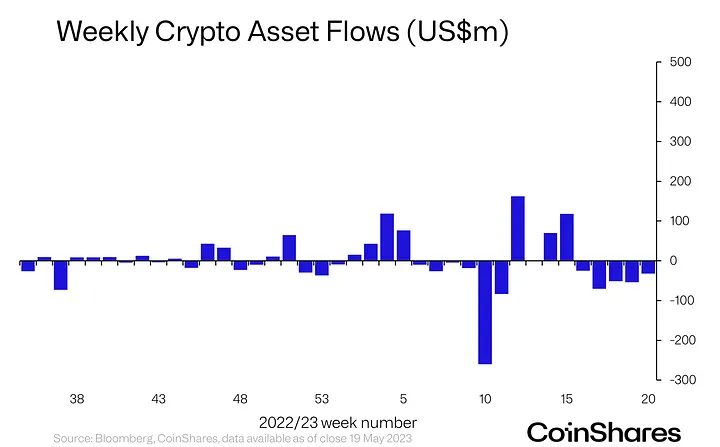

According to the latest weekly report from asset management firm CoinShares, institutional investor capital flows in cryptocurrency investment products have seen $32 million in net outflows for the fifth consecutive week.

CoinShares

Weekly trading volume on major exchanges fell to $20 billion, the lowest level since the end of 2020.

This is in contrast to the Tokyo stock market, where foreign investors’ escape funds are flowing in after the corona crisis, amid concerns about the risk of credit crunch such as bank instability.

According to data from the Japan Exchange Group (JPX), overseas investors have been net buyers of Japanese stocks for seven consecutive weeks, with a cumulative total of 3 trillion yen. The Nikkei 225 Stock Average reached its highest level in 33 years since the bubble economy.

Bloomberg Intelligence strategist Mike McGlone is among the pessimistic forecasters against the backdrop of drying up liquidity in the cryptocurrency market and rising interest rates. In a scenario where the macro environment worsens further, he shows a pessimistic view that the price level of 2019 (1 BTC = $ 7,000), which was the starting point of the previous bull market, could fall.

That the #FederalReserve has kept hiking rates in 1H despite a bank run, plunging commodities and producer prices may portend deflation potential for risk assets. Peaking #Bitcoin and #copper vs. rallying #equitymarkets appears as an unsustainable trajectory. pic.twitter.com/deEhESQ62u

— Mike McGlone (@mikemcglone11) May 22, 2023

DCG Fails to Pay Its May Debt

Digital Currency Group (DCG), the parent company of insolvent and insolvent lender Genesis Global Capital, has issued a loan to Gemini, which holds Genesis debt, as of last week, according to a statement from cryptocurrency exchange Gemini. $630 million of debt due is due.

connection:Digital Currency Group and Genesis could break up on debt repayment plans

Genesis has lost more than $35 billion to multiple creditors, affected by the default of three arrows capital (3AC), which went bankrupt last year, and the collapse of major cryptocurrency exchange FTX, according to court documents. presumed to be in debt.

Gemini and the Unsecured Credit Committee are considering a moratorium, but if the Digital Currency Group is deemed to have effectively defaulted, it will become more difficult to raise funds due to a decline in creditworthiness, and there are concerns about the risk of bankruptcy. is.

If DCG, a leading conglomerate company in the crypto asset (virtual currency) industry, goes bankrupt, it will face the sale of assets such as the investment trust “GBTC” of the related company Grayscale as part of the debt consolidation, which will have a wide-ranging impact on the market. It is pointed out that there is a possibility that

connection:

Gemini Considers DCG Default Avoidance, Significant Debt Repayment Moves

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post The cryptocurrency market is the thinnest since September 2019, and the DCG debt problem is smoldering appeared first on Our Bitcoin News.

2 years ago

147

2 years ago

147

English (US) ·

English (US) ·