Some consider technical analysis (TA) to be a solid tool based on asset prices. Others, on the other hand, see no need to pay attention to it at all, given that it is nothing more than lines on the screen and self-fulfilling prophecies.

Working in the TradFi (traditional finance) world, I often thought of the latter. Given the significance of all publicly available data, including earnings, debt, and management commentary, I thought fundamental analysis was more important. The underlying idea was that if legendary investor Warren Buffett thought it was good enough, it should be good enough for us.

Now, I have to admit that it’s biased in the opposite direction.

In 2018, when I was still specializing in stocks, I became a Chartered Market Technician (CMT) after obtaining a certification from the American Society of Technical Analysts. I still feel the benefits of that knowledge every day. I don’t believe in the “random walk” theory of prices, which claims that price movements are totally unpredictable. The data and the charts that represent it have predictive power.

judgment without emotion

Technical analysis helps answer key and important questions. The question is, “What if I’m completely wrong?” For example, technical analysis allows us to make emotionless decisions, such as whether now is the time to liquidate a position.

If you buy something for $10 and the price drops to $5, you might be a contrarian and buy more. The idea is, “If you like it for $10, you’ll love it for $5.”

In such cases, technical analysis can help you to make decisions with your feet on the ground. “I thought the price would go up to $15, but I was wrong. It’s time to liquidate.”

What is technical analysis? I think of it as a chart representation of investor behavior. Certain patterns and signs give us hints about what will happen next. It is an important part of the trinity of fundamental, technical and quantitative analysis.

Fundamental data, while widely used in TradFi, is less prevalent in crypto. For many, the appeal of crypto-assets is their decentralized nature. Bitcoin (BTC) has no CEO, no balance sheet, no accounts. In other words, one of the three treasures of analysis is missing. It makes sense to focus on the other two.

Technical analysis involves many elements that go far beyond chart analysis and subjective judgment. During the preparation period for acquiring CMT, I was strongly impressed by the emphasis on numbers when making decisions.

practical use

For example, it is easy to see that BTC has crossed the top of the Bollinger Bands three times in the last 25 days (at the time of this writing). When that happened in January, BTC was up 11% after 30 days. We also see that it has been 24 days since the volume was at least double the 20-day moving average, yet the volume is not among the top 50 BTC trading volumes since 2015. .

From a risk management perspective, we often use the Average True Range (ATR) to measure volatility.

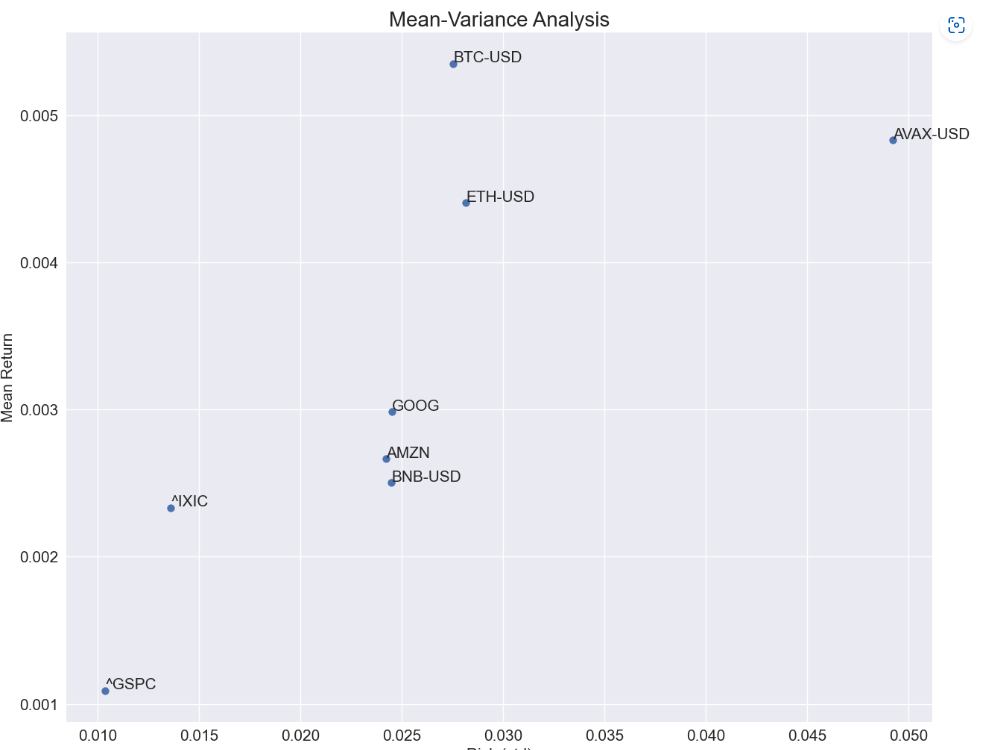

I like to take it one step further and look at the return of an asset and the standard deviation of returns relative to other assets. Extract what you see on the chart into another format.

By doing so, we can see the relationship between risk and return for BTC, Ethereum (ETH), Avalanche (AVAX), and Binance Coin (BNB) since January, as shown in the chart below. Out of curiosity, I also added the S&P500 (GSPC), Nasdaq (IXIC), Google (GOOG), and Amazon (AMZN).

From this chart, we can see that BTC outperformed with slightly less standard deviation (risk) than ETH. Additionally, we can see that AVAX performed well, albeit with significantly higher risk.

Keep that in mind when looking at other indicators, especially momentum and volume. Moreover, I often make similar comparisons over different time periods.

In short, technical analysis is the analysis of data, and it begins by analyzing price-specific data. In many ways, it allows you to ignore the noise and hype around your property. This will become even more important as key players in the cryptocurrency industry face various challenges this year.

Whether you believe technical analysis or not, it’s hard to ignore price. Moreover, it is even harder to ignore the market reaction to prices. In the cryptocurrency market, market reaction is always worth watching.

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

|Image: Shutterstock

|Original: A Technical Analyst’s Take on Crypto

The post The Importance of Technical Analysis in Crypto Assets[Opinion]| coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

119

2 years ago

119

English (US) ·

English (US) ·