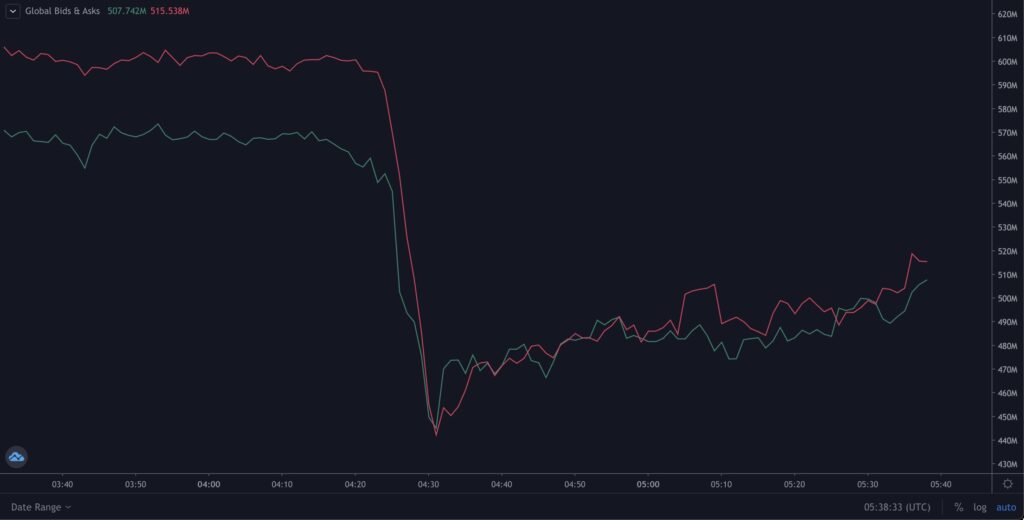

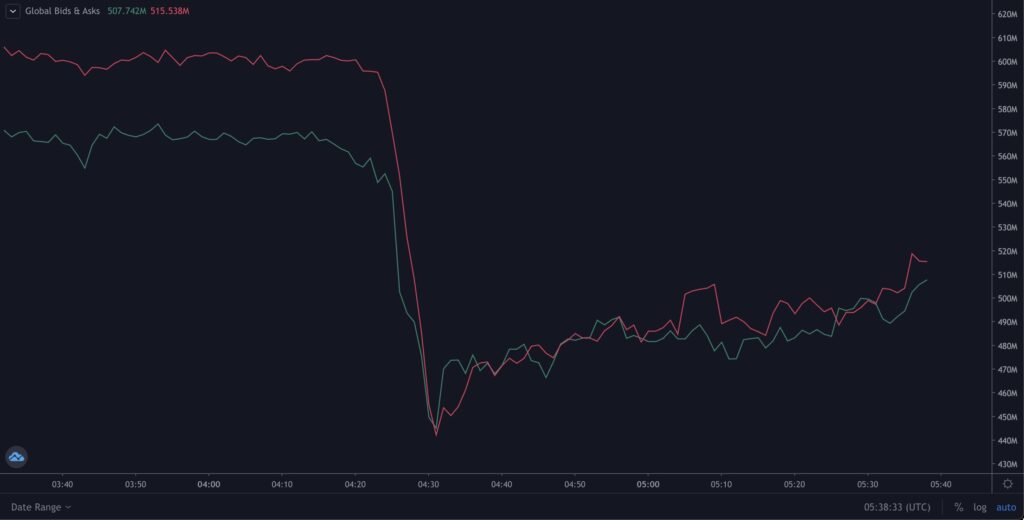

A key indicator that tracks liquidity in the cryptocurrency market plunged over the weekend, leaving only a handful of orders that could amplify price volatility.

Crypto research firm Hyblock Capital’s Global Bid & Ask Index aggregates the dollar amount of bid & ask orders for more than 1,100 coins listed worldwide, up 20% across spot markets on June 10. fell.

The plunge came as altcoins such as Solana (SOL), Polygon (MATIC) and Dogecoin (DOGE) crashed amid rumors that the fund would liquidate its holdings.

According to Joe McCann, CIO of crypto hedge fund Assymetric, some market makers likely pulled out of the market during the altcoin crash, leading to a sharp drop in order volume.

“Hyblock Capital’s Global Bid & Ask Index is down 20%. Many market makers seem to have withdrawn orders to create paper-thin order books,” McCann tweeted. Other observers attributed the drop in liquidity to one market maker running out of collateral.

Think it was only one, and don’t think they pulled, think they got called and ran out of collateral…

—Adam Cochran (adamscochran.eth) (@adamscochran) June 10, 2023

Low liquidity means that traders may struggle to execute large orders at stable prices. Also, small orders can have a big impact on the market.

An order book is a listing of all open orders and quotes posted by market makers and other market participants for a particular financial instrument. A bid is the highest price a user is willing to pay to buy the financial instrument, and an ask or offer is the lowest price someone is willing to sell the financial instrument. A resting order is a limit order to buy below or sell above the market price.

A market maker is the entity responsible for creating bid and ask orders and providing liquidity to the order book.

The value of orders waiting to be filled plunged 20% on June 10 (Hyblock Capital)

The value of orders waiting to be filled plunged 20% on June 10 (Hyblock Capital)The green line shows the dollar amount of bids awaiting execution, while the red line shows the dollar amount of asks. Both plunged more than 20% to less than $500 million on June 10, Asian time.

The drop in liquidity means markets could see above-average volatility after the release of US inflation data and the Federal Reserve’s interest rate decision. According to Reuters data from FXStreet, the consumer price index will be released at 8:30 a.m. ET (12:30 UTC, 9:30 p.m. Japan time) on the 13th, and the Fed will release it at 2:00 p.m. It is expected that the policy rate will be announced at 6:00 pm UTC, 3:00 am Japan time on the 15th, and the status quo will be maintained.

|Translation: coindesk JAPAN

|Editing: Toshihiko Inoue

|Image: Shutterstock

|Original: Crypto Global Bid and Ask Metric Plunged 20% Over Weekend, Points to Paper Thin Liquidity

The post The liquidity of the crypto-asset market has deteriorated rapidly ─ price fluctuations may increase | CoinDesk JAPAN | CoinDesk Japan appeared first on Our Bitcoin News.

2 years ago

209

2 years ago

209

English (US) ·

English (US) ·