On January 11th, the US Securities and Exchange Commission (SEC) approved the start of trading of 11 Bitcoin ETFs. With the approval of the first Bitcoin ETF in the United States, investors around the world are closely watching the potential impact on the broader asset class in the short and medium to long term.

Buy on rumors and sell on facts?

Bitcoin rose 160% in 2023, driving a significant rise in the crypto asset (virtual currency) market. After a scandal-filled 2022 that saw the demise of Three Arrows Capital, Celsius, and FTX, Bitcoin made a spectacular comeback before the ink was dry on the obituaries.

A major driving force behind the price revival was the expectation that the SEC would approve the first Bitcoin ETF in the United States. When major asset management company BlackRock filed for a Bitcoin ETF on June 15, 2023, Bitcoin rose about 22% in one week.

Then, on October 23, when it became clear that the SEC would not appeal a court ruling that effectively reversed the denial of Grayscale's application for a Bitcoin ETF, Bitcoin once again fell to 15% in two days. %Rose.

While other factors helped drive the rally, including the U.S. economic environment in the fourth quarter of 2023 (October-December period) and macro tailwinds, the main driver was precisely ETFs.

Adhering to this binary event carried multiple risks.

For naysayers, the lack of a follow-up story results in a classic “buy on rumors, sell on facts'' situation. Adhering to the binary event showed that crypto assets still have a long way to go before becoming mainstream.

Bitcoin has been trading on an uptrend since the ETF was approved, but the large rally many technical analysts predicted has not materialized.

However, the inflow of funds into Bitcoin ETFs has been strong, with an inflow of $9.7 billion (approximately 1,455 billion yen, equivalent to 150 yen to the dollar) recorded on February 12th.

Implications for medium-term asset class growth

The approval of a Bitcoin ETF was a milestone for the $1.7 trillion digital asset industry.

With the entry of institutional investors, demand for Bitcoin will grow significantly. For example, analysts at Galaxy Digital expect inflows into Bitcoin ETFs to reach $14.4 billion in 2024, $27 billion in the second year, and $39 billion in the third year.

Capital inflows will primarily come from the asset management sector, which currently cannot secure large-scale Bitcoin exposure. A multibillion-dollar investment would also significantly change the value of Bitcoin.

The influx of funds from institutional investors will further solidify crypto assets' status as an asset class. Liquidity may become more stable, and Bitcoin prices may become less susceptible to extreme price fluctuations.

Additionally, there are positive side effects, such as the approval of ETFs for other crypto assets, an influx of VC money, and greater acceptance of crypto assets as a payment method. Specifically, the approval of the Ethereum ETF will be the next notable event. The deadline for the decision is May 23rd.

What is a balanced multi-asset portfolio?

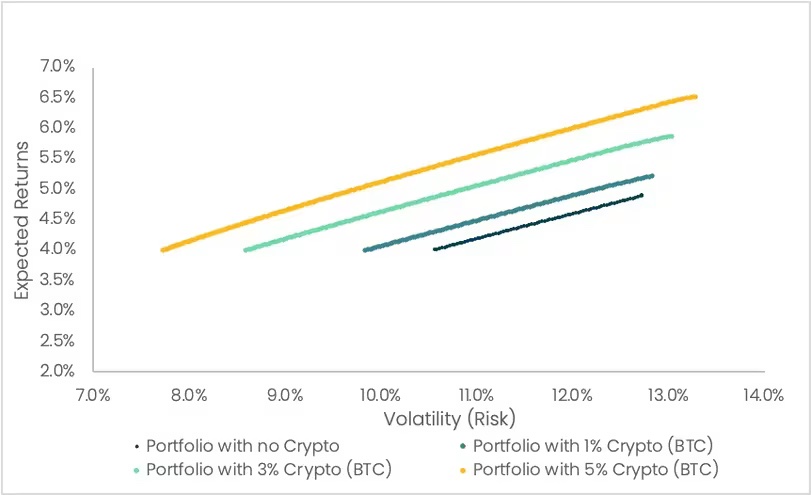

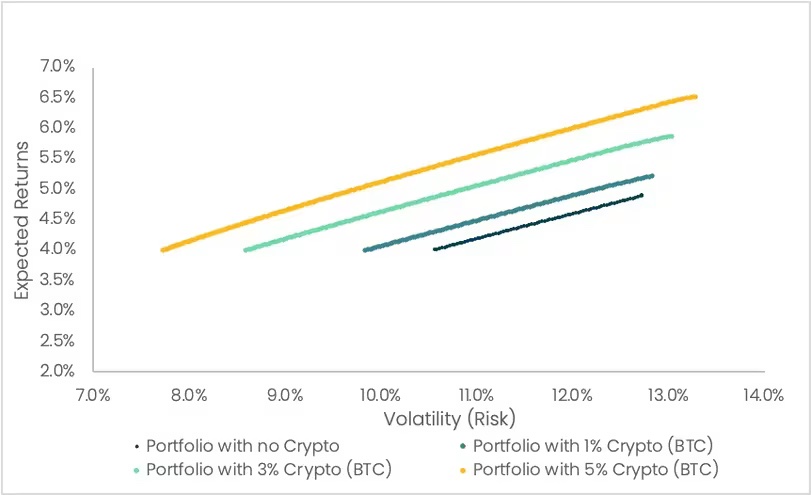

Adding a small amount of crypto assets to a multi-asset portfolio can improve returns without impacting the portfolio's risk profile.

The figure below shows the increase in the efficient frontier by allocating a small percentage of a balanced portfolio to Bitcoin.

(Balanced portfolio consisting of 50% MSCI World AC, 40% Bloomberg Barclay Global Aggregate Index, 10% Bloomberg Commodity Index. Source: AMINA Bank. Start date: January 1, 2016, End date: 2023 December 29th)

(Balanced portfolio consisting of 50% MSCI World AC, 40% Bloomberg Barclay Global Aggregate Index, 10% Bloomberg Commodity Index. Source: AMINA Bank. Start date: January 1, 2016, End date: 2023 December 29th)While most institutional investors agree that crypto assets have a role to play in their portfolios, the question that divides experts is: What is the most efficient way to gain exposure to crypto assets? is.

Bitcoin? A basket of coins? Which coins should be included in the basket? What is the weighting method? How often do you rebalance? Many factors can influence the outcome of investing in this sector, from universe selection to regulatory compliance to market structure and liquidity.

Strictly adhering to market cap weighting can result in an overly concentrated portfolio (mostly BTC and ETH), limiting exposure to altcoins and impacting portfolio diversification.

Another approach addresses the above issues by implementing smart beta allocation based on risk parity and market capitalization, with the aim of increasing exposure to altcoins in a systematic and controlled manner. Other “factor” weighting techniques may show similarly promising results for long-term buy-and-hold investing.

When investing in crypto assets, it is worth thinking beyond simple position sizing issues such as diversification, coin selection, rebalancing frequency, and weighting methods.

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

|Image: Shutterstock

|Original text: Crypto for Advisors: Impact of the Spot Bitcoin ETFs for Portfolios

The post The impact of Bitcoin ETFs on your portfolio: Is it a game changer for the industry? | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

124

1 year ago

124

English (US) ·

English (US) ·